- Canada

- /

- Metals and Mining

- /

- TSX:AAUC

Discover August 2025's Undervalued Small Caps With Insider Action In Global

Reviewed by Simply Wall St

As global markets experience a surge driven by favorable economic data and speculation of interest rate cuts, small-cap stocks have notably outperformed larger indices, with the Russell 2000 Index leading the charge. This environment presents an intriguing opportunity to explore small-cap companies that may be undervalued yet poised for growth, particularly those showing insider activity which can often signal confidence in the company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morguard North American Residential Real Estate Investment Trust | 6.6x | 1.8x | 21.27% | ★★★★★☆ |

| Lion Rock Group | 5.2x | 0.4x | 49.23% | ★★★★☆☆ |

| Hemisphere Energy | 5.8x | 2.3x | 10.22% | ★★★★☆☆ |

| East West Banking | 3.4x | 0.8x | 14.74% | ★★★★☆☆ |

| Sagicor Financial | 7.0x | 0.4x | -70.90% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 12.9x | 6.7x | 15.96% | ★★★★☆☆ |

| CVS Group | 45.7x | 1.3x | 37.25% | ★★★★☆☆ |

| Absolent Air Care Group | 33.4x | 2.2x | 49.86% | ★★★☆☆☆ |

| A.G. BARR | 19.2x | 1.8x | 46.86% | ★★★☆☆☆ |

| Dicker Data | 20.2x | 0.7x | -19.38% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

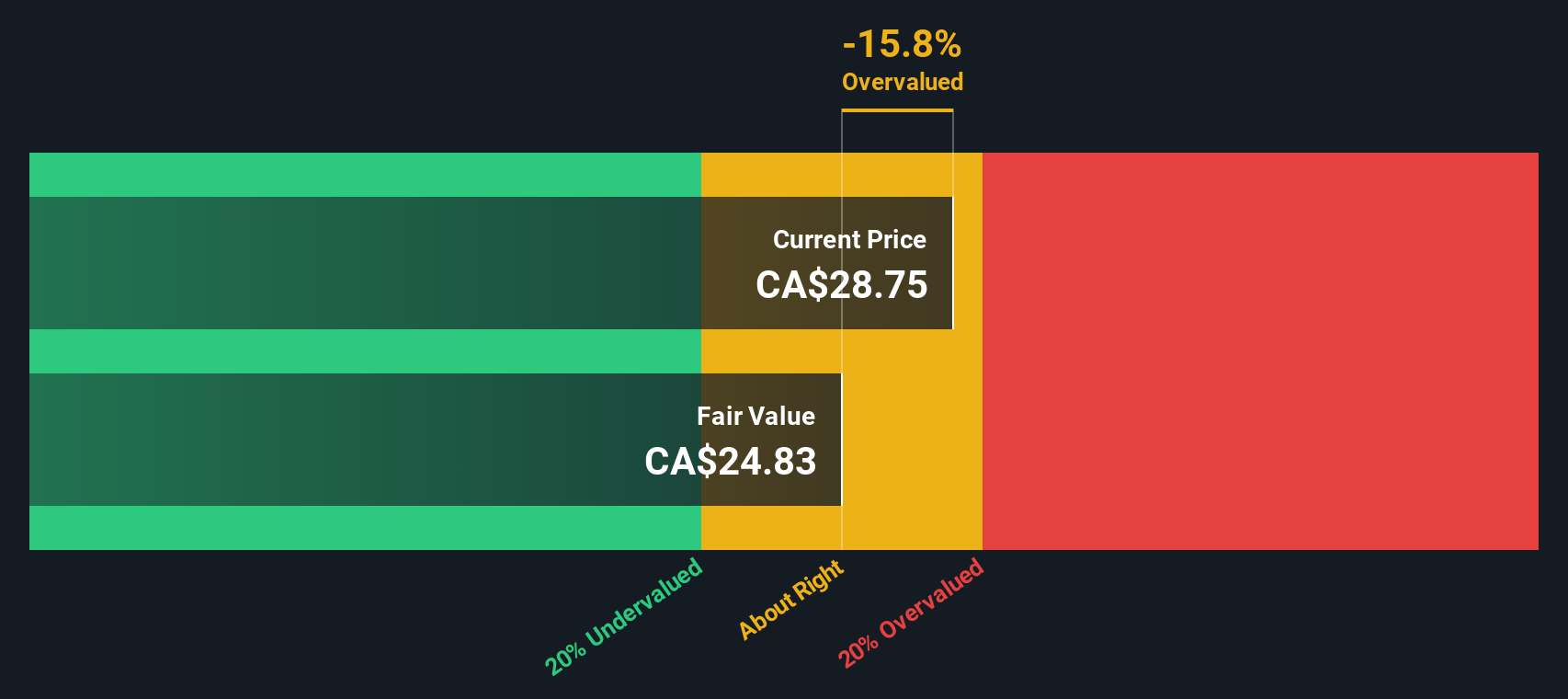

Allied Gold (TSX:AAUC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Allied Gold is a mining company focused on the exploration and production of gold, operating mines such as Agbaou, Bonikro, and Sadiola, with a market capitalization of approximately $1.25 billion.

Operations: Allied Gold generates revenue primarily from its Agbaou, Bonikro, and Sadiola mines. The company's gross profit margin has experienced fluctuations, reaching 39.14% in the first quarter of 2025. Operating expenses have been a significant cost factor, with general and administrative expenses contributing notably to this category.

PE: -11.0x

Allied Gold, a small company in the gold mining sector, recently projected third-quarter production between 88,000 and 91,000 ounces and fourth-quarter output of up to 122,000 ounces. Despite a net loss of US$25.41 million in Q2 2025 compared to last year's profit, sales rose significantly to US$251.98 million from US$195.61 million year-over-year. Insider confidence is evident with recent share purchases by executives over the past few months. Earnings growth is anticipated at an impressive pace annually at over 86%.

- Click to explore a detailed breakdown of our findings in Allied Gold's valuation report.

Evaluate Allied Gold's historical performance by accessing our past performance report.

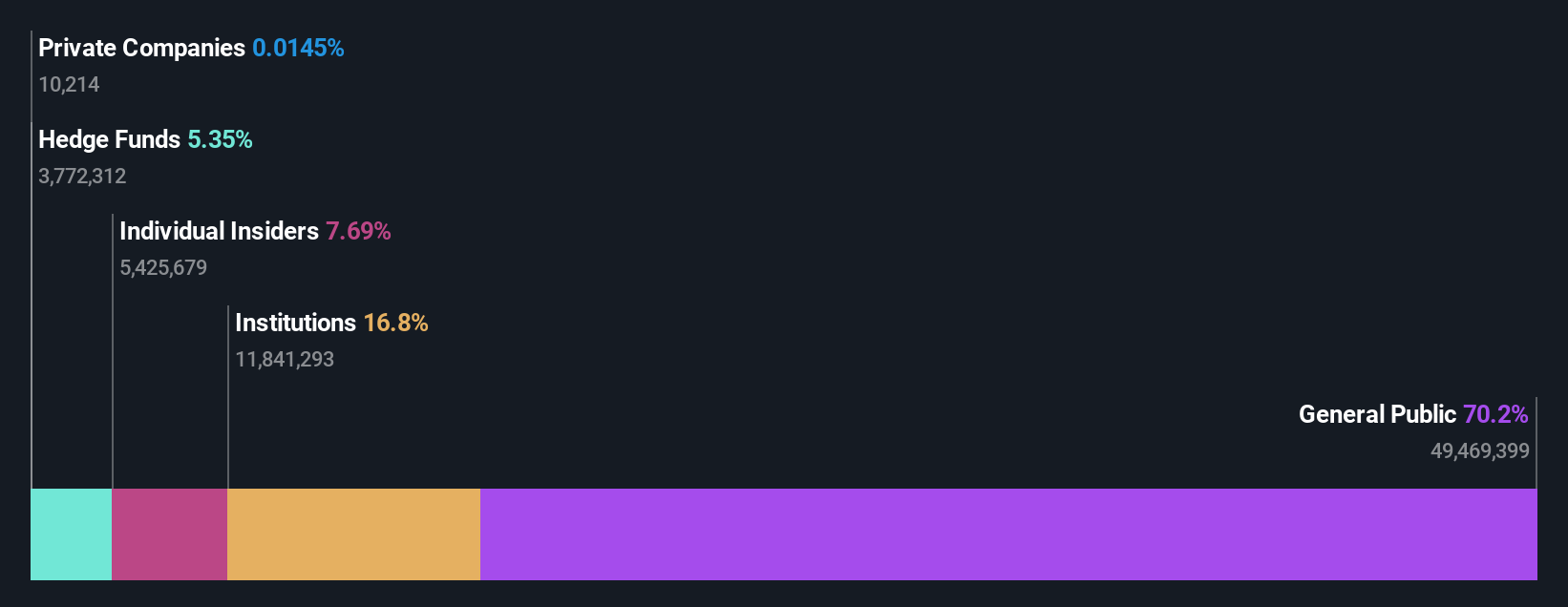

Obsidian Energy (TSX:OBE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Obsidian Energy is a Canadian oil and gas exploration and production company with a focus on developing its assets in the Western Canadian Sedimentary Basin, currently holding a market cap of approximately CA$0.52 billion.

Operations: Obsidian Energy's revenue primarily stems from its oil and gas exploration and production activities, with a recent quarterly revenue of CA$694 million. The company's cost of goods sold (COGS) was CA$274.3 million, resulting in a gross profit margin of 60.48%. Operating expenses have varied significantly over time, impacting net income figures.

PE: -2.4x

Obsidian Energy's recent activities highlight its potential in the undervalued stock category. The company repurchased 5.99 million shares for CAD 51.5 million, indicating insider confidence from April to July 2025. Despite a dip in net income to CAD 15.3 million for Q2, production guidance remains promising with expectations between 27,100 and 28,300 boe/d for the second half of 2025. Recent debt financing efforts include an offer to purchase up to US$48.4 million of senior notes, reflecting strategic financial management amid higher-risk funding sources.

- Take a closer look at Obsidian Energy's potential here in our valuation report.

Examine Obsidian Energy's past performance report to understand how it has performed in the past.

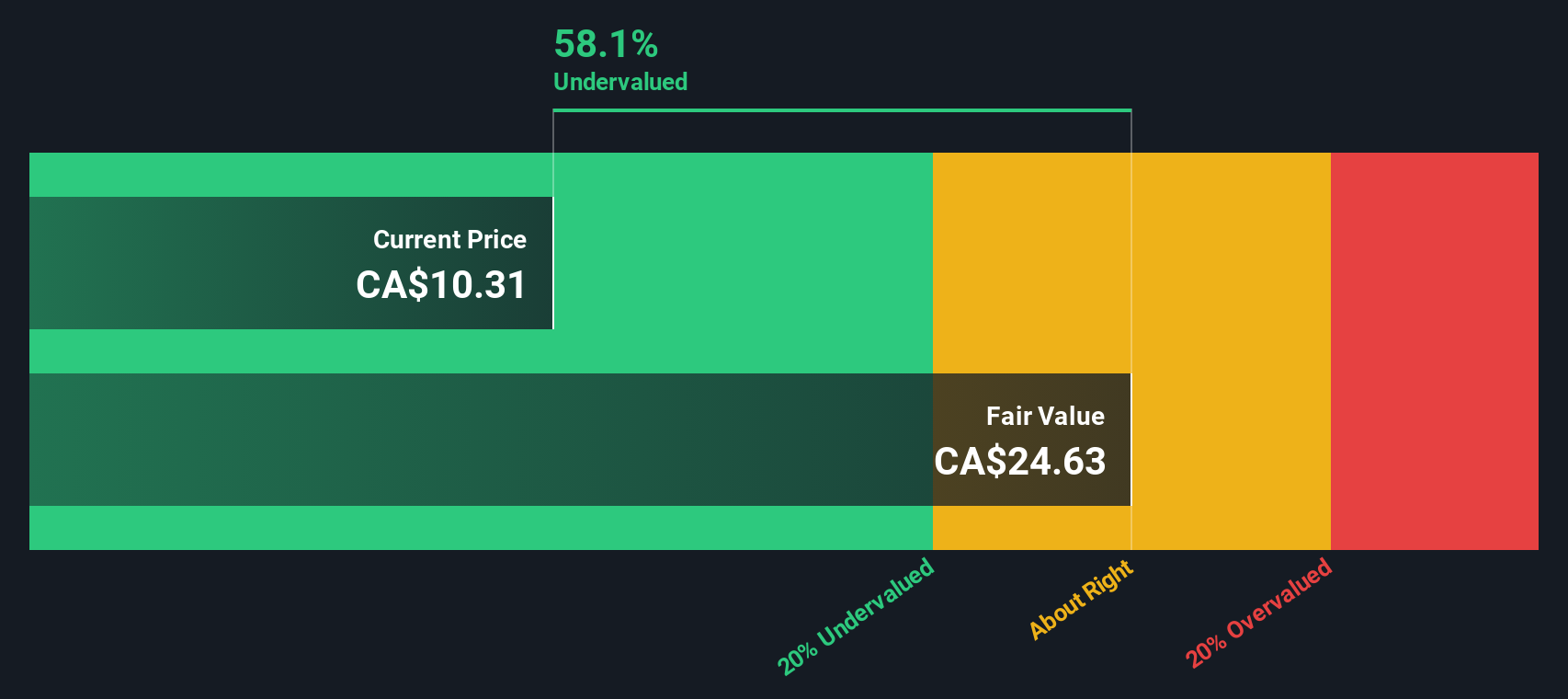

Versamet Royalties (TSXV:VMET)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Versamet Royalties focuses on generating revenue through its royalty interests in mining projects, with operations primarily in Mexico and Canada, and has a market capitalization of $150 million.

Operations: Greenstone, Canada is the primary revenue contributor with $10.82 million, compared to Mercedes, Mexico's $1.96 million. The company experienced fluctuating gross profit margins, with a notable decline from 55.52% in 2023 to 15.39% by March 2025. Operating expenses and non-operating expenses are significant cost components impacting profitability, with general and administrative expenses reaching up to $5.48 million in December 2024.

PE: -1097.8x

Versamet Royalties is drawing attention with its recent insider confidence, as Director Marcel de Groot acquired 143,000 shares for approximately CAD 146,000. This move suggests a belief in the company's potential despite its reliance on external borrowing. Recent developments include a CAD 400 million shelf registration filing and strategic board appointments. Additionally, West African Resources' Kiaka mine has exceeded expectations with gold production ahead of schedule. Earnings are projected to grow by nearly 42% annually, indicating promising prospects amidst industry challenges.

- Delve into the full analysis valuation report here for a deeper understanding of Versamet Royalties.

Seize The Opportunity

- Get an in-depth perspective on all 103 Undervalued Global Small Caps With Insider Buying by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAUC

Very undervalued with high growth potential.

Market Insights

Community Narratives