Unfortunately for shareholders, when Kolibri Global Energy Inc. (TSE:KEI) reported results for the period to December 2020, its auditors, KPMG LLP - Klynveld Peat Marwick Goerdeler, expressed uncertainty about whether it can continue as a going concern. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

Given its situation, it may not be in a good position to raise capital on favorable terms. So shareholders should absolutely be taking a close look at how risky the balance sheet is. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

Check out our latest analysis for Kolibri Global Energy

What Is Kolibri Global Energy's Net Debt?

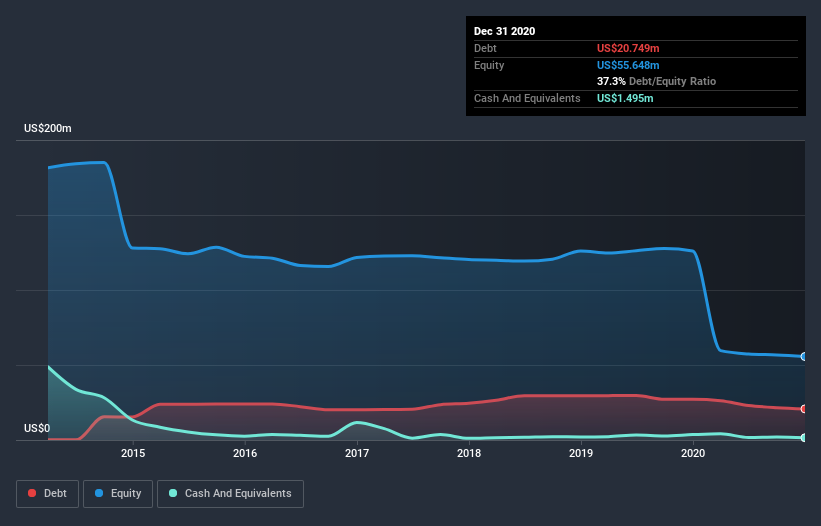

As you can see below, Kolibri Global Energy had US$20.7m of debt at December 2020, down from US$27.2m a year prior. However, it also had US$1.50m in cash, and so its net debt is US$19.3m.

How Strong Is Kolibri Global Energy's Balance Sheet?

We can see from the most recent balance sheet that Kolibri Global Energy had liabilities of US$6.56m falling due within a year, and liabilities of US$20.0m due beyond that. Offsetting this, it had US$1.50m in cash and US$1.61m in receivables that were due within 12 months. So its liabilities total US$23.4m more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of US$24.2m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While we wouldn't worry about Kolibri Global Energy's net debt to EBITDA ratio of 2.6, we think its super-low interest cover of 2.1 times is a sign of high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Looking on the bright side, Kolibri Global Energy boosted its EBIT by a silky 49% in the last year. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. There's no doubt that we learn most about debt from the balance sheet. But it is Kolibri Global Energy's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Kolibri Global Energy recorded free cash flow of 24% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Kolibri Global Energy's interest cover and level of total liabilities definitely weigh on it, in our esteem. But its EBIT growth rate tells a very different story, and suggests some resilience. When we consider all the factors discussed, it seems to us that Kolibri Global Energy is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. While some investors may specialize in these sort of situations, it's simply too risky and complicated for us to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. Our preference is to invest in companies that always make sure the auditor has confidence that the company will continue as a going concern. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Kolibri Global Energy (including 1 which is concerning) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Kolibri Global Energy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kolibri Global Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:KEI

Kolibri Global Energy

Engages in the exploration and exploitation of oil, gas, and clean and sustainable energy reserves in the United States.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives