- Canada

- /

- Oil and Gas

- /

- TSX:GEI

Newsflash: Gibson Energy Inc. (TSE:GEI) Analysts Have Been Trimming Their Revenue Forecasts

The latest analyst coverage could presage a bad day for Gibson Energy Inc. (TSE:GEI), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well. The stock price has risen 9.7% to CA$20.97 over the past week. It will be interesting to see if this downgrade motivates investors to start selling their holdings.

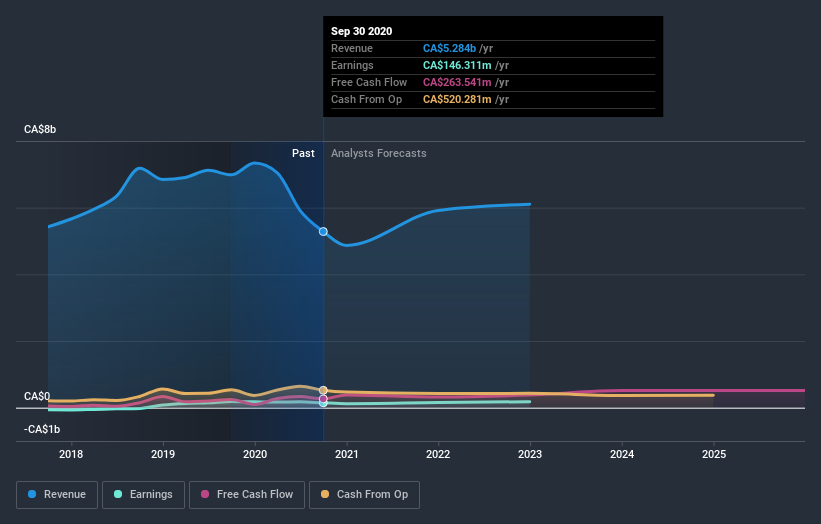

After this downgrade, Gibson Energy's nine analysts are now forecasting revenues of CA$5.9b in 2021. This would be a decent 12% improvement in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing CA$6.7b of revenue in 2021. The consensus view seems to have become more pessimistic on Gibson Energy, noting the substantial drop in revenue estimates in this update.

See our latest analysis for Gibson Energy

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Gibson Energy's past performance and to peers in the same industry. It's clear from the latest estimates that Gibson Energy's rate of growth is expected to accelerate meaningfully, with the forecast 12% revenue growth noticeably faster than its historical growth of 6.7% p.a. over the past five years. Other similar companies in the industry (with analyst coverage) are also forecast to grow their revenue at 9.9% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Gibson Energy is expected to grow at about the same rate as the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for next year. They're also forecasting for revenues to grow at about the same rate as companies in the wider market. Overall, given the drastic downgrade to next year's forecasts, we'd be feeling a little more wary of Gibson Energy going forwards.

There might be good reason for analyst bearishness towards Gibson Energy, like the risk of cutting its dividend. For more information, you can click here to discover this and the 1 other concern we've identified.

We also provide an overview of the Gibson Energy Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

When trading Gibson Energy or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:GEI

Gibson Energy

Engages in the gathering, storing, optimizing, and processing of liquids and refined products in Canada and the United States.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives