- Canada

- /

- Oil and Gas

- /

- TSX:GXE

Easy Come, Easy Go: How Gear Energy Shareholders Got Unlucky And Saw 85% Of Their Cash Evaporate

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding Gear Energy Ltd. (TSE:GXE) during the five years that saw its share price drop a whopping 85%. We also note that the stock has performed poorly over the last year, with the share price down 22%. There was little comfort for shareholders in the last week as the price declined a further 4.7%.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Gear Energy

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

In the last five years Gear Energy improved its bottom line results, having previously been loss-making. That would generally be considered a positive, so we are surprised to see the share price is down.

The revenue decline of 2.3% isn't too bad. But if the market expected durable top line growth, then that could explain the share price weakness.

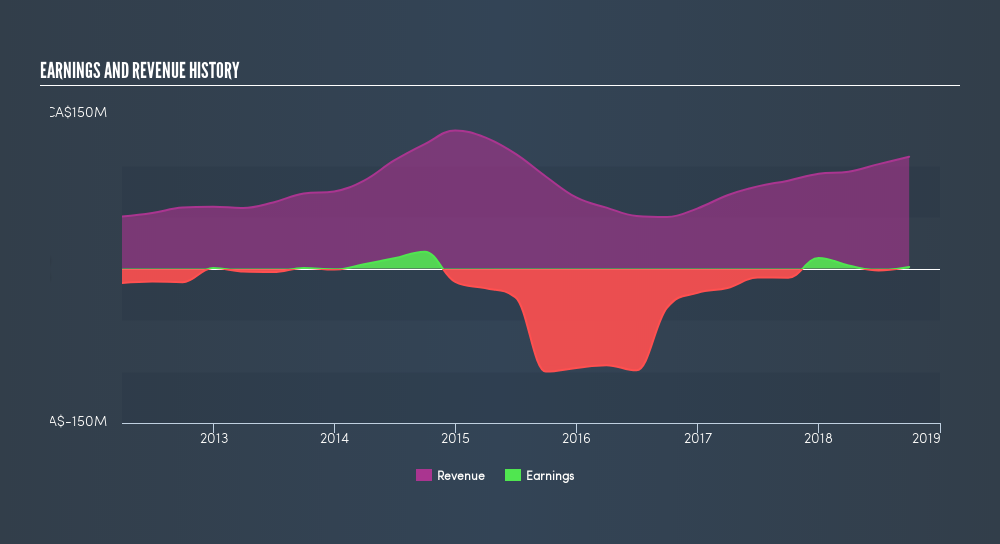

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Gear Energy stock, you should check out this freereport showing analyst profit forecasts.

A Different Perspective

While the broader market gained around 2.6% in the last year, Gear Energy shareholders lost 22%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 31% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:GXE

Gear Energy

An exploration and production company, engages in the acquiring, developing, and holding of interests in petroleum and natural gas properties and assets in Canada.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives