- Canada

- /

- Oil and Gas

- /

- TSX:FEC

Did Changing Sentiment Drive Frontera Energy's (TSE:FEC) Share Price Down By 23%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

While it may not be enough for some shareholders, we think it is good to see the Frontera Energy Corporation (TSE:FEC) share price up 21% in a single quarter. But that doesn't change the fact that the returns over the last year have been less than pleasing. In fact the stock is down 23% in the last year, well below the market return.

See our latest analysis for Frontera Energy

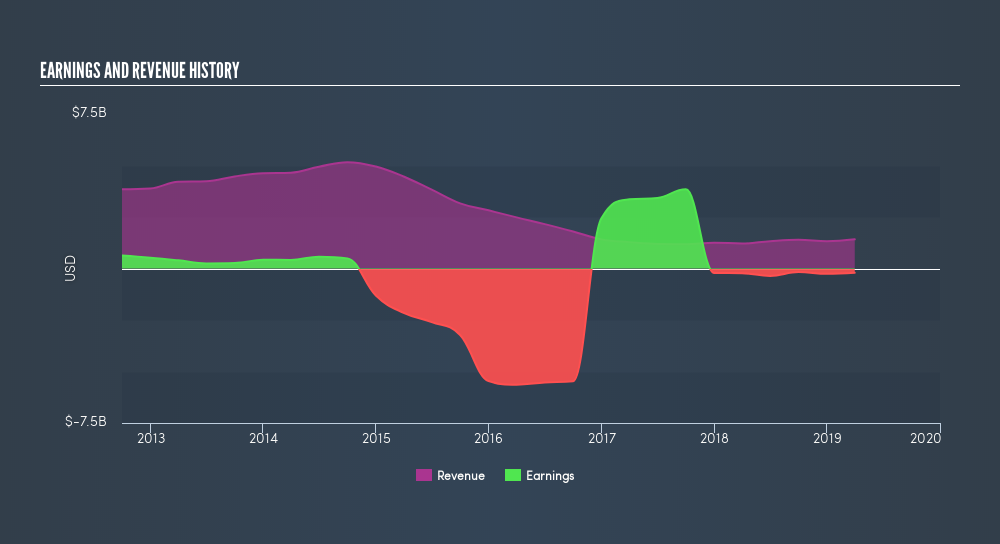

Because Frontera Energy is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Frontera Energy increased its revenue by 17%. We think that is pretty nice growth. Meanwhile, the share price is down 23% over twelve months, which is disappointing given the progress made. You might even wonder if the share price was previously over-hyped. But if revenue keeps growing, then at a certain point the share price would likely follow.

This free interactive report on Frontera Energy's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Frontera Energy, it has a TSR of -19% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Given that the market gained 1.3% in the last year, Frontera Energy shareholders might be miffed that they lost 19% (even including dividends). While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 21% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). If you would like to research Frontera Energy in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:FEC

Frontera Energy

Engages in the exploration, development, production, transportation, storage, and sale of oil and natural gas in South America.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives