- Canada

- /

- Oil and Gas

- /

- TSX:MEG

MEG Energy (TSX:MEG): Valuation in Focus After Recent Momentum Pause

Reviewed by Kshitija Bhandaru

MEG Energy (TSX:MEG) has caught the attention of investors as its stock price recently drifted slightly lower over the past week, despite a solid year-to-date gain. This movement has some asking questions about what could be next for the company.

See our latest analysis for MEG Energy.

MEG Energy’s share price momentum has cooled a bit this week, though the stock’s impressive 21.8% year-to-date share price return shows investors still see potential. Long-term holders have experienced even greater rewards, with a standout 1,126.7% total shareholder return over five years. This suggests that underlying optimism remains strong even as some near-term volatility returns.

If you want to see where similar patterns of growth and conviction are emerging, it’s worth exploring fast growing stocks with high insider ownership.

With MEG Energy’s strong returns and solid fundamentals, investors are now left to wonder whether the recent share price pullback means the stock is trading below its true value. Alternatively, some may question if future growth is already accounted for in the current price.

Most Popular Narrative: Fairly Valued

With MEG Energy’s last close at CA$29.22 and the widely followed narrative fair value at CA$29.11, the market appears closely aligned with consensus expectations. This near match spotlights the reasons behind the valuation, which hinge on future expansion and operational strategy.

The 25,000 barrel per day facility expansion at Christina Lake remains on track and on budget for completion by mid-2027, significantly increasing production capacity and top-line revenue potential as global energy demand continues to rise with population growth and urbanization.

Want to know what’s fueling this tight price match? The narrative banks on growth from a major project rollout and some bold projections for cash flows and margins. Discover what underpins this valuation and why analysts see a stark future shift for MEG Energy.

Result: Fair Value of $29.11 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, MEG’s reliance on the Christina Lake project and its exposure to volatile oil prices could still challenge the current fair value narrative.

Find out about the key risks to this MEG Energy narrative.

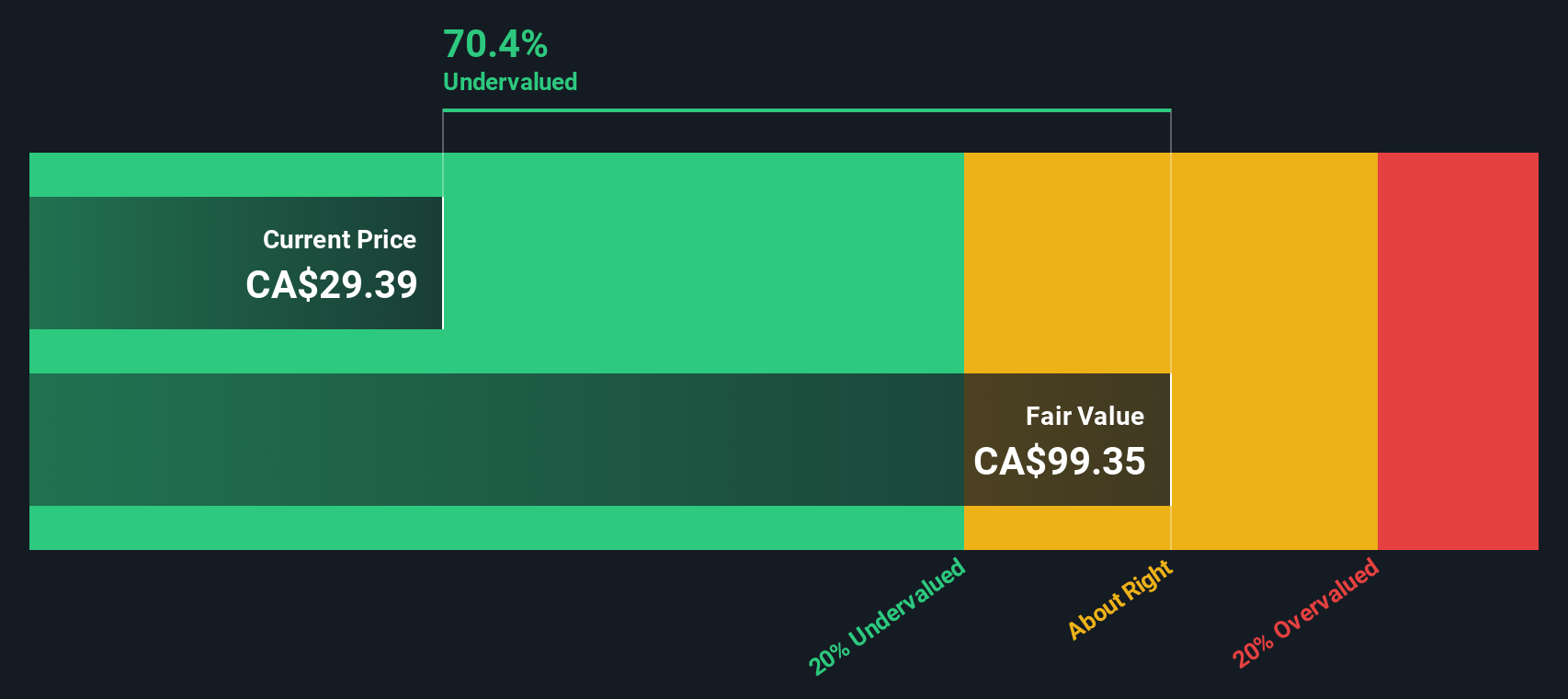

Another View: SWS DCF Model Suggests More Upside

While consensus analysts see MEG Energy as fairly valued, our DCF model presents a different take, indicating the stock is trading at a steep 71.7% discount to estimated fair value. This significant gap suggests there could be much more room for the price to rise if the model assumptions bear out. But why is there such a disconnect between these perspectives?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MEG Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MEG Energy Narrative

If you want to dive into the numbers or see things from a different angle, it’s quick and simple to shape your own outlook. Do it your way.

A great starting point for your MEG Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t settle for sticking with only what you know. You could be missing out on some incredible growth or steady returns by not checking these ideas right now.

- Tap into tech by reviewing these 24 AI penny stocks, which bring artificial intelligence into real-world applications across industries.

- Boost your portfolio’s income stream by considering these 20 dividend stocks with yields > 3% with robust yields exceeding 3%.

- Seize undervalued gems before the market catches up by analyzing these 867 undervalued stocks based on cash flows, all based on solid cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MEG

MEG Energy

An energy company, focuses on in situ thermal oil production in its Christina Lake Project in the southern Athabasca oil region of Alberta, Canada.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives