- Canada

- /

- Oil and Gas

- /

- TSXV:AVN

Promising TSX Penny Stocks To Consider In February 2025

Reviewed by Simply Wall St

The Canadian market is currently navigating a period of economic adjustment, with the Bank of Canada cutting rates amid tariff uncertainty and a recent contraction in GDP. Despite these challenges, investors can still find opportunities by focusing on stocks that demonstrate strong financial health and potential for growth. Penny stocks, often representing smaller or newer companies, remain an intriguing investment area; when selected carefully, they can offer hidden value and the possibility of significant returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.71 | CA$998.61M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.69 | CA$441.37M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.40 | CA$120.99M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$224.43M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.53 | CA$13.18M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$619.87M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.82 | CA$175.73M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.02 | CA$134.8M | ★★★★★☆ |

Click here to see the full list of 929 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

InPlay Oil (TSX:IPO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: InPlay Oil Corp. is involved in the acquisition, exploration, development, and production of petroleum and natural gas properties in Canada with a market cap of CA$145.09 million.

Operations: The company's revenue is primarily generated from its Oil & Gas - Exploration & Production segment, amounting to CA$140.26 million.

Market Cap: CA$145.09M

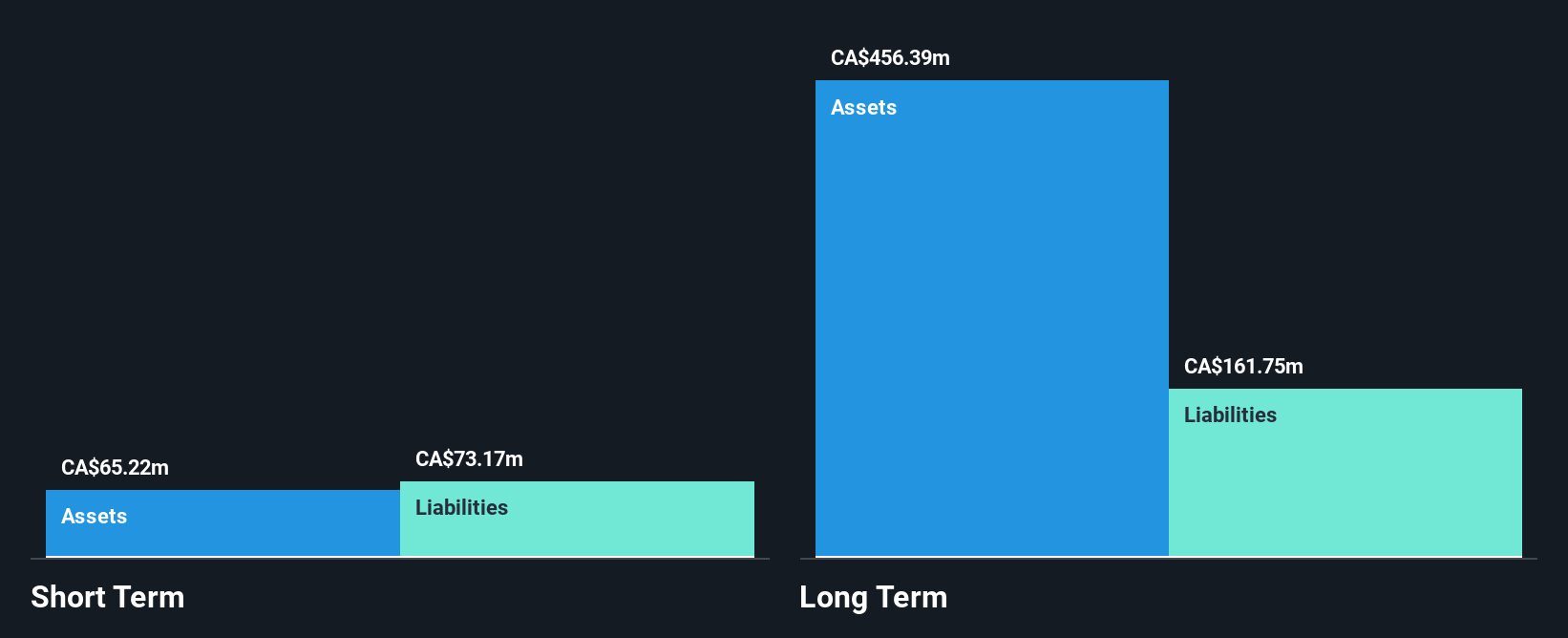

InPlay Oil Corp. has demonstrated a stable financial position with a net debt to equity ratio of 19.1%, indicating satisfactory leverage management, and its interest payments are well covered by EBIT at 3.4 times coverage. Despite this, the company faces challenges with short-term assets not covering liabilities and declining earnings growth over the past year, down by 55%. Profit margins have also decreased from 25.6% to 13.4%. While dividends are consistent at CA$0.015 per share monthly, they aren't well covered by free cash flow, raising sustainability concerns amidst forecasts of an average annual earnings decline of 10.8% over the next three years.

- Click here to discover the nuances of InPlay Oil with our detailed analytical financial health report.

- Assess InPlay Oil's future earnings estimates with our detailed growth reports.

Avanti Helium (TSXV:AVN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Avanti Helium Corp. focuses on acquiring, exploring, and evaluating helium properties in Canada and the United States, with a market cap of CA$10.65 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$10.65M

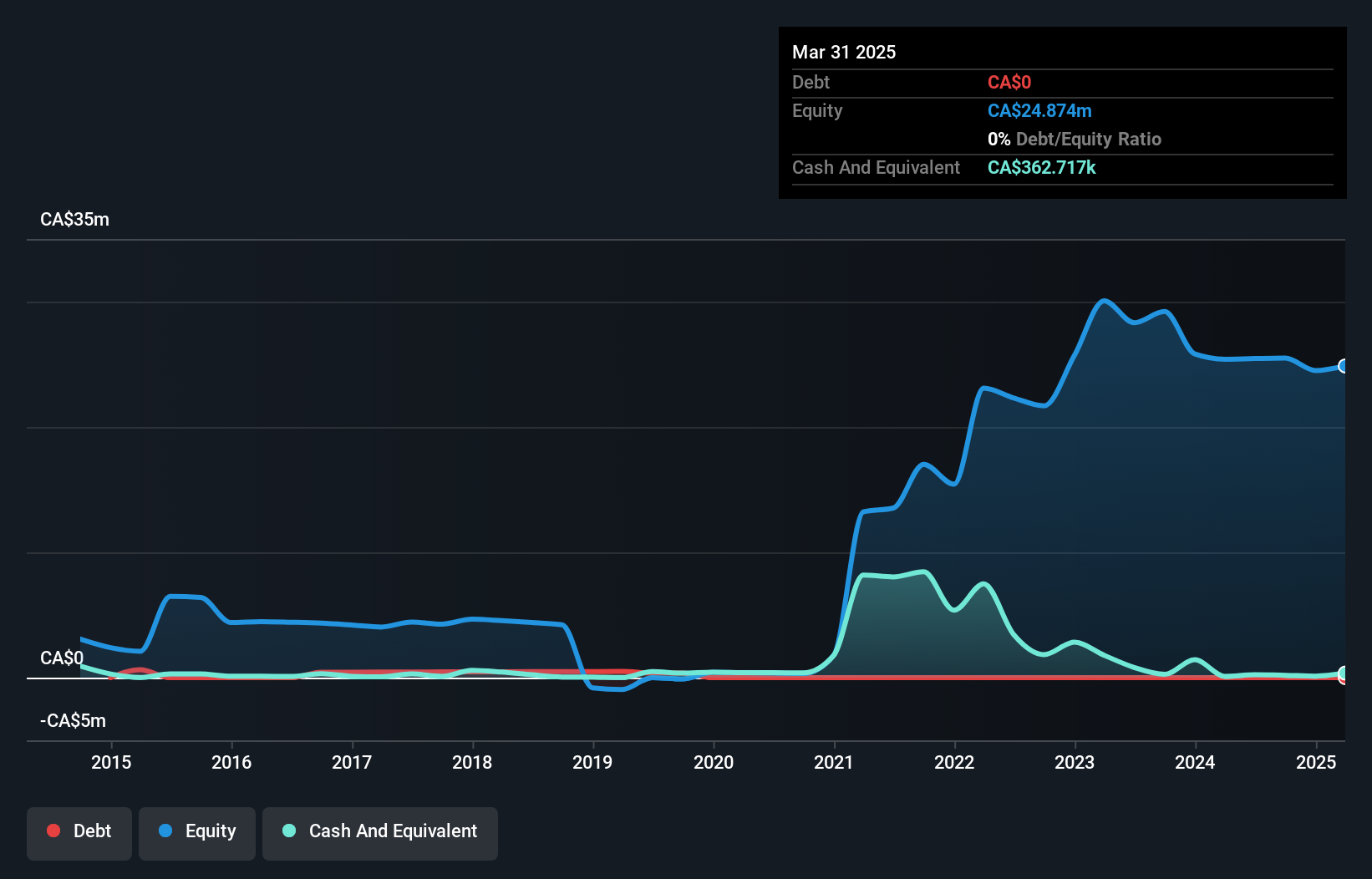

Avanti Helium Corp., with a market cap of CA$10.65 million, is currently pre-revenue, reflecting its early-stage status in the helium exploration sector. Recent private placements have bolstered its financial position, raising CA$1.53 million in January 2025 and CA$0.50 million in December 2024, though short-term assets remain insufficient to cover liabilities of CA$1.7 million. The company is debt-free but faces challenges with negative equity returns and an inexperienced board averaging one year in tenure. Despite these hurdles, Avanti's strategic capital raises indicate efforts to stabilize operations amid high share price volatility and no significant shareholder dilution recently.

- Navigate through the intricacies of Avanti Helium with our comprehensive balance sheet health report here.

- Learn about Avanti Helium's future growth trajectory here.

Frontier Lithium (TSXV:FL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frontier Lithium Inc. is involved in the acquisition, exploration, and development of mining properties in North America with a market cap of CA$101.47 million.

Operations: No revenue segments have been reported for this company.

Market Cap: CA$101.47M

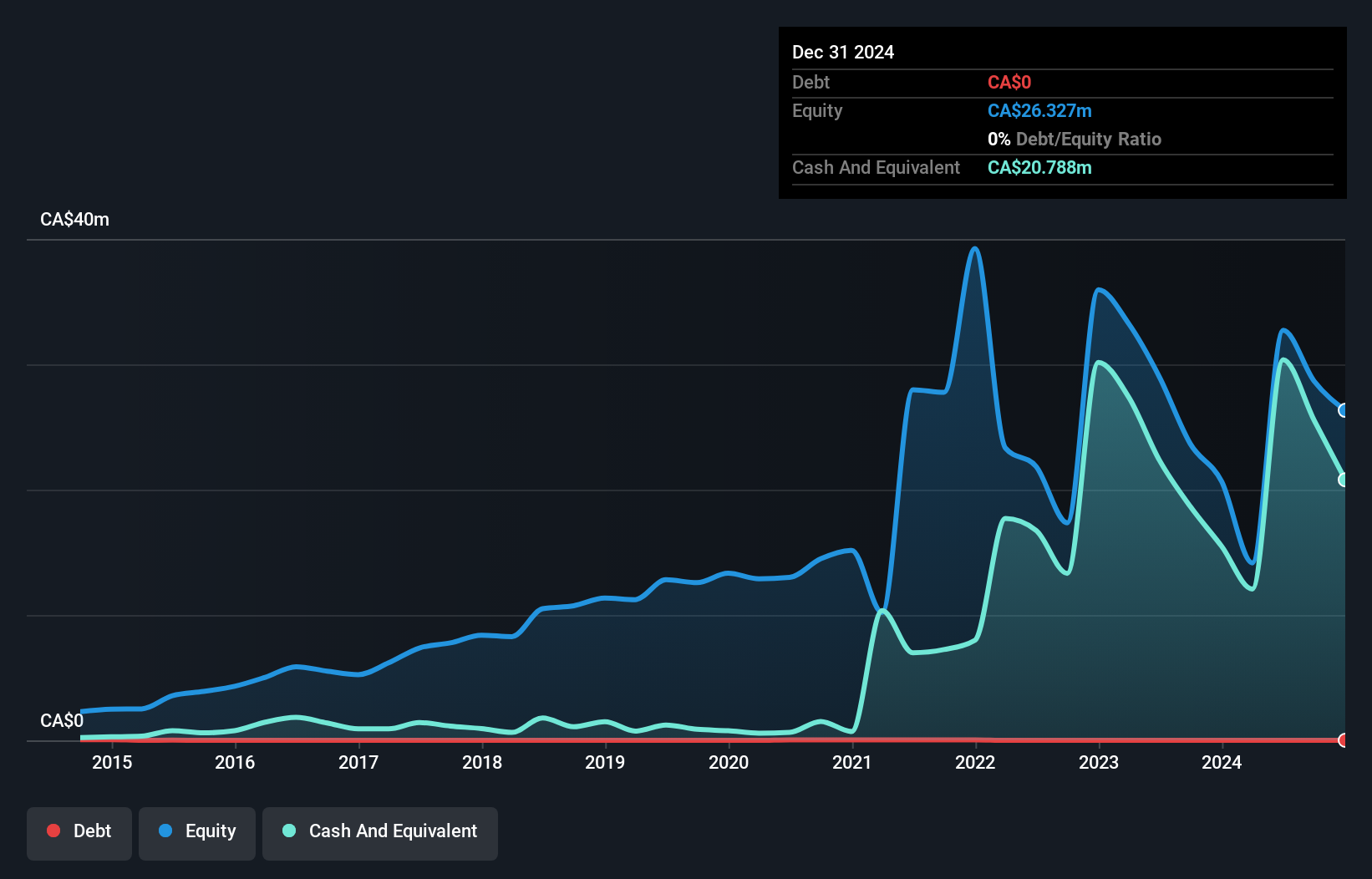

Frontier Lithium Inc., with a market cap of CA$101.47 million, is pre-revenue and unprofitable, showing increased losses over the past five years. Despite these challenges, the company remains debt-free and has sufficient cash runway for over a year. Recent exploration updates highlight progress on their PAK Lithium Project, including promising drill results at the Ember pegmatite. Analysts expect significant stock price appreciation, though profitability isn't anticipated in the near term. The management team is experienced with an average tenure of 3.4 years, while short-term assets exceed liabilities by a healthy margin.

- Take a closer look at Frontier Lithium's potential here in our financial health report.

- Evaluate Frontier Lithium's prospects by accessing our earnings growth report.

Where To Now?

- Embark on your investment journey to our 929 TSX Penny Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AVN

Avanti Helium

Engages in the acquisition, exploration, development, and evaluation of helium properties in Canada and the United States.

Moderate and slightly overvalued.

Market Insights

Community Narratives