- Canada

- /

- Oil and Gas

- /

- TSX:PEY

Should July 2025 Dividend Confirmation Require Action From Peyto (TSX:PEY) Investors?

Reviewed by Simply Wall St

- Peyto Exploration & Development recently confirmed its July 2025 monthly dividend of CA$0.11 per common share, payable on August 15, 2025, to shareholders of record as of July 31, 2025.

- This affirmation of recurring dividends highlights the company's ongoing commitment to shareholder returns, which investors often regard as a sign of steady operational confidence.

- Now, we'll examine how the confirmed dividend payout reinforces investor expectations for Peyto's consistent cash flow and financial discipline.

Peyto Exploration & Development Investment Narrative Recap

To be a Peyto Exploration & Development shareholder, you need to believe in the resilience of Canadian natural gas markets and management’s ability to sustain operational and financial discipline despite market volatility. The freshly confirmed July 2025 dividend underscores the company’s intent to deliver shareholder value in the short term, but the news does not meaningfully change the immediate catalysts or largest risks, such as exposure to AECO pricing and the continued importance of cost management.

Among Peyto’s recent updates, the Q1 2025 earnings report remains particularly relevant. It highlighted higher year-over-year revenue and net income alongside improved natural gas production, which supports the reliability of dividend payouts. However, with net profit margins slightly down from last year, effective cost control remains integral to securing future returns.

But investors should also weigh the possibility that, despite these positive signals, evolving market trends could put pressure on Peyto’s margins if...

Read the full narrative on Peyto Exploration & Development (it's free!)

Peyto Exploration & Development's narrative projects CA$1.5 billion in revenue and CA$397.0 million in earnings by 2028. This requires 20.7% yearly revenue growth and a CA$116.4 million earnings increase from the current earnings of CA$280.6 million.

Exploring Other Perspectives

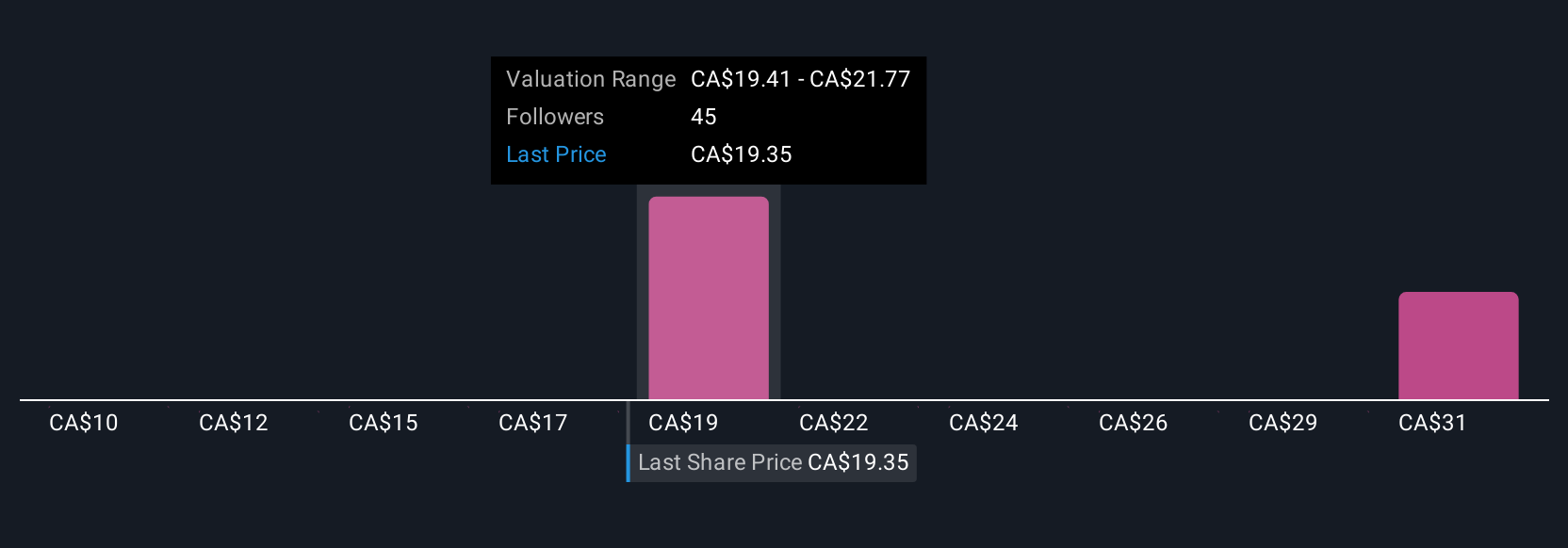

Five members of the Simply Wall St Community set Peyto’s fair value between CA$10 and CA$33.81, illustrating a spread in retail investor expectations. While production and earnings growth provide support, the company’s continued exposure to fluctuating AECO prices remains a concern for many and could affect long-term performance.

Build Your Own Peyto Exploration & Development Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peyto Exploration & Development research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Peyto Exploration & Development research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peyto Exploration & Development's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PEY

Peyto Exploration & Development

Engages in the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta’s deep basin.

Good value average dividend payer.

Market Insights

Community Narratives