- Canada

- /

- Oil and Gas

- /

- TSX:PEY

Peyto (TSX:PEY) Valuation in Focus After Strong Q2 Revenue and Earnings Growth

Reviewed by Simply Wall St

If you have been tracking Peyto Exploration & Development (TSX:PEY), you probably noticed the flurry of activity following its latest earnings release. The company just turned in a strong second quarter, reporting considerable year-over-year gains in revenue and net income, with natural gas output also rising. For shareholders, these numbers stand out as a sign of operational momentum that could change how the market views Peyto’s growth prospects.

The stock has climbed 39% over the past year and is up nearly 12% year-to-date, moving past short-term dips in the past month as traders digested the news. Momentum has broadly been positive this year, even as energy prices shifted and dividend affirmations provided stability for income-focused investors. Recent quarterly updates and a new shelf registration filing also reflect an active period for the company, suggesting management is preparing for possible future moves.

So after a year of market-beating performance and standout operational results, is Peyto’s current valuation a bargain, or has the market already priced in more growth ahead?

Most Popular Narrative: 12.2% Undervalued

According to community narrative, Peyto Exploration & Development is currently seen as undervalued, with a potential upside highlighted by analyst consensus expectations. The most popular narrative estimates that the fair value is meaningfully above the current share price.

The ramp-up of LNG export facilities, especially with LNG Canada beginning exports, is expected to increase long-term demand and support higher benchmark prices for Canadian natural gas. This development should enhance Peyto's sales volumes and revenue prospects. Peyto's consistently low-cost structure, driven by efficient Deep Basin development, cost reductions in drilling and completions, and a focus on high-margin inventory, positions the company to maintain resilient net margins even during periods of commodity price volatility.

Something significant could be underway for Peyto shareholders. The fair value calculation is based on ambitious revenue and earnings targets, but there is one key operating assumption driving the analyst price target that might surprise you. Interested in what future profit factors are considered in this narrative and why valuations appear so optimistic? Read on to learn about the financial reasoning behind this notable undervaluation call.

Result: Fair Value of $21.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent regulatory cost pressures and local pricing risks remain. These factors have the potential to dampen future earnings and challenge the optimistic outlook.

Find out about the key risks to this Peyto Exploration & Development narrative.Another View: Discounted Cash Flow Model

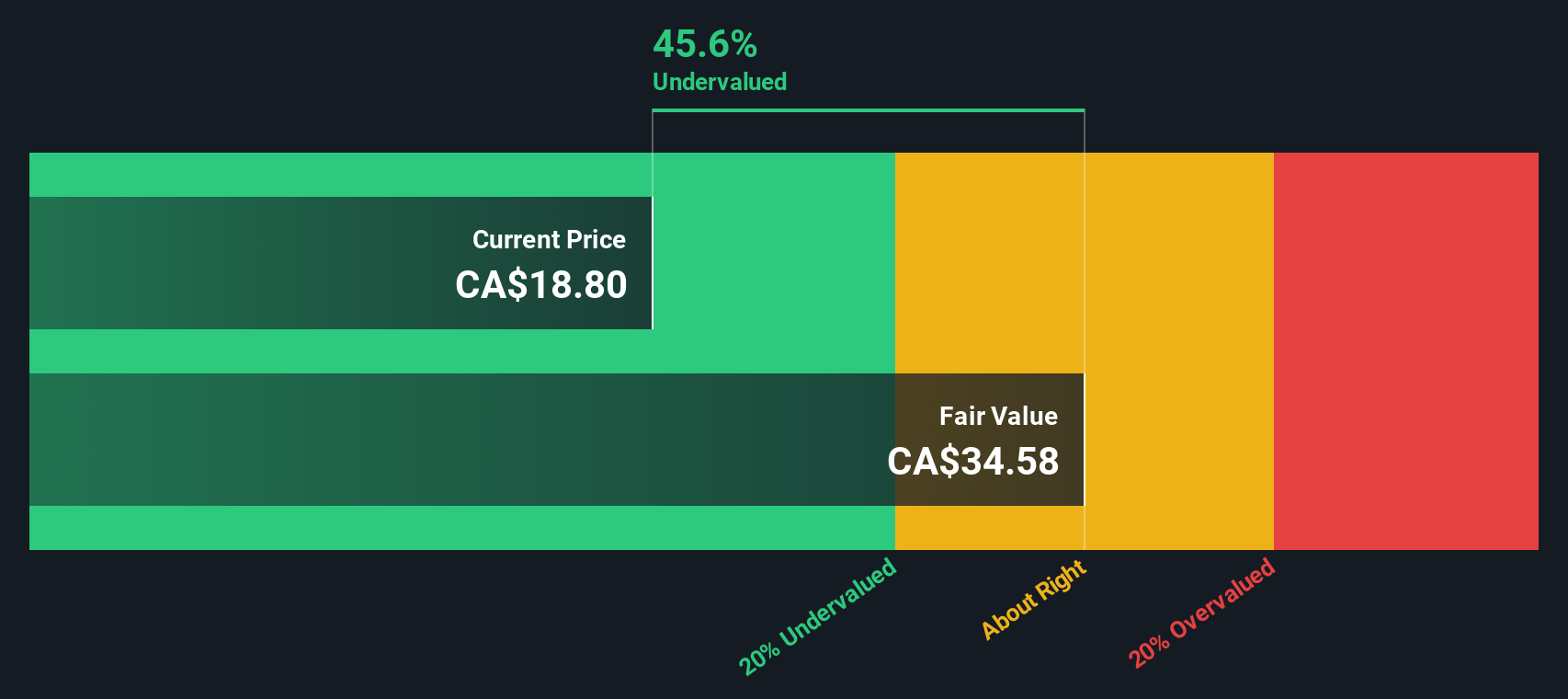

Looking from a different angle, our DCF model also signals that Peyto shares are currently trading below their intrinsic value. This approach weighs long-term cash flow outlooks and offers context for the recent fair value estimate. However, does consensus on undervaluation mean opportunity, or are there factors the models might miss?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Peyto Exploration & Development Narrative

Keep in mind, if this perspective does not match your own or you would rather analyze the numbers firsthand, you can quickly craft your own outlook in just a few minutes by using do it your way.

A great starting point for your Peyto Exploration & Development research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stop with just one opportunity? Shake up your portfolio and boost your research with hand-picked lists curated for unique growth and value. Find tomorrow’s leaders, smart alternatives, and high-yield options in just a few clicks. Missing out could mean letting the next big winner pass you by.

- Snag exceptional yields and unlock fresh income potential by reviewing dividend stocks with yields > 3% that could reshape your dividend game.

- Tap into the tech frontier by scanning quantum computing stocks, where breakthrough innovations in quantum computing are generating powerful market buzz.

- Kickstart your hunt for hidden gems by searching undervalued stocks based on cash flows with strong fundamentals that could be seriously under the radar right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PEY

Peyto Exploration & Development

Engages in the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta’s deep basin.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives