- Canada

- /

- Metals and Mining

- /

- TSX:DSV

3 TSX Growth Companies With High Insider Ownership And 52% Earnings Growth

Reviewed by Simply Wall St

In the current economic landscape, Canada is navigating through a complex environment marked by new tariffs and shifting global trade dynamics, which could impact its growth trajectory. In this context, identifying growth companies with high insider ownership can be particularly appealing as they often demonstrate strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Tenaz Energy (TSX:TNZ) | 10.3% | 151.2% |

| SolarBank (NEOE:SUNN) | 15.9% | 52.1% |

| Robex Resources (TSXV:RBX) | 24.4% | 90.6% |

| Propel Holdings (TSX:PRL) | 36.3% | 31.1% |

| Orla Mining (TSX:OLA) | 11.2% | 44.8% |

| Enterprise Group (TSX:E) | 32.2% | 70.3% |

| Discovery Silver (TSX:DSV) | 15.1% | 39.5% |

| Burcon NutraScience (TSX:BU) | 15.3% | 125.9% |

| Aritzia (TSX:ATZ) | 17.3% | 27.6% |

| Allied Gold (TSX:AAUC) | 16% | 64.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Discovery Silver (TSX:DSV)

Simply Wall St Growth Rating: ★★★★★★

Overview: Discovery Silver Corp. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Canada with a market cap of CA$2.54 billion.

Operations: Discovery Silver Corp. does not currently generate revenue from its mineral exploration activities in Canada.

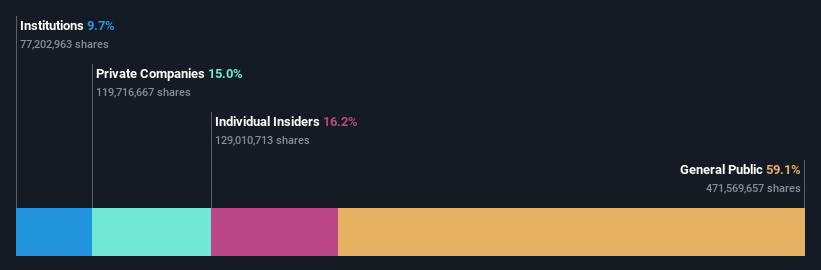

Insider Ownership: 15.1%

Earnings Growth Forecast: 39.5% p.a.

Discovery Silver is poised for growth with high forecasted revenue increases of 38.2% annually, outpacing the Canadian market. Despite recent insider selling, substantial purchases have occurred over the past three months. The company trades significantly below its estimated fair value and aims to become profitable within three years. Recent executive appointments bolster strategic capabilities amid advanced talks to acquire Barrick's Hemlo gold mine, potentially enhancing Discovery's asset base in a high-demand sector.

- Click here and access our complete growth analysis report to understand the dynamics of Discovery Silver.

- Insights from our recent valuation report point to the potential overvaluation of Discovery Silver shares in the market.

North American Construction Group (TSX:NOA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: North American Construction Group Ltd. offers mining and heavy civil construction services in the resource development and industrial construction sectors across Australia, Canada, and the United States, with a market cap of CA$614.52 million.

Operations: The company's revenue segments include CA$575.13 million from heavy equipment services in Canada and CA$614.69 million from similar services in Australia.

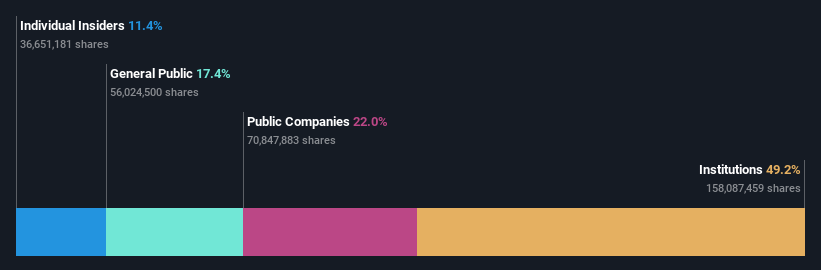

Insider Ownership: 10.9%

Earnings Growth Forecast: 52.9% p.a.

North American Construction Group is forecast to achieve significant earnings growth of 52.9% annually, surpassing the Canadian market's average. Despite a decline in profit margins and substantial recent insider selling, the company trades well below its estimated fair value. Recent financial maneuvers include a CAD 225 million debt offering to refinance existing obligations, and an active share buyback program has repurchased 1.82% of shares, indicating confidence in long-term prospects despite current challenges.

- Delve into the full analysis future growth report here for a deeper understanding of North American Construction Group.

- The analysis detailed in our North American Construction Group valuation report hints at an deflated share price compared to its estimated value.

Orla Mining (TSX:OLA)

Simply Wall St Growth Rating: ★★★★★★

Overview: Orla Mining Ltd. is engaged in the acquisition, exploration, development, and exploitation of mineral properties with a market cap of CA$5.27 billion.

Operations: Orla Mining Ltd. generates its revenue through the acquisition, exploration, development, and exploitation of mineral properties.

Insider Ownership: 11.2%

Earnings Growth Forecast: 44.8% p.a.

Orla Mining is poised for robust growth, with projected annual revenue and earnings increases of 20.1% and 44.8%, respectively, outpacing the Canadian market. Recent production guidance reaffirms a target of up to 300,000 ounces of gold in 2025. Despite no substantial insider buying recently, insider activity shows more purchases than sales over three months. However, the company faces challenges with high debt levels and reported a net loss in Q1 despite increased sales to US$140.67 million.

- Get an in-depth perspective on Orla Mining's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Orla Mining's share price might be on the expensive side.

Make It Happen

- Discover the full array of 47 Fast Growing TSX Companies With High Insider Ownership right here.

- Interested In Other Possibilities? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DSV

Discovery Silver

A mineral exploration company, engages in the acquisition, exploration, and development of mineral properties in Canada.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives