- Canada

- /

- Oil and Gas

- /

- TSX:IMO

Is Imperial Oil’s 43% Rally in 2025 Backed by Its Low-Carbon Strategy?

Reviewed by Bailey Pemberton

- Wondering if Imperial Oil is still a bargain or if recent momentum means it's too late to buy in? You're not alone. It's a question on the minds of investors navigating today's energy market.

- Shares have climbed an impressive 4.6% in the last week, and are up 43.3% year-to-date, showing that investor sentiment is running strong and growth potential is on the radar.

- Recent headlines have spotlighted Imperial Oil's new low-carbon initiatives and strategic investments in production. These moves are reshaping both its risk profile and its industry position. Major energy sector deals and shifting regulatory landscapes have also factored into the stock's ascent, underscoring that there's more in play than just commodity prices.

- On our core valuation checks, Imperial Oil earns a score of 4 out of 6, suggesting it ticks many undervalued boxes but not all. Let's break down what this means across different valuation approaches, and look ahead to an even better way to gauge its worth at the end of this article.

Approach 1: Imperial Oil Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its expected future cash flows and discounting them back to today's terms. This approach helps investors assess whether the current share price reflects the company's long-term earning power.

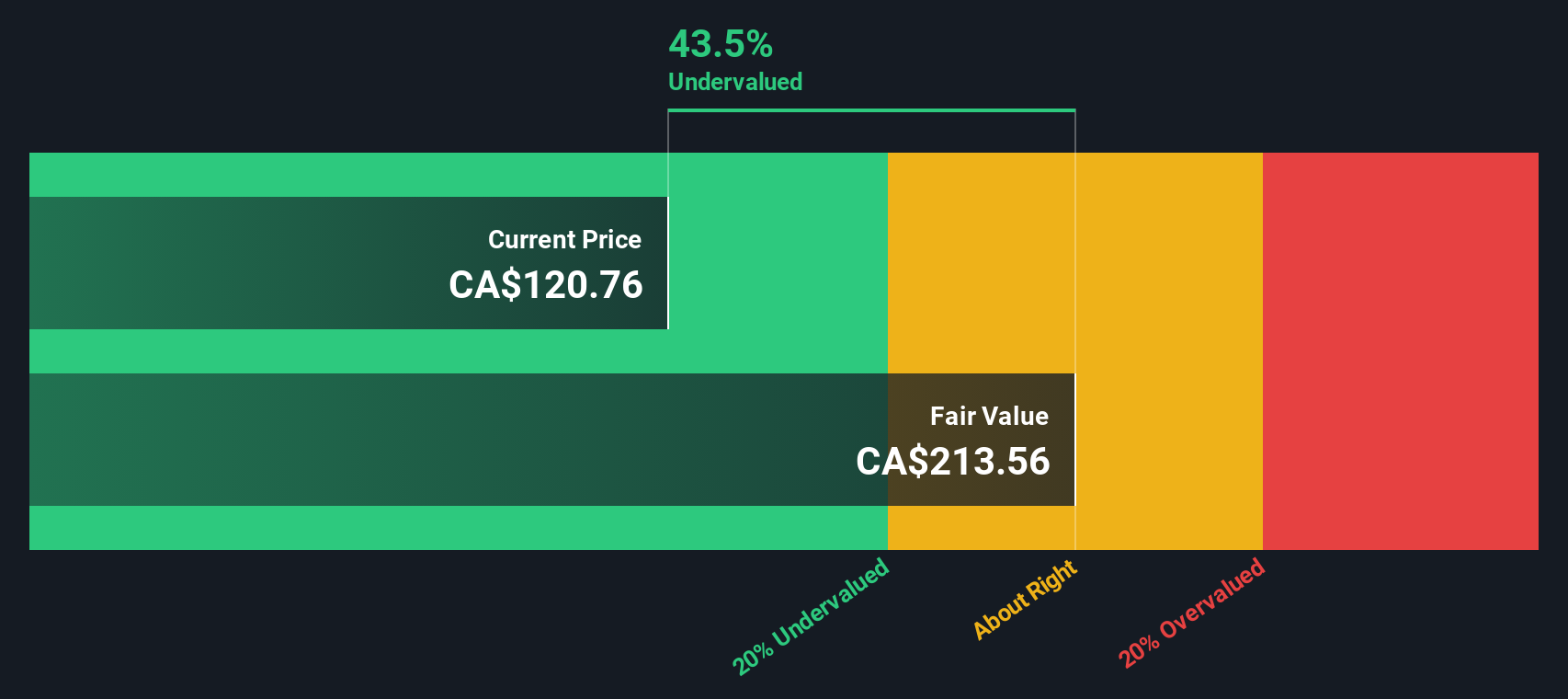

For Imperial Oil, the DCF analysis is based on the 2 Stage Free Cash Flow to Equity method. Over the last twelve months, the company generated around CA$4.54 billion in free cash flow. Analysts forecast fluctuations in Imperial Oil's annual free cash flow, projecting it to be around CA$3.78 billion in 2029. Although detailed analyst estimates only cover the next few years, these longer-term projections are extrapolated using models designed by Simply Wall St.

This method produces an estimated intrinsic value of CA$183.12 per share. Compared to the current price, the DCF model suggests the stock is trading at a 29.6% discount, meaning it may be undervalued when considering its projected cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Imperial Oil is undervalued by 29.6%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

Approach 2: Imperial Oil Price vs Earnings

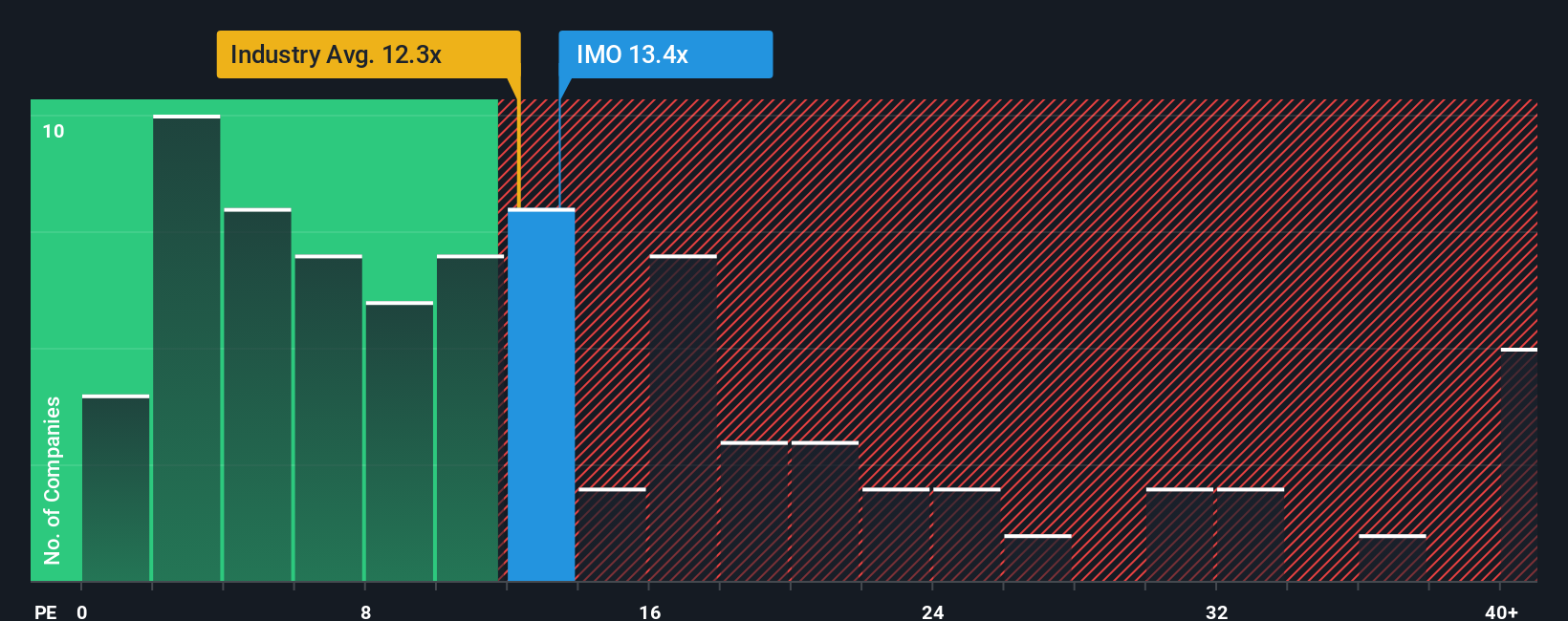

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Imperial Oil. It provides investors with a way to judge how much they are paying for each dollar of company earnings, and is especially relevant when the company has a solid track record of profitability.

However, what counts as a "normal" or "fair" PE ratio is not set in stone. It depends on expectations for the company's future growth, how risky its business is, and the overall sentiment in its industry. Faster-growing or less risky companies often warrant higher PE ratios, while those facing uncertainty might trade at a discount.

At the moment, Imperial Oil trades at a PE ratio of 14.0x. This is very close to the peer group average of 14.1x, but sits above the broader Oil and Gas industry average of 12.2x. On a surface level, this suggests that Imperial Oil is valued roughly in line with similar businesses but carries a modest premium compared to the industry as a whole.

To provide a more tailored benchmark, Simply Wall St’s proprietary "Fair Ratio" comes into play. The Fair Ratio is a calculated multiple that takes into account not just industry levels and peer comparisons, but also the company’s unique earnings growth, profit margins, risks, and market capitalization. This makes it a more tailored and insightful comparison than using generic industry averages or peer numbers alone.

For Imperial Oil, the Fair Ratio stands at 14.4x. With the company's actual PE at 14.0x, there is only a minor difference, suggesting that the current price reflects a balanced view of the company’s prospects, risks, and profit outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1380 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Imperial Oil Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your investment story, including the reasons, beliefs, and future expectations you have for a company, linked directly to numbers like revenue projections, earnings, and profit margins that together calculate your assumed fair value.

Instead of relying solely on PE ratios or analyst consensus, Narratives empower you to define your own assumptions and see in real time whether Imperial Oil’s price is above or below what you believe it is worth. Narratives are available to everyone on Simply Wall St’s Community page, used by millions globally, and are easy to start and update as the news or earnings change, so your fair value always stays relevant.

For example, among investors analyzing Imperial Oil, some use bullish Narratives that expect efficiency upgrades, renewable projects, and steady revenue growth, projecting a fair value as high as CA$131. Others focus on risks such as heavy reliance on oil sands and potential margin pressure, resulting in a fair value as low as CA$81. This range shows how Narratives let you compare different investment stories, helping you decide when to buy or sell based on your own evidence-backed perspective.

Do you think there's more to the story for Imperial Oil? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IMO

Imperial Oil

Engages in exploration, production, and sale of crude oil and natural gas in Canada.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives