- Canada

- /

- Oil and Gas

- /

- TSX:IPCO

Assessing International Petroleum (TSX:IPCO) Valuation After Earnings Show Declining Sales and Net Income

Reviewed by Simply Wall St

International Petroleum (TSX:IPCO) released its third quarter earnings, showing both sales and net income declining compared to last year. While production stayed steady, the company’s profitability took a significant hit this quarter.

See our latest analysis for International Petroleum.

Despite the dip in quarterly profits, International Petroleum’s share price has rallied, rising more than 26% in the past month and boasting a stellar 1-year total shareholder return of 85%. Momentum has clearly been building this year as investors look past the latest earnings lull.

If the strong rebound in International Petroleum has you searching for companies on the move, it’s worth exploring fast growing stocks with high insider ownership.

Given the soaring returns but weakened earnings, the question now is whether International Petroleum’s shares are undervalued after the rally or if investors have already priced in the company’s future growth prospects.

Most Popular Narrative: 6% Overvalued

International Petroleum’s narrative fair value estimate of CA$25.17 stands just below the recent close of CA$26.77, reflecting a tight valuation spread. The current price has moved ahead, and the most followed storyline weighs the growth catalysts versus lingering risks.

The imminent completion and ramp-up of Blackrod Phase 1 is expected to significantly increase long-life, low-cost production, materially improving operating cash flow and free cash flow from late 2026 onwards. This is anticipated to support future revenue and earnings growth. Tightening differentials between WTI and WCS, supported by structural pipeline expansions such as TMX, are expected to persist. These factors could bolster realized prices for Canadian crude and increase netback per barrel, directly benefiting net margins.

What’s really fueling this price? Find out which ambitious growth forecasts and margin assumptions push the projected fair value higher than you might expect. Explore the bold financial outlooks driving the valuation and see how much is riding on one project along with what’s factored into future cash flow surprises.

Result: Fair Value of $25.17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks at Blackrod or rising project costs could quickly shake confidence in International Petroleum’s growth story and affect the share price outlook.

Find out about the key risks to this International Petroleum narrative.

Another Perspective: What Does the DCF Say?

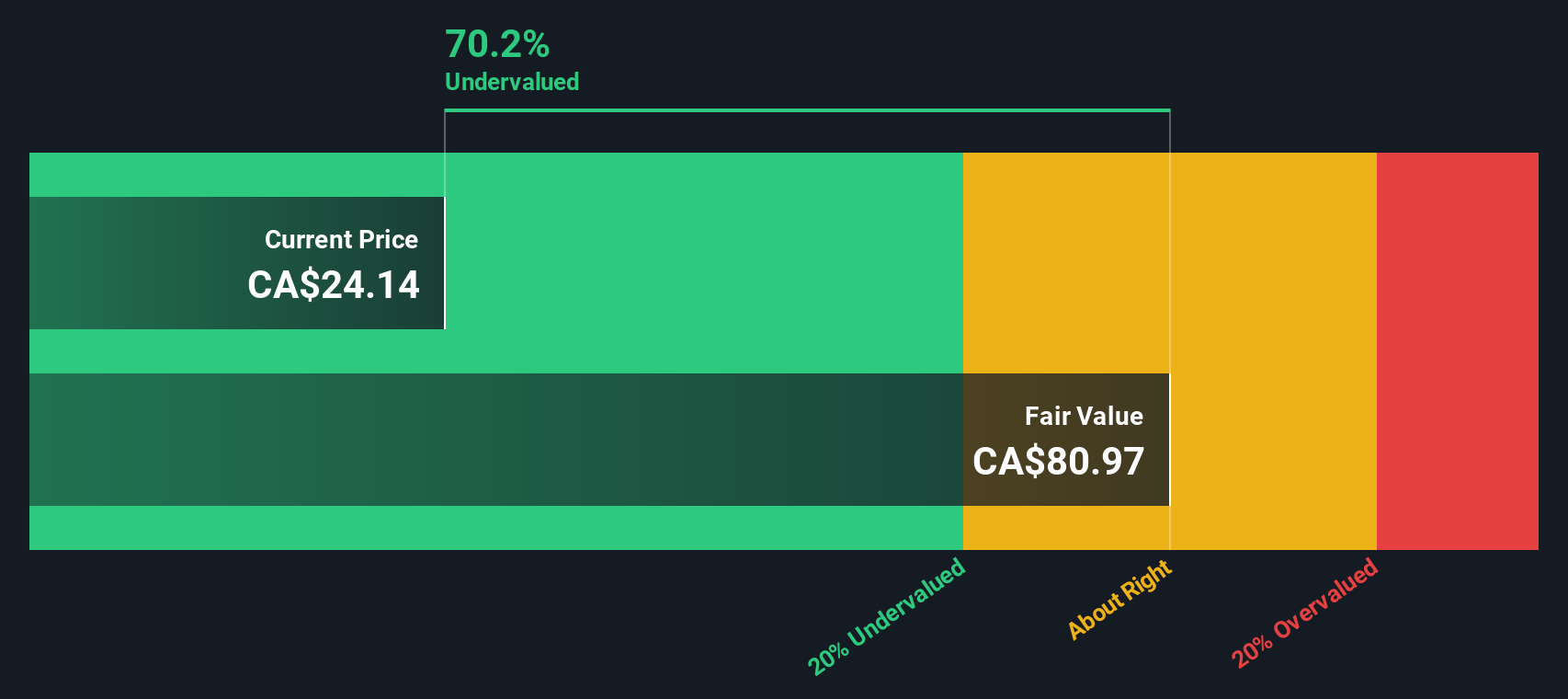

While analyst consensus sees International Petroleum as largely fairly valued, our SWS DCF model presents a notably different perspective. Based on long-term cash flow projections, the company could be trading at a significant discount to its intrinsic value. Which method will prove right in the end?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out International Petroleum for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own International Petroleum Narrative

If these views do not resonate with you or you prefer digging into the numbers on your own, take a moment to craft your own perspective. It takes less than three minutes. Do it your way

A great starting point for your International Petroleum research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for Your Next Investment Move?

Want to get ahead of the curve? Take action now and uncover other promising stocks that could be the serious outperformers most investors miss.

- Supercharge your income strategy by exploring these 16 dividend stocks with yields > 3% with strong yields and reliable track records that can boost your returns in any market.

- Tap into tomorrow’s breakthroughs by researching these 25 AI penny stocks shaping the front lines of artificial intelligence and fueling rapid growth.

- Secure value by targeting these 886 undervalued stocks based on cash flows that analysts believe are priced below their intrinsic worth and may be set to rebound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IPCO

International Petroleum

Explores for, develops, and produces oil and gas.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives