- Canada

- /

- Oil and Gas

- /

- TSX:IPCO

Imagine Owning International Petroleum (TSE:IPCO) And Wondering If The 31% Share Price Slide Is Justified

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by International Petroleum Corporation (TSE:IPCO) shareholders over the last year, as the share price declined 31%. That contrasts poorly with the market return of 1.1%. Because International Petroleum hasn't been listed for many years, the market is still learning about how the business performs. Furthermore, it's down 22% in about a quarter. That's not much fun for holders.

Check out our latest analysis for International Petroleum

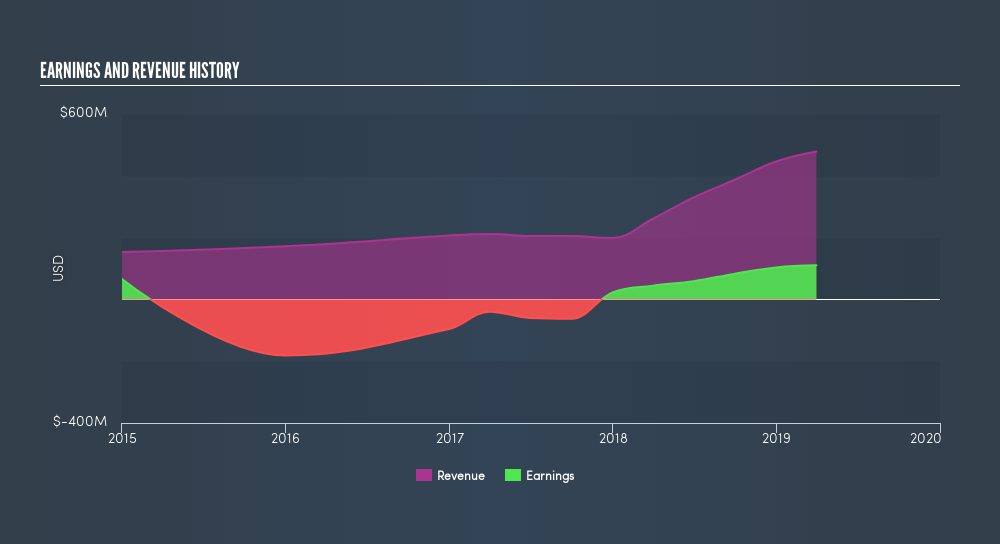

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the International Petroleum share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped. It's surprising to see the share price fall so much, despite the improved EPS. So it's easy to justify a look at some other metrics.

International Petroleum managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. You can see what analysts are predicting for International Petroleum in this interactive graph of future profit estimates.

A Different Perspective

Given that the market gained 1.1% in the last year, International Petroleum shareholders might be miffed that they lost 31%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 22% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

International Petroleum is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:IPCO

International Petroleum

Explores for, develops, and produces oil and gas.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives