Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

While it may not be enough for some shareholders, we think it is good to see the Oryx Petroleum Corporation Limited (TSE:OXC) share price up 24% in a single quarter. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. In fact, the share price has tumbled down a mountain to land 98% lower after that period. The recent bounce might mean the long decline is over, but we are not confident. The million dollar question is whether the company can justify a long term recovery.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Oryx Petroleum

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

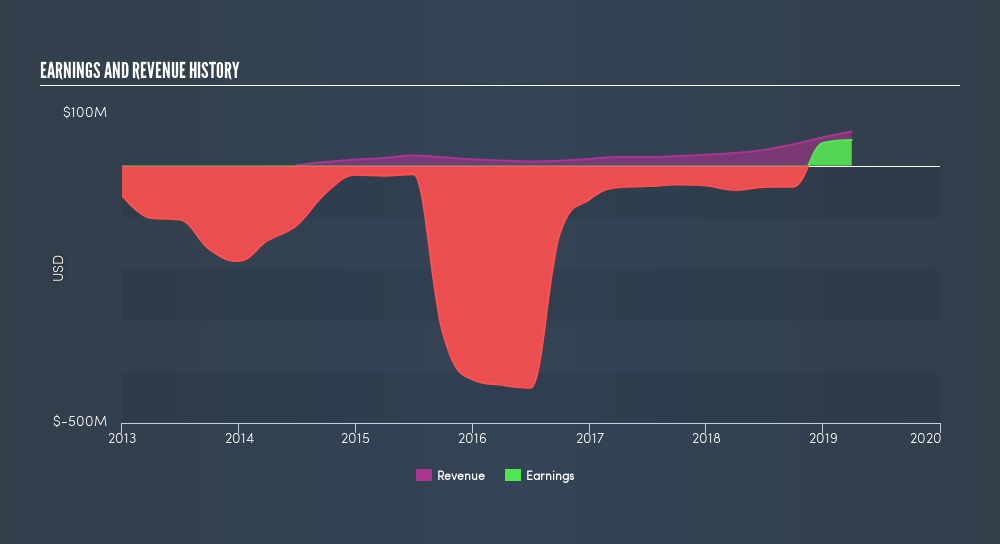

Oryx Petroleum became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

Revenue is actually up 43% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

This free interactive report on Oryx Petroleum's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Oryx Petroleum has rewarded shareholders with a total shareholder return of 27% in the last twelve months. Notably the five-year annualised TSR loss of 52% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. Before spending more time on Oryx Petroleum it might be wise to click here to see if insiders have been buying or selling shares.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:FORZ

Forza Petroleum

Forza Petroleum Limited engages in the acquisition, exploration, development, commercialization, and production of crude oil and natural gas in the Middle East.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives