- Canada

- /

- Oil and Gas

- /

- TSX:KEY

Keyera Shares Rise 5.7% After Major Partnership But Is the Stock Fairly Priced?

Reviewed by Bailey Pemberton

- Wondering if Keyera is undervalued or fairly priced? You are not alone, as many investors are taking a closer look at this stock's potential.

- In the past week, Keyera shares gained 5.7%, even though the stock is nearly flat over the past year and down 2.5% year-to-date. This recent momentum is all the more eye-catching.

- This price action comes after analysts and market watchers highlighted Keyera’s strategic midstream asset investments and a major infrastructure partnership announced earlier this quarter. These developments have put the company back in the conversation around future growth and reliability in Canada’s energy sector.

- From a valuation perspective, Keyera scores just 2/6 on our undervaluation checks. This hints at both opportunity and risk. Let’s dive into the different ways you can assess Keyera’s true value and stick around for a better way to understand whether the stock is really a bargain.

Keyera scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Keyera Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and discounting them back to today’s value. This approach helps investors gauge whether a stock is trading at a price below or above its fundamental worth, based on anticipated cash generation.

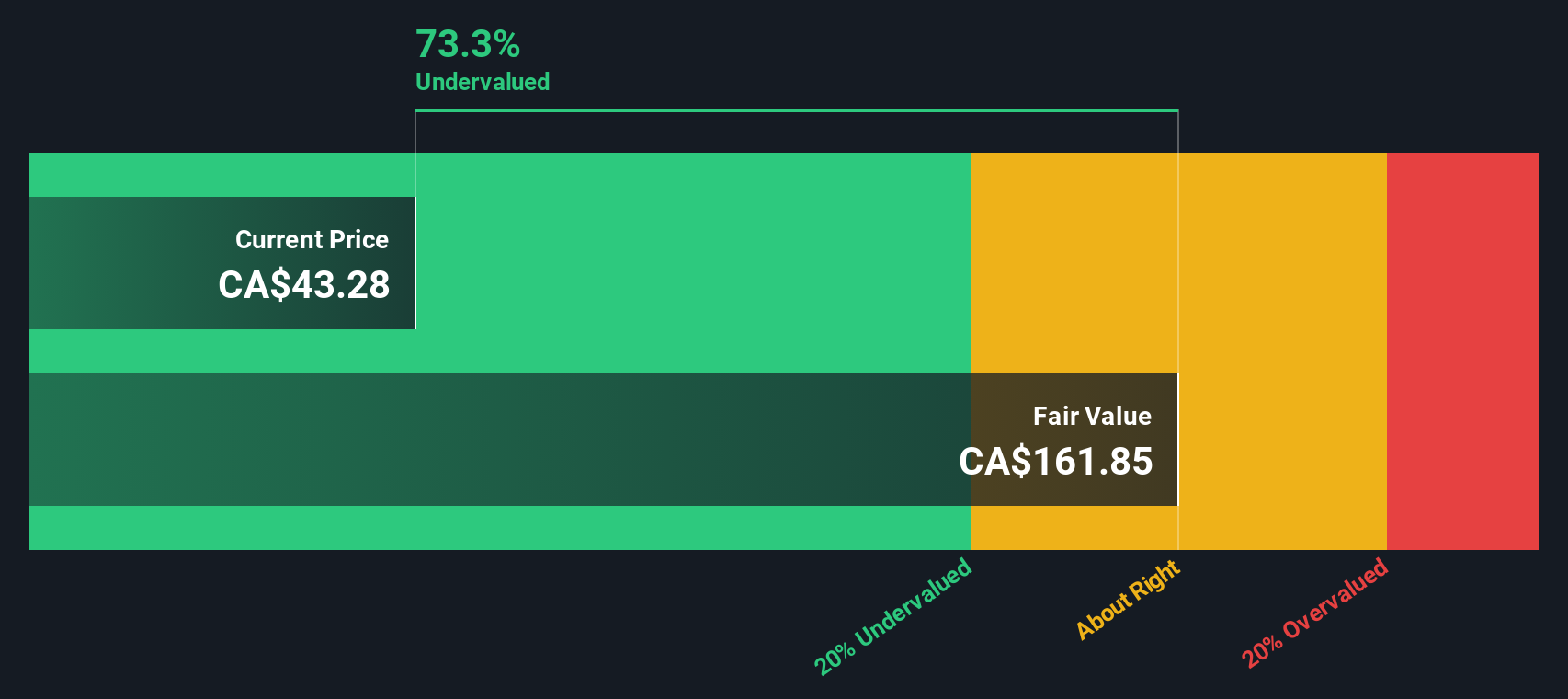

For Keyera, the current Free Cash Flow over the last twelve months stands at CA$394 million. Analyst consensus projects strong growth over the coming years, supported by substantial infrastructure investments and operational momentum. While analyst estimates cover up to five years, longer-term forecasts, extrapolated by Simply Wall St, anticipate annual free cash flows reaching approximately CA$1.47 billion by 2029, with further moderate increases extending into the next decade.

Applying the 2 Stage Free Cash Flow to Equity model, these projections are integrated and discounted to calculate an estimated intrinsic value for Keyera shares. The resulting intrinsic value from the DCF analysis is CA$177.60 per share. Compared to Keyera’s current market price, this represents a discount of 75.6%, suggesting that the stock may be significantly undervalued at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Keyera is undervalued by 75.6%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Keyera Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is one of the most widely used valuation tools for profitable companies, helping investors determine how much they are paying for each dollar of earnings. It is especially relevant for a company like Keyera, which has maintained consistent profitability and earnings visibility.

The “normal” or “fair” PE ratio for a stock is shaped by several factors, most notably growth expectations and the level of risk associated with its future earnings. High-growth companies typically warrant higher PE ratios, while riskier or slower-growing businesses usually trade at a discount.

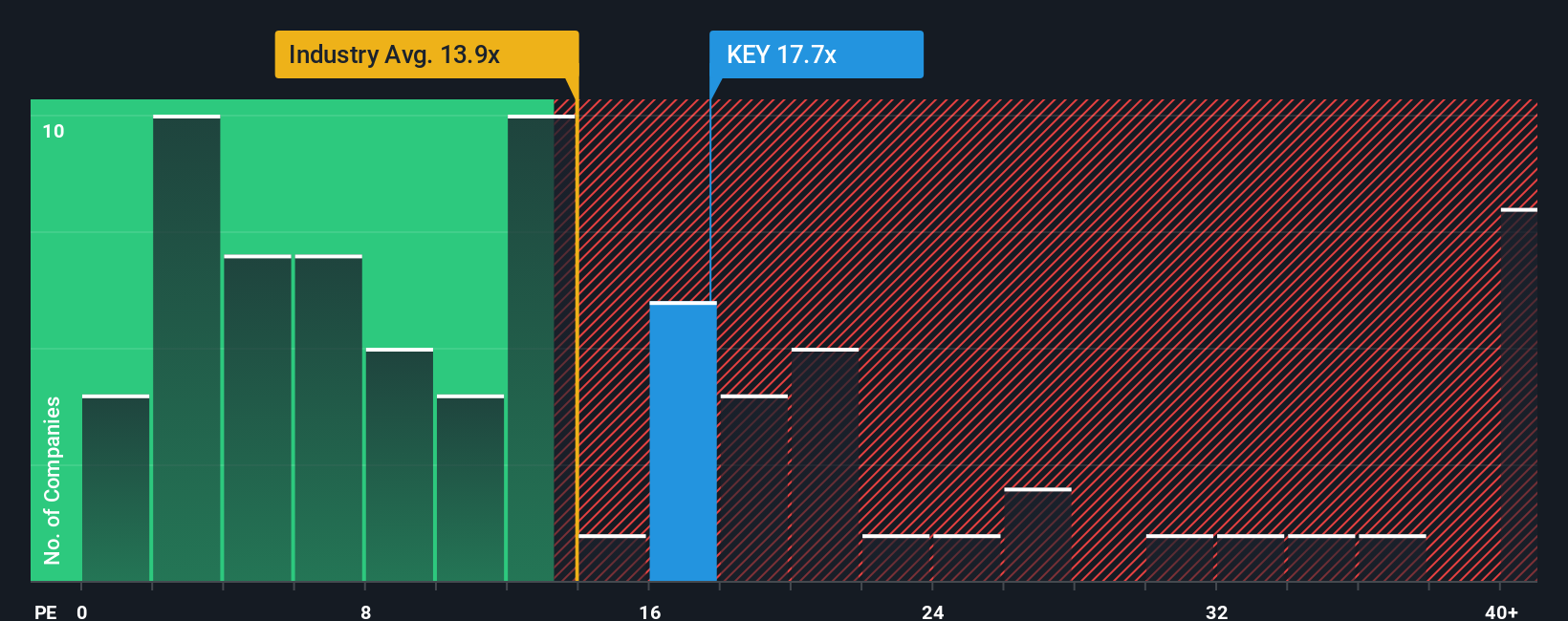

Keyera’s current PE ratio stands at 18.70x. This is moderately above the average for Canadian oil and gas peers, which sits at 17.27x. It is also ahead of the broader industry average of 14.66x. However, a more refined benchmark is the Simply Wall St Fair Ratio, calculated at 16.60x. This Fair Ratio estimates the multiple Keyera deserves, factoring in its unique growth profile, industry positioning, margins, size and risks.

Relying on the Fair Ratio offers a more tailored lens than simply comparing Keyera to generic peers or industry averages. It incorporates not just financials but also risk factors and growth momentum, giving a truer sense of whether the current market price fairly reflects the company’s prospects.

With Keyera trading at 18.70x versus a fair value of 16.60x, the stock appears somewhat expensive on an earnings basis, although not dramatically so.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Keyera Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a clear, personal story you build around your view of a company, connecting your expectations for Keyera’s future revenue, profit margins, and fair value to a single, dynamic forecast. By linking what you believe about Keyera’s growth drivers, risks, and industry position to a financial model (rather than just sticking to generic ratios), Narratives bring the company’s unique story to life and put real numbers behind your view.

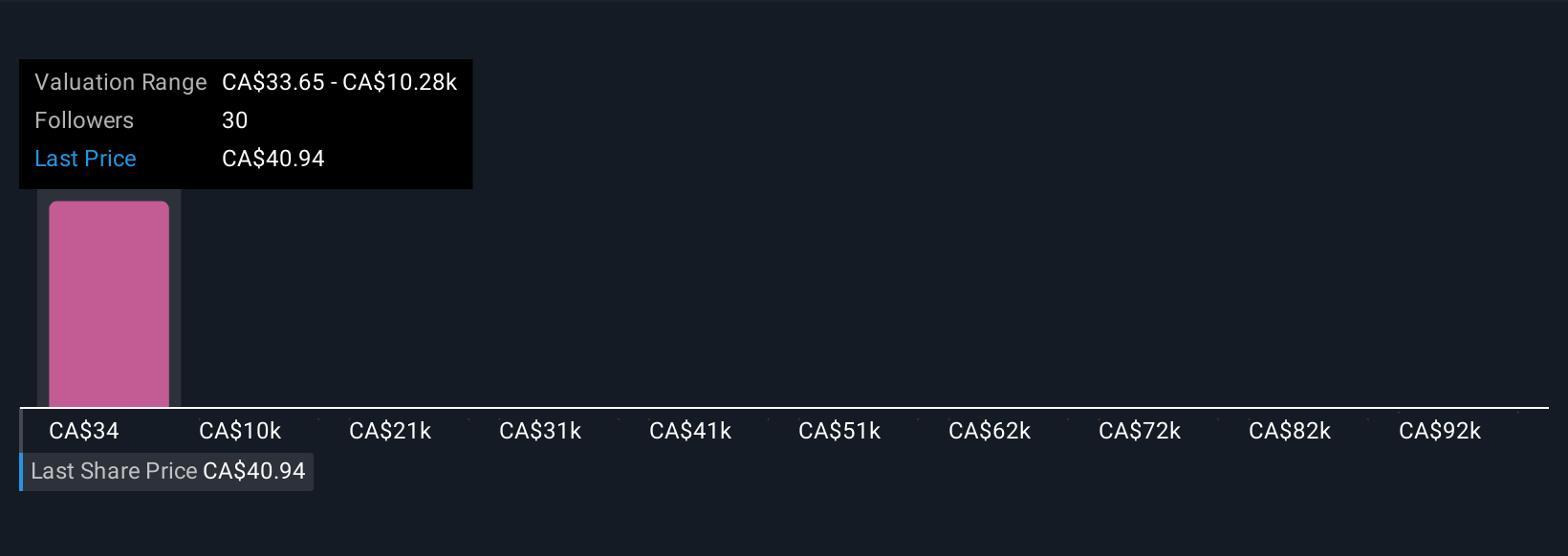

These Narratives are easy to create and update on Simply Wall St’s Community page, where millions of investors discuss and share their perspectives. Narratives help investors decide when to buy, hold, or sell by comparing their own Fair Value estimate with the current market price. Since they update automatically as new news, earnings, or forecasts come in, you are always acting on the latest information. For example, among Keyera investors right now, some believe the company could reach a fair value of CA$61.0 by 2028 based on aggressive growth, while others see a lower target of just CA$42.0 due to regional risks and industry headwinds.

Do you think there's more to the story for Keyera? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keyera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KEY

Keyera

Engages in the gathering and processing of natural gas; and the transportation, storage, and marketing of natural gas liquids (NGLs) in Canada and the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives