- Canada

- /

- Oil and Gas

- /

- TSX:KEL

Some Kelt Exploration (TSE:KEL) Shareholders Have Copped A Big 59% Share Price Drop

Statistically speaking, long term investing is a profitable endeavour. But along the way some stocks are going to perform badly. To wit, the Kelt Exploration Ltd. (TSE:KEL) share price managed to fall 59% over five long years. That's not a lot of fun for true believers. And some of the more recent buyers are probably worried, too, with the stock falling 27% in the last year. It's down 4.2% in the last seven days.

Check out our latest analysis for Kelt Exploration

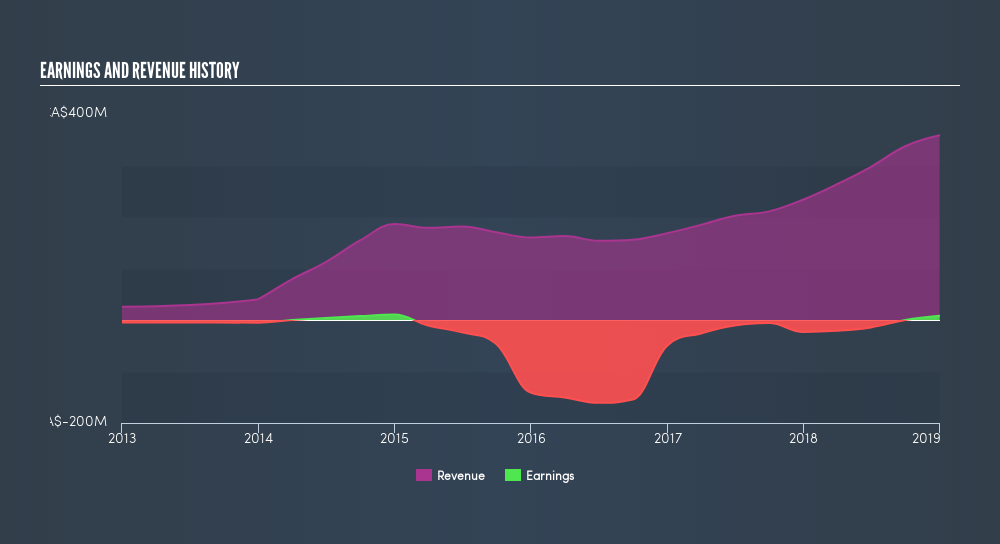

Given that Kelt Exploration only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last half decade, Kelt Exploration saw its revenue increase by 23% per year. That's well above most other pre-profit companies. In contrast, the share price is has averaged a loss of 16% per year - that's quite disappointing. This could mean high expectations have been tempered, potentially because investors are looking to the bottom line. Given the revenue growth we'd consider the stock to be quite an interesting prospect if the company has a clear path to profitability.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Kelt Exploration will earn in the future (free profit forecasts)

A Different Perspective

While the broader market gained around 7.7% in the last year, Kelt Exploration shareholders lost 27%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 16% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:KEL

Kelt Exploration

An oil and gas company, engages in the exploration, development, and production of crude oil and natural gas resources primarily in Western Canada.

Adequate balance sheet with limited growth.

Market Insights

Community Narratives