- Canada

- /

- Oil and Gas

- /

- TSX:FEC

Some Frontera Energy (TSE:FEC) Shareholders Have Copped A Big 63% Share Price Drop

Investing in stocks inevitably means buying into some companies that perform poorly. Long term Frontera Energy Corporation (TSE:FEC) shareholders know that all too well, since the share price is down considerably over three years. So they might be feeling emotional about the 63% share price collapse, in that time. And more recent buyers are having a tough time too, with a drop of 35% in the last year. Shareholders have had an even rougher run lately, with the share price down 21% in the last 90 days.

See our latest analysis for Frontera Energy

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

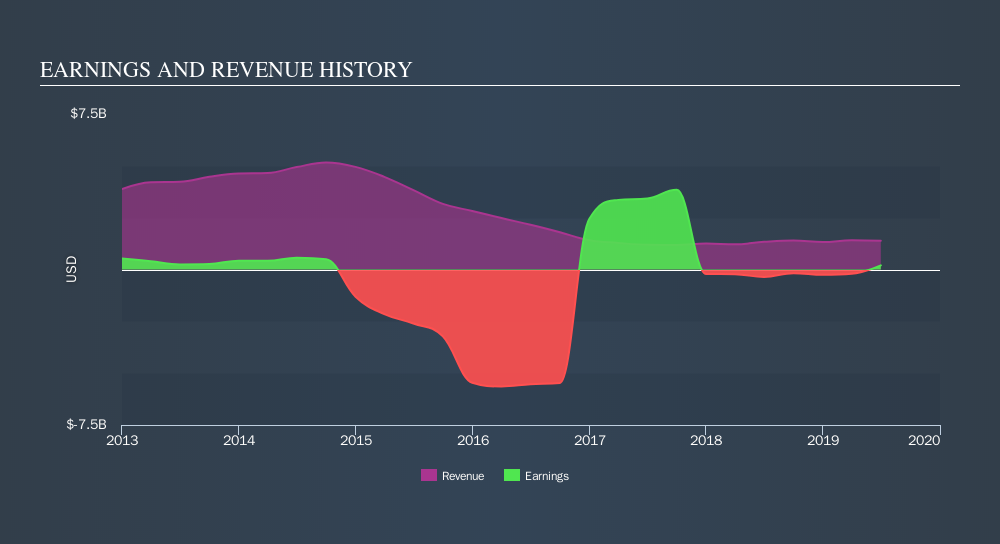

During five years of share price growth, Frontera Energy moved from a loss to profitability. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

We note that the dividend seems healthy enough, so that probably doesn't explain the share price drop. However, the weak share price might be related to the fact revenue has been disappearing at a rate of 9.7% each year, over three years. This could have some investors worried about the longer term growth potential (or lack thereof).

The image below shows how earnings and revenue have tracked over time.

We know that Frontera Energy has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Frontera Energy's TSR for the last 3 years was -58%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Frontera Energy shareholders are down 28% for the year (even including dividends) , but the broader market is up 8.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 25% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:FEC

Frontera Energy

Engages in the exploration, development, production, transportation, storage, and sale of oil and natural gas in South America.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives