- Canada

- /

- Oil and Gas

- /

- TSX:IMO

Imperial Oil (TSX:IMO): Examining Valuation After Record Production and Lower Earnings

Reviewed by Simply Wall St

Imperial Oil (TSX:IMO) just posted its strongest quarterly oil-equivalent production in over 30 years, even as revenue and earnings slipped compared to last year. The company also wrapped up a major share buyback and reaffirmed its quarterly dividend.

See our latest analysis for Imperial Oil.

Imperial Oil’s share price momentum has been robust in 2025, with a year-to-date share price return of 50.79% and a 1-year total shareholder return of 36.63%. The recent run higher appears to reflect investor confidence in operational execution and capital returns, even though there are some short-term earnings headwinds.

If Imperial’s production record has you surveying the broader energy sector, it may be a good time to broaden your search and discover fast growing stocks with high insider ownership

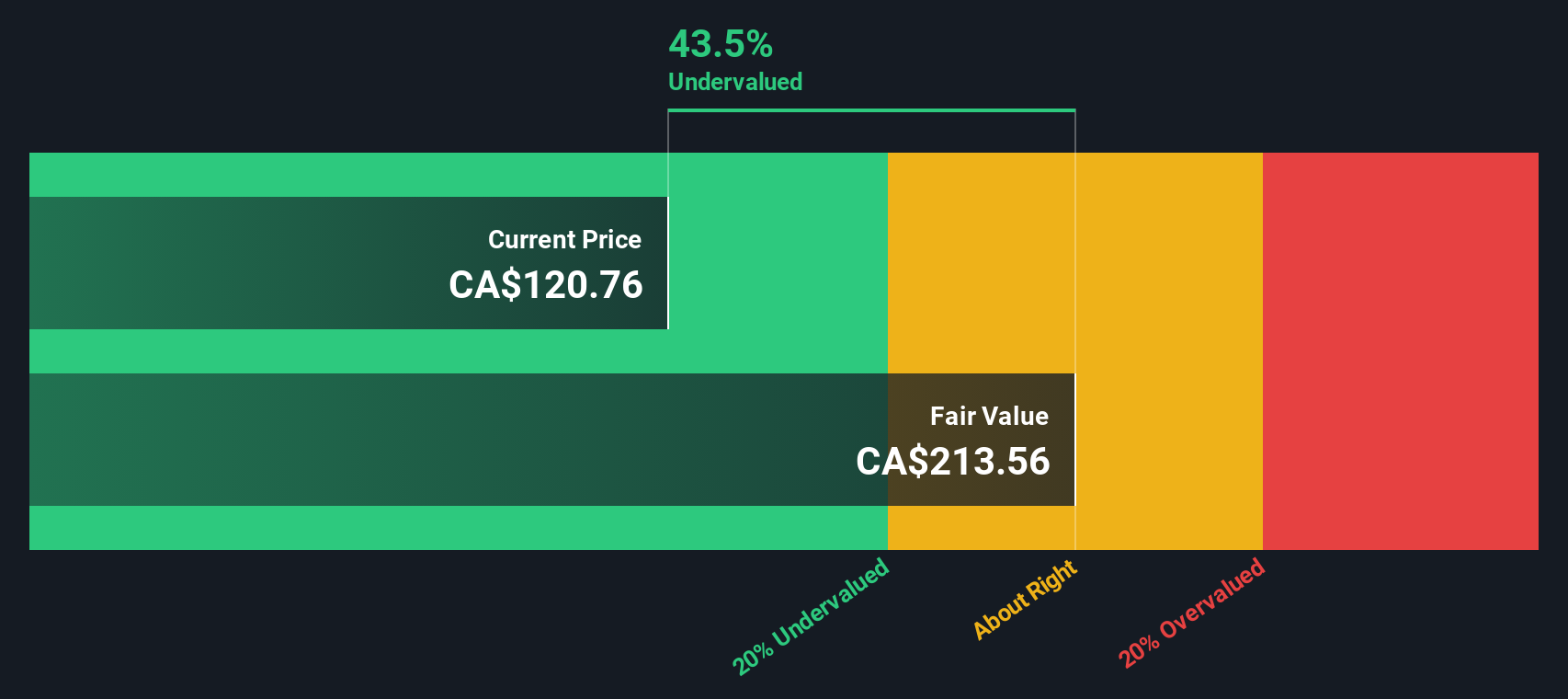

With strong production metrics but softening earnings, and the stock now trading well above analyst targets, investors may wonder if there is real value left in Imperial Oil or if the market has already priced in future gains.

Most Popular Narrative: 21% Overvalued

Imperial Oil’s share price sits well above the consensus fair value indicated by the most widely followed narrative, sparking debate around just how much future growth is truly priced in.

Major efficiency improvements at Kearl, including unit cash cost reductions (approximately $2/bbl year over year), productivity upgrades, and extension of turnaround intervals, position Imperial Oil for sustained margin expansion and higher ROIC as production targets increase toward 300,000 bbl/d, improving future net margins and earnings. Ramped-up production and expansion of solvent-assisted SAGD at Cold Lake, as well as new projects with decades of inventory, are expected to drive long-term production growth and lower per-barrel emissions and costs, supporting both higher revenue and better regulatory risk management.

Want to see what’s behind the forecast? The story hinges on pivotal assumptions around how fast profits and revenues could shift, and a bold take on future margins. The next big surprise could be in the detailed projections themselves—are these numbers too ambitious or not ambitious enough?

Result: Fair Value of $112.06 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clouds on the horizon, including sustained exposure to oil sands emissions policies and the potential for cost overruns, which could impact future profitability.

Find out about the key risks to this Imperial Oil narrative.

Another View: Discounted Cash Flow Says Undervalued

While most analysts believe Imperial Oil is overvalued based on current prices and future earnings expectations, our DCF model estimates a fair value of CA$277.85, which is more than double today’s share price. This suggests the market may be underestimating Imperial’s longer-term cash flow potential. Could the crowd be missing something big?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Imperial Oil for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Imperial Oil Narrative

Keep in mind, if you’d rather dig into the numbers yourself or craft a different perspective, you can create your own narrative in just a few minutes. Do it your way

A great starting point for your Imperial Oil research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count. These unique opportunities are waiting for you to act. Don’t let key trends or market innovations slip past your radar.

- Unlock potential by targeting growth companies with solid business models through these 3589 penny stocks with strong financials offering strong financials and attractive price points.

- Capture tomorrow’s breakthroughs early by researching these 27 AI penny stocks at the forefront of artificial intelligence advancements and rapid industry disruption.

- Secure steady returns with these 14 dividend stocks with yields > 3% among the market’s most reliable income-generating stocks, topping yields above 3% for long-term investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IMO

Imperial Oil

Engages in exploration, production, and sale of crude oil and natural gas in Canada.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives