- Canada

- /

- Oil and Gas

- /

- TSX:KEY

Does Plains NGL Deal Offset Weaker Results for Keyera (TSX:KEY) or Add New Uncertainty?

Reviewed by Sasha Jovanovic

- Keyera Corp. recently reported third-quarter 2025 earnings, with sales of C$1.79 billion and net income of C$85.22 million, both declining year-over-year and leading to a reduction in marketing margin guidance and growth capital spending for next year.

- Despite these pressures, Keyera highlighted double-digit growth in its fee-for-service margins and reaffirmed progress on the pending Plains Canadian NGL acquisition, which is expected to expand operational scale and support future growth.

- We’ll examine how Keyera’s resilient fee-for-service performance and transformative Plains acquisition influence its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Keyera Investment Narrative Recap

To own Keyera, investors need to believe in the company's ability to generate reliable fee-for-service income from its integrated midstream energy platform while successfully executing its acquisition of Plains’ Canadian NGL business. The recent earnings shortfall and lowered marketing margin guidance reinforce that the biggest near-term catalyst remains delivering integration synergies from the Plains deal, while the main risk now is ensuring these synergies are realized on time and without operational setbacks; neither the earnings decline nor the dividend affirmation represent an immediate material impact to these drivers.

One of the most relevant recent announcements is Keyera’s affirmation of its Q4 2025 dividend at CA$0.54 per share, despite weaker marketing results and cutbacks to growth capital. This supports the broader catalyst of stable fee-based cash flows and ongoing investor returns, though it does not fully address possible headwinds tied to competitive pressures or integration complexity with the pending Plains transaction.

On the other hand, investors should be aware that while Keyera remains committed to its growth plans, successful integration of Plains is not without ...

Read the full narrative on Keyera (it's free!)

Keyera's narrative projects CA$9.2 billion in revenue and CA$830.8 million in earnings by 2028. This requires 8.2% annual revenue growth and a CA$300 million earnings increase from the current CA$530.4 million.

Uncover how Keyera's forecasts yield a CA$50.71 fair value, a 17% upside to its current price.

Exploring Other Perspectives

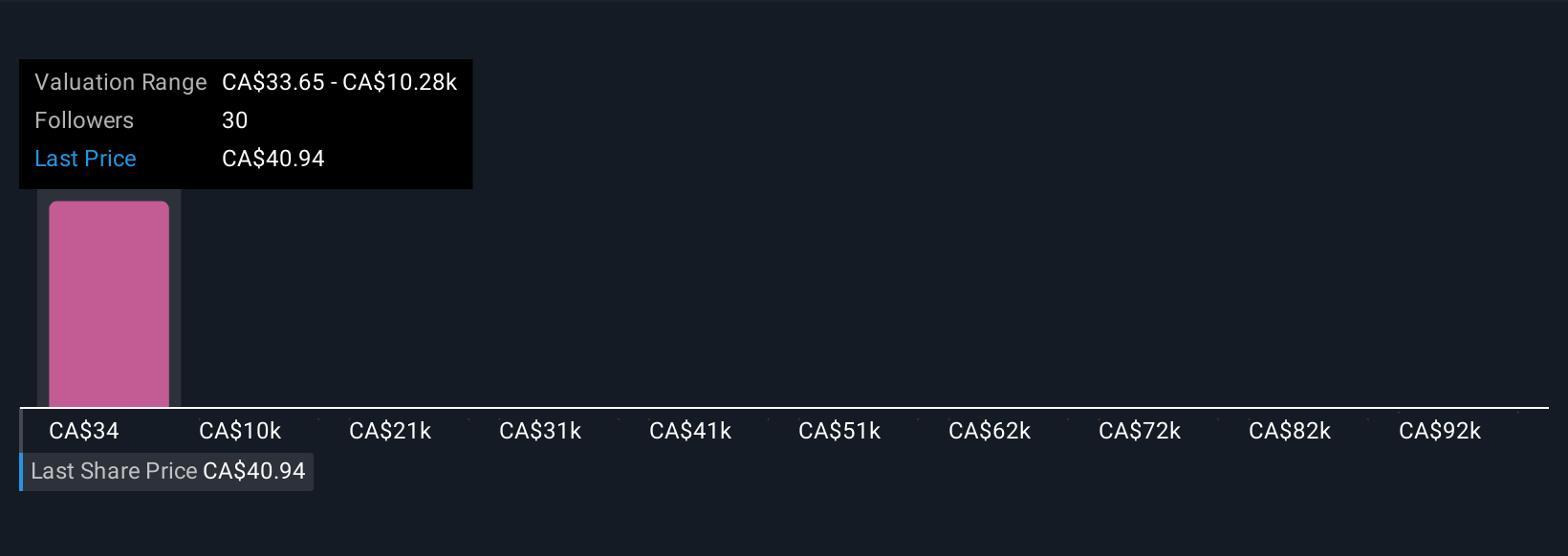

Seven Simply Wall St Community fair value estimates for Keyera range dramatically from CA$33.65 to CA$102,530.29 per share. While some see upside tied to the Plains acquisition and volume growth, others warn that execution risk may create uneven outcomes and invite you to consider various viewpoints now.

Explore 7 other fair value estimates on Keyera - why the stock might be a potential multi-bagger!

Build Your Own Keyera Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Keyera research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Keyera research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Keyera's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keyera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KEY

Keyera

Engages in the gathering and processing of natural gas; and the transportation, storage, and marketing of natural gas liquids (NGLs) in Canada and the United States.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives