- Canada

- /

- Oil and Gas

- /

- TSX:PEY

Here's Why Peyto Exploration & Development (TSE:PEY) Is Weighed Down By Its Debt Load

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Peyto Exploration & Development Corp. (TSE:PEY) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Peyto Exploration & Development

What Is Peyto Exploration & Development's Debt?

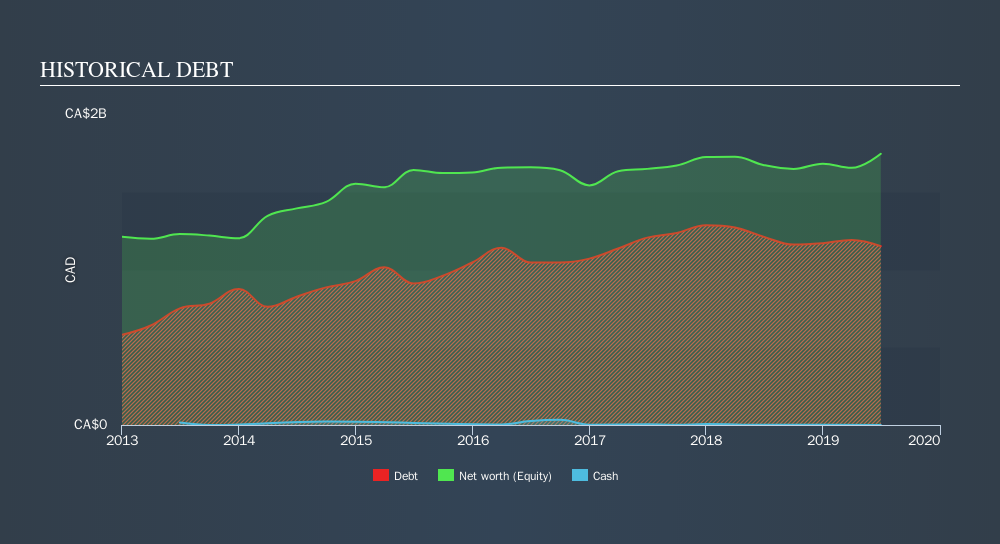

You can click the graphic below for the historical numbers, but it shows that Peyto Exploration & Development had CA$1.15b of debt in June 2019, down from CA$1.21b, one year before. Net debt is about the same, since the it doesn't have much cash.

How Strong Is Peyto Exploration & Development's Balance Sheet?

According to the last reported balance sheet, Peyto Exploration & Development had liabilities of CA$67.9m due within 12 months, and liabilities of CA$1.81b due beyond 12 months. Offsetting these obligations, it had cash of CA$662.0k as well as receivables valued at CA$45.1m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$1.83b.

This deficit casts a shadow over the CA$440.2m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Peyto Exploration & Development would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Peyto Exploration & Development's debt is 2.6 times its EBITDA, and its EBIT cover its interest expense 3.3 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Even worse, Peyto Exploration & Development saw its EBIT tank 41% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Peyto Exploration & Development can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent three years, Peyto Exploration & Development recorded free cash flow of 49% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

To be frank both Peyto Exploration & Development's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least its conversion of EBIT to free cash flow is not so bad. After considering the datapoints discussed, we think Peyto Exploration & Development has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. Given our concerns about Peyto Exploration & Development's debt levels, it seems only prudent to check if insiders have been ditching the stock.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:PEY

Peyto Exploration & Development

Engages in the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta’s deep basin.

Good value average dividend payer.

Market Insights

Community Narratives