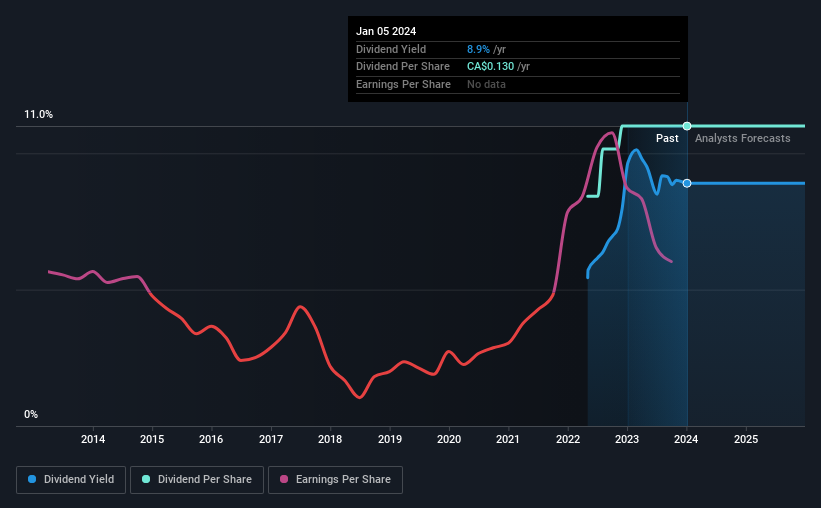

Pine Cliff Energy Ltd. (TSE:PNE) has announced that it will pay a dividend of CA$0.0108 per share on the 31st of January. This makes the dividend yield 8.9%, which will augment investor returns quite nicely.

View our latest analysis for Pine Cliff Energy

Pine Cliff Energy Doesn't Earn Enough To Cover Its Payments

If the payments aren't sustainable, a high yield for a few years won't matter that much. Based on the last payment, the dividend made up 79% of cash flows, but a higher proportion of net income. While the cash payout ratio isn't necessarily a cause for concern, the company is probably focusing more on returning cash to shareholders than growing the business.

Over the next year, EPS is forecast to expand by 23.5%. If the dividend continues on its recent course, the payout ratio in 12 months could be 114%, which is a bit high and could start applying pressure to the balance sheet.

Pine Cliff Energy Doesn't Have A Long Payment History

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 2 years, which isn't that long in the grand scheme of things. Since 2022, the annual payment back then was CA$0.0996, compared to the most recent full-year payment of CA$0.13. This means that it has been growing its distributions at 14% per annum over that time. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

Dividend Growth Could Be Constrained

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Pine Cliff Energy has seen EPS rising for the last five years, at 62% per annum. Although earnings per share is up nicely Pine Cliff Energy is paying out 134% of its earnings as dividends, which we feel is borderline unsustainable without extenuating circumstances.

The Dividend Could Prove To Be Unreliable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Pine Cliff Energy's payments, as there could be some issues with sustaining them into the future. Strong earnings growth means Pine Cliff Energy has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 2 warning signs for Pine Cliff Energy that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:PNE

Pine Cliff Energy

Engages in the acquisition, exploration, development, and production of natural gas and crude oil in the Western Canadian Sedimentary Basin.

Good value with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.