- Canada

- /

- Oil and Gas

- /

- TSX:IPO

Introducing InPlay Oil (TSE:IPO), The Stock That Slid 53% In The Last Year

InPlay Oil Corp. (TSE:IPO) shareholders will doubtless be very grateful to see the share price up 32% in the last month. But that's not enough to compensate for the decline over the last twelve months. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 53% in that time. So the bounce should be viewed in that context. It may be that the fall was an overreaction.

View our latest analysis for InPlay Oil

InPlay Oil isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, InPlay Oil increased its revenue by 3.0%. That's not a very high growth rate considering it doesn't make profits. It's likely this muted growth has contributed to the share price decline of 53% in the last year. Like many holders, we really want to see better revenue growth in companies that lose money. When a stock falls hard like this, it can signal an over-reaction. Our preference is to wait for a fundamental improvements before buying, but now could be a good time for some research.

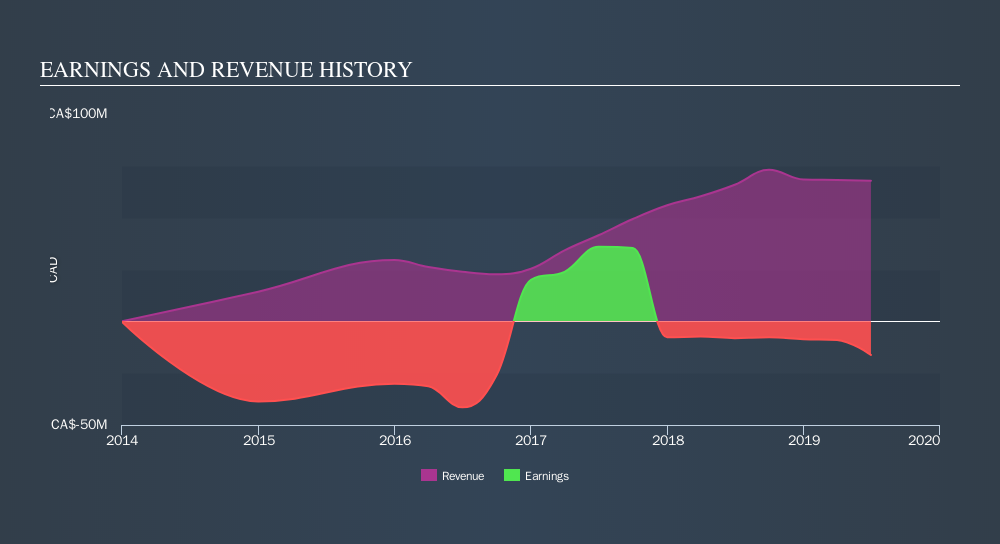

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on InPlay Oil's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While InPlay Oil shareholders are down 53% for the year, the market itself is up 3.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 13%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:IPO

InPlay Oil

Engages in the acquisition, exploration, development, and production of petroleum and natural gas properties in Canada.

High growth potential and fair value.

Market Insights

Community Narratives