- Canada

- /

- Energy Services

- /

- TSX:NOA

Most Shareholders Will Probably Agree With North American Construction Group Ltd.'s (TSE:NOA) CEO Compensation

Key Insights

- North American Construction Group to hold its Annual General Meeting on 15th of May

- Total pay for CEO Joe Lambert includes CA$600.0k salary

- The total compensation is similar to the average for the industry

- North American Construction Group's EPS grew by 4.7% over the past three years while total shareholder return over the past three years was 81%

Under the guidance of CEO Joe Lambert, North American Construction Group Ltd. (TSE:NOA) has performed reasonably well recently. As shareholders go into the upcoming AGM on 15th of May, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

Check out our latest analysis for North American Construction Group

Comparing North American Construction Group Ltd.'s CEO Compensation With The Industry

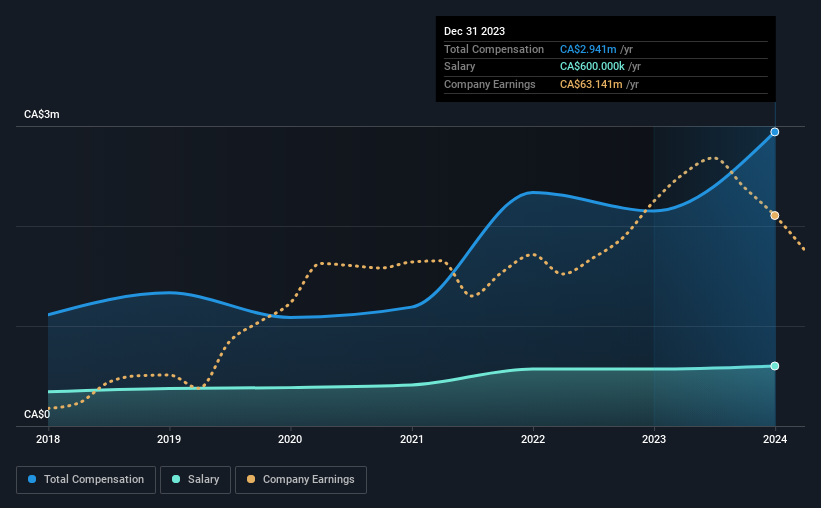

At the time of writing, our data shows that North American Construction Group Ltd. has a market capitalization of CA$749m, and reported total annual CEO compensation of CA$2.9m for the year to December 2023. That's a notable increase of 37% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CA$600k.

For comparison, other companies in the Canadian Energy Services industry with market capitalizations ranging between CA$275m and CA$1.1b had a median total CEO compensation of CA$4.1m. So it looks like North American Construction Group compensates Joe Lambert in line with the median for the industry. Furthermore, Joe Lambert directly owns CA$9.8m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CA$600k | CA$570k | 20% |

| Other | CA$2.3m | CA$1.6m | 80% |

| Total Compensation | CA$2.9m | CA$2.1m | 100% |

On an industry level, roughly 23% of total compensation represents salary and 77% is other remuneration. It's interesting to note that North American Construction Group allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at North American Construction Group Ltd.'s Growth Numbers

Over the past three years, North American Construction Group Ltd. has seen its earnings per share (EPS) grow by 4.7% per year. Its revenue is up 21% over the last year.

We think the revenue growth is good. And the improvement in EPSis modest but respectable. So while we'd stop just short of calling this a top performer, but we think it is well worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has North American Construction Group Ltd. Been A Good Investment?

Boasting a total shareholder return of 81% over three years, North American Construction Group Ltd. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 3 warning signs for North American Construction Group you should be aware of, and 1 of them is concerning.

Switching gears from North American Construction Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if North American Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:NOA

North American Construction Group

Provides mining and heavy civil construction services to customers in the resource development and industrial construction sectors in Australia, Canada, and the United States.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026