- Canada

- /

- Oil and Gas

- /

- TSX:PEY

How Strong Q2 Earnings and Production Growth at Peyto (TSX:PEY) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Peyto Exploration & Development Corp. recently reported a year-over-year increase in second quarter 2025 revenue to CA$307.46 million and net income to CA$87.83 million, supported by higher natural gas and NGLs production volumes.

- The company also filed a universal shelf registration, offering operational flexibility for future financings across various security types, while affirming its monthly dividend of CA$0.11 per common share for August 2025.

- We'll explore how Peyto’s strong earnings growth and production increase may influence its investment narrative going forward.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Peyto Exploration & Development Investment Narrative Recap

To be a shareholder in Peyto Exploration & Development, you need confidence in the company’s ability to deliver strong free cash flow from Alberta’s Deep Basin and to capitalize on long-term natural gas demand growth. While the recent earnings beat and production uplift underscore operational momentum, these do not materially shift the biggest short-term catalyst, higher realized natural gas prices via market access improvements, nor do they offset the persistent risk of AECO price volatility from infrastructure constraints.

Among the latest announcements, Peyto’s filing of a universal shelf registration stands out as most relevant. This move enhances the company’s flexibility to raise capital efficiently, potentially supporting continued development and operational projects if market or regulatory conditions create the need, which plays into the key short-term catalyst of addressing market access for gas sales and mitigating regional price discounts.

However, investors should also be aware that, despite these positive signals, the company’s earnings are still linked to...

Read the full narrative on Peyto Exploration & Development (it's free!)

Peyto Exploration & Development is projected to reach CA$1.5 billion in revenue and CA$472.4 million in earnings by 2028. This outlook assumes annual revenue growth of 19.1% and a CA$141.2 million increase in earnings from the current level of CA$331.2 million.

Uncover how Peyto Exploration & Development's forecasts yield a CA$21.66 fair value, a 14% upside to its current price.

Exploring Other Perspectives

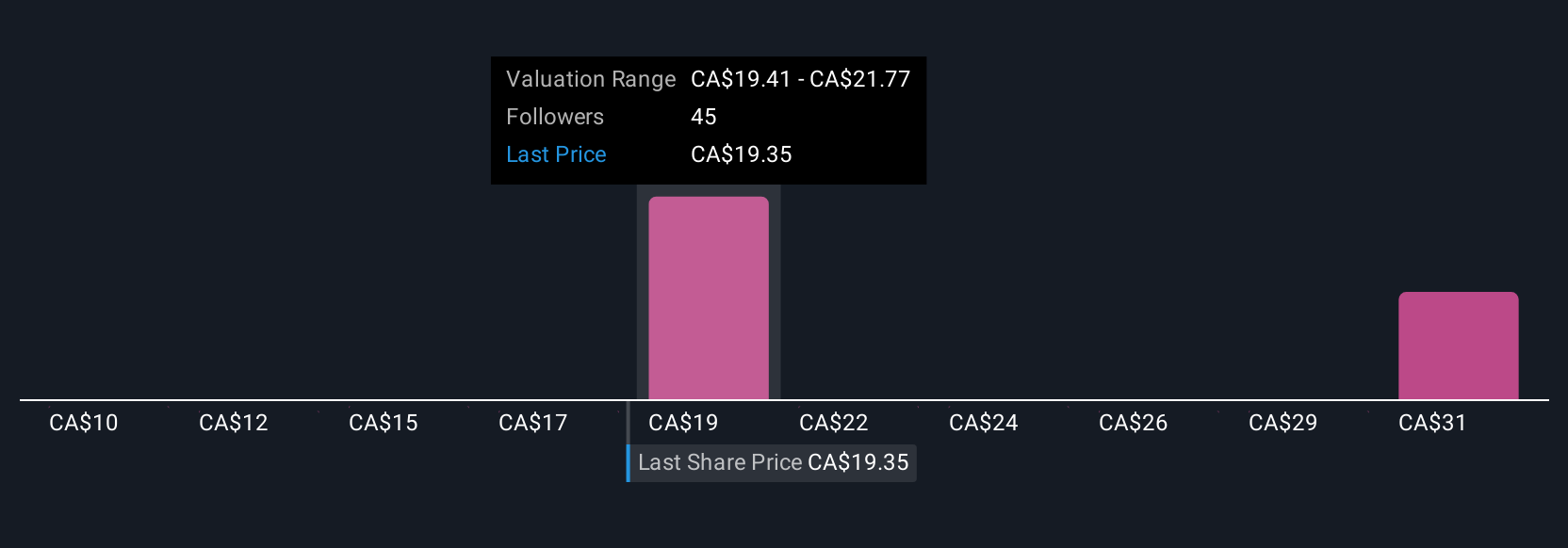

Six different Simply Wall St Community estimates place Peyto’s fair value between CA$10 and CA$34.92, suggesting a broad range of investor opinions. While market participants hold diverse views, persistent AECO pricing risk could continue to affect realized revenue and highlight why monitoring local infrastructure remains essential to the story.

Explore 6 other fair value estimates on Peyto Exploration & Development - why the stock might be worth 47% less than the current price!

Build Your Own Peyto Exploration & Development Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peyto Exploration & Development research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Peyto Exploration & Development research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peyto Exploration & Development's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PEY

Peyto Exploration & Development

Engages in the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta’s deep basin.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives