- Canada

- /

- Oil and Gas

- /

- TSX:IPCO

How Investors May Respond To International Petroleum (TSX:IPCO) Posting Lower Q3 Production and Earnings

Reviewed by Sasha Jovanovic

- International Petroleum Corporation recently announced its third quarter and nine-month operating and financial results, revealing average net production of approximately 45,900 boepd in Q3 and nine-month sales of US$506.47 million, both lower than the figures recorded a year earlier.

- Net income and earnings per share declined year-over-year during the third quarter and first nine months, highlighting changing profitability and potential pressures on future operational performance.

- We'll examine how the contraction in net income and sales this quarter could reshape International Petroleum's investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

International Petroleum Investment Narrative Recap

To be a shareholder in International Petroleum today, you need to believe that the imminent completion and ramp-up of Blackrod Phase 1 will unlock a period of significantly increased production and stronger free cash flow, with the short-term catalyst being operational execution at Blackrod. The recent drop in net income and sales, while raising questions on short-term momentum, does not materially shift the immediate outlook for Blackrod’s impact or balance sheet risks, but it does highlight pressure on earnings and operational performance should these trends continue.

One recent announcement especially relevant here is International Petroleum’s ongoing share buyback activity, with 1,149,005 shares repurchased (1.01%) for CA$27.25 million in Q3, despite weaker earnings and cash flow. This consistency in returning capital may be seen as a sign of management’s confidence in future cash generation from assets like Blackrod, but it also draws attention to the importance of future operational delivery for sustaining shareholder returns.

By contrast, investors should be aware that persistent declines in net margins and earnings could...

Read the full narrative on International Petroleum (it's free!)

International Petroleum's outlook anticipates $1.2 billion in revenue and $218.6 million in earnings by 2028. This projection assumes an 18.7% annual revenue growth rate and reflects a $165.2 million increase in earnings from the current $53.4 million.

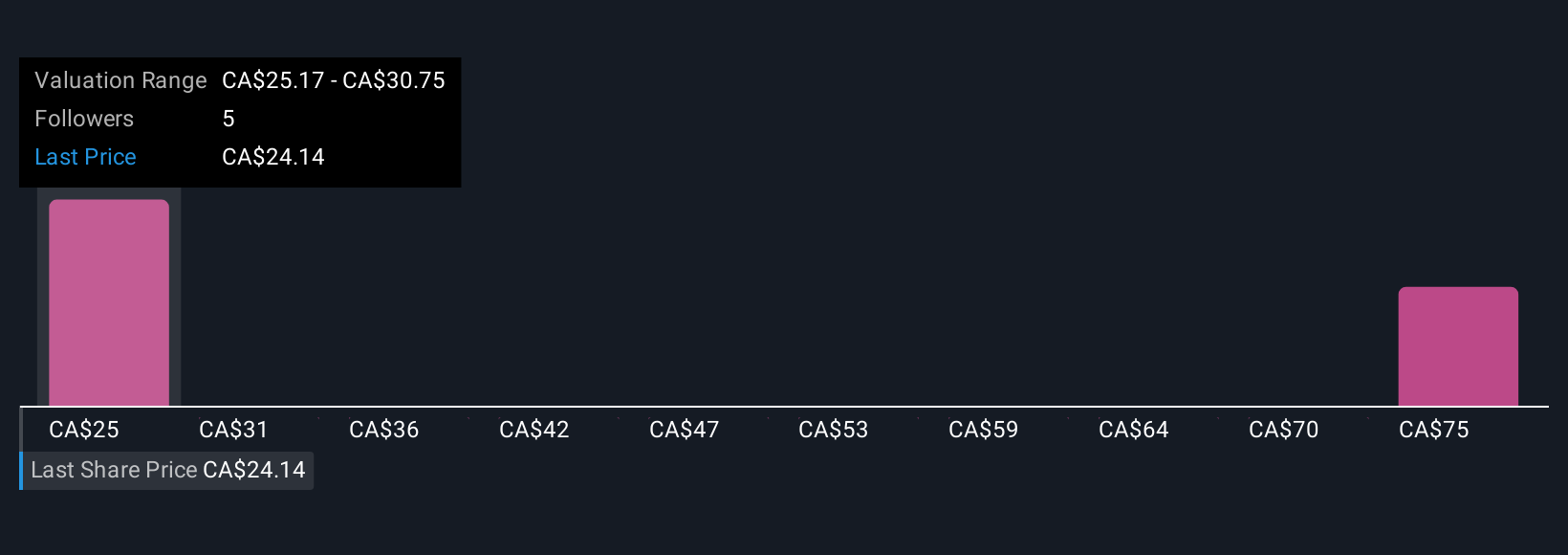

Uncover how International Petroleum's forecasts yield a CA$25.17 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Three perspectives from the Simply Wall St Community put International Petroleum’s fair value between CA$25.17 and CA$85.68. Strong Blackrod execution remains crucial, especially as consensus expects this project to power future revenue and earnings growth.

Explore 3 other fair value estimates on International Petroleum - why the stock might be worth over 3x more than the current price!

Build Your Own International Petroleum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Petroleum research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free International Petroleum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Petroleum's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IPCO

International Petroleum

Explores for, develops, and produces oil and gas.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives