- Canada

- /

- Oil and Gas

- /

- TSX:CVVY

With EPS Growth And More, Pieridae Energy (TSE:PEA) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Pieridae Energy (TSE:PEA). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Pieridae Energy

How Fast Is Pieridae Energy Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. Which is why EPS growth is looked upon so favourably. It is awe-striking that Pieridae Energy's EPS went from CA$0.15 to CA$0.82 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Pieridae Energy is growing revenues, and EBIT margins improved by 6.3 percentage points to 24%, over the last year. Both of which are great metrics to check off for potential growth.

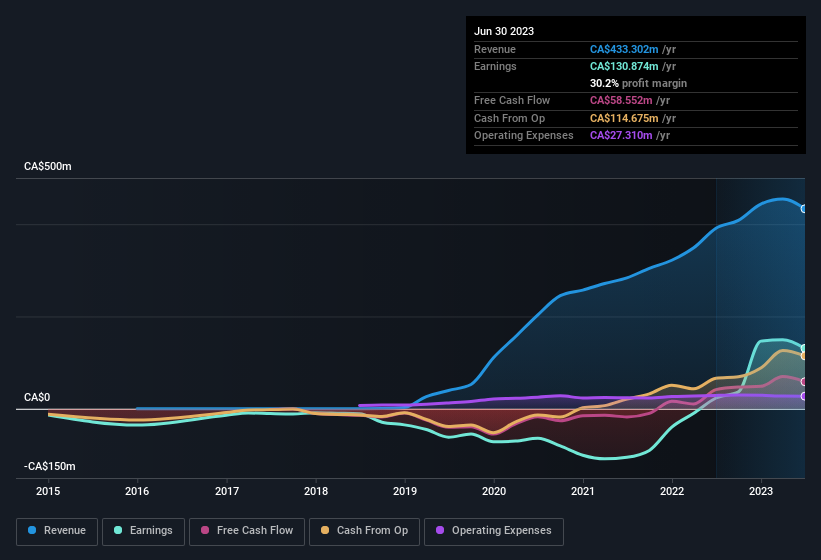

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Pieridae Energy isn't a huge company, given its market capitalisation of CA$89m. That makes it extra important to check on its balance sheet strength.

Are Pieridae Energy Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Pieridae Energy insiders refrain from selling stock during the year, but they also spent CA$96k buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. We also note that it was the Independent Director, Doug Dreisinger, who made the biggest single acquisition, paying CA$22k for shares at about CA$1.10 each.

Should You Add Pieridae Energy To Your Watchlist?

Pieridae Energy's earnings per share have been soaring, with growth rates sky high. Growth investors should find it difficult to look past that strong EPS move. And indeed, it could be a sign that the business is at an inflection point. If that's the case, you may regret neglecting to put Pieridae Energy on your watchlist. You should always think about risks though. Case in point, we've spotted 3 warning signs for Pieridae Energy you should be aware of, and 2 of them are significant.

Keen growth investors love to see insider buying. Thankfully, Pieridae Energy isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CVVY

Cavvy Energy

Operates as an integrated midstream and upstream energy company in Canada.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives