- Canada

- /

- Metals and Mining

- /

- TSXV:MMG

TSX Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

The Canadian market is currently navigating a complex landscape marked by potential tariff impacts and political uncertainty, with the TSX showing modest gains amidst broader caution. In such times, investors often seek opportunities in overlooked areas like penny stocks, which refer to smaller or newer companies that can offer growth potential at lower price points. Despite their historical reputation, these stocks can present compelling opportunities when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.60 | CA$168.17M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.80 | CA$450.76M | ★★★★★★ |

| NTG Clarity Networks (TSXV:NCI) | CA$2.05 | CA$86.42M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.64 | CA$586.49M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.08 | CA$39.87M | ★★★★★★ |

| McCoy Global (TSX:MCB) | CA$2.92 | CA$79.37M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.15 | CA$3.28B | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$31.16M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.82 | CA$379.19M | ★★★★★☆ |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

InPlay Oil (TSX:IPO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: InPlay Oil Corp. is involved in the acquisition, exploration, development, and production of petroleum and natural gas properties in Canada with a market cap of CA$143.29 million.

Operations: In the Oil & Gas - Exploration & Production segment, the company generated CA$140.26 million in revenue.

Market Cap: CA$143.29M

InPlay Oil Corp., with a market cap of CA$143.29 million, has shown robust financial management, as its debt is well covered by operating cash flow and interest payments are adequately managed. Despite having a seasoned board, the company faces challenges with declining earnings growth and lower profit margins compared to last year. Recent strategic moves include acquiring Cardium light oil assets for approximately $309 million and securing $300 million in credit facilities, indicating an aggressive expansion strategy. However, short-term liabilities exceed short-term assets, which may pose liquidity concerns amidst these expansions.

- Take a closer look at InPlay Oil's potential here in our financial health report.

- Evaluate InPlay Oil's prospects by accessing our earnings growth report.

Mega Uranium (TSX:MGA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mega Uranium Ltd. is a uranium mining and investment company focused on exploring uranium properties mainly in Canada and Australia, with a market cap of CA$98.57 million.

Operations: Mega Uranium Ltd. does not report specific revenue segments.

Market Cap: CA$98.57M

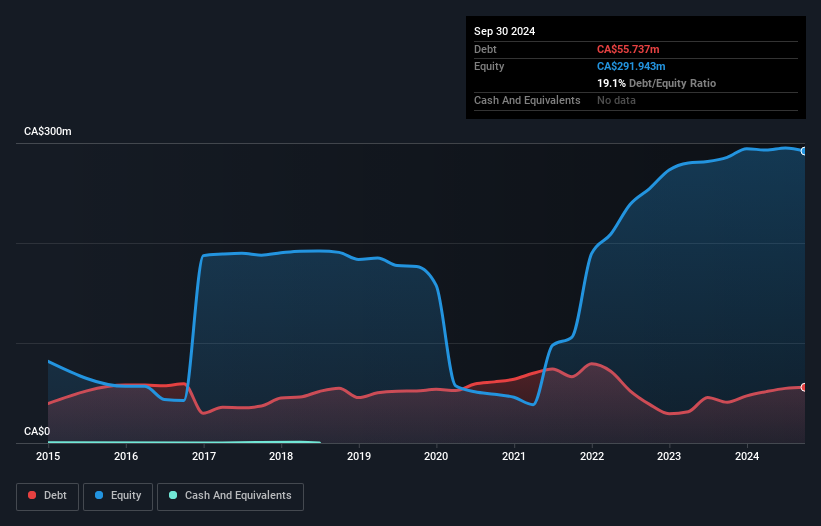

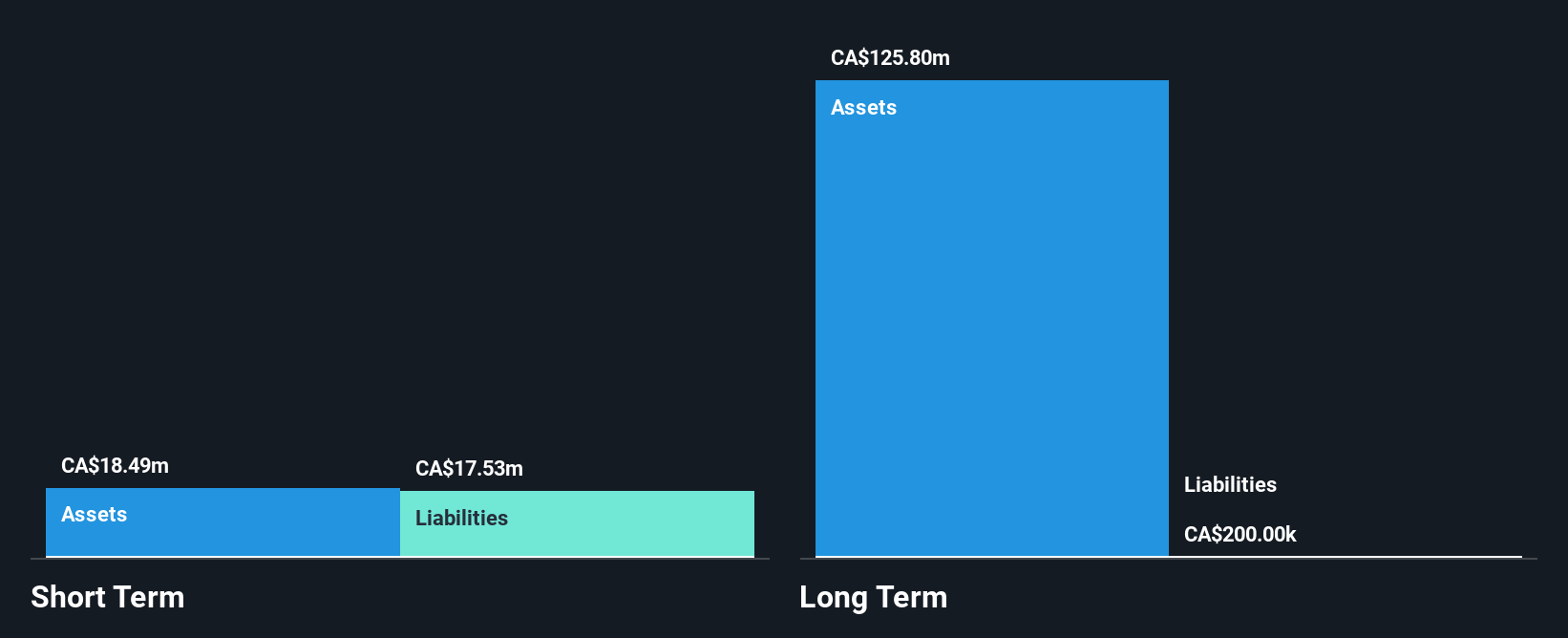

Mega Uranium Ltd., with a market cap of CA$98.57 million, is pre-revenue and currently unprofitable, reporting a net loss of CA$6.46 million for the latest quarter. Despite this, the company maintains financial stability with short-term assets of CA$22.5 million exceeding both short-term and long-term liabilities, suggesting prudent asset management. The firm benefits from a seasoned management team and board with average tenures of 10 and 9 years respectively. Although its debt to equity ratio has increased to 9.1% over five years, Mega Uranium holds more cash than total debt, providing a sufficient cash runway for over three years due to positive free cash flow growth.

- Unlock comprehensive insights into our analysis of Mega Uranium stock in this financial health report.

- Evaluate Mega Uranium's historical performance by accessing our past performance report.

Metallic Minerals (TSXV:MMG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Metallic Minerals Corp. focuses on the acquisition, exploration, and development of mineral properties in Canada and the United States, with a market cap of CA$38.81 million.

Operations: Currently, there are no specific revenue segments reported for this company.

Market Cap: CA$38.81M

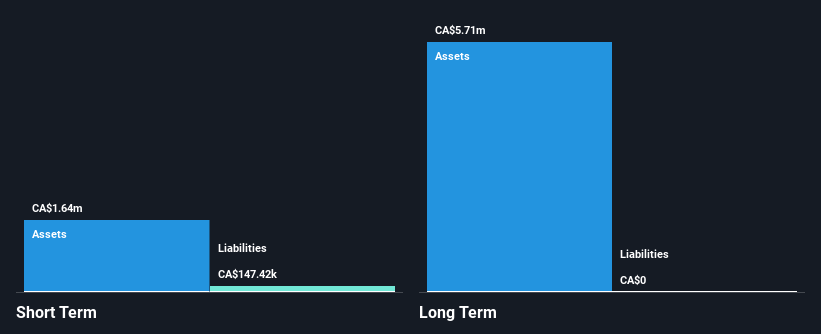

Metallic Minerals Corp., with a market cap of CA$38.81 million, is pre-revenue and currently unprofitable, reporting a reduced net loss of CA$1.5 million for the latest quarter. The company benefits from financial prudence as its short-term assets of CA$1.4 million surpass short-term liabilities, while maintaining zero debt and no long-term liabilities. However, it faces challenges with less than a year of cash runway if current free cash flow trends persist. Despite these hurdles, the management team and board are experienced with average tenures exceeding four years each, offering stability in leadership amidst financial volatility.

- Get an in-depth perspective on Metallic Minerals' performance by reading our balance sheet health report here.

- Examine Metallic Minerals' past performance report to understand how it has performed in prior years.

Next Steps

- Investigate our full lineup of 936 TSX Penny Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MMG

Metallic Minerals

Engages in the acquisition, exploration, and development of mineral properties in Canada and the United States.

Moderate with adequate balance sheet.

Market Insights

Community Narratives