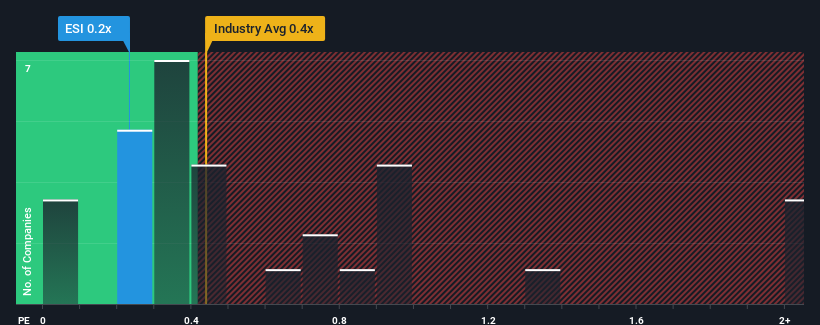

There wouldn't be many who think Ensign Energy Services Inc.'s (TSE:ESI) price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S for the Energy Services industry in Canada is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Ensign Energy Services

What Does Ensign Energy Services' P/S Mean For Shareholders?

Recent revenue growth for Ensign Energy Services has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. Those who are bullish on Ensign Energy Services will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think Ensign Energy Services' future stacks up against the industry? In that case, our free report is a great place to start.How Is Ensign Energy Services' Revenue Growth Trending?

In order to justify its P/S ratio, Ensign Energy Services would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 30% last year. The latest three year period has also seen an excellent 65% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to remain somewhat buoyant, growing by 3.2% per year during the coming three years according to the six analysts following the company. Meanwhile, the broader industry is forecast to contract by 7.4% per year, which would indicate the company is doing better than the majority of its peers.

Even though the growth is only slight, it's peculiar that Ensign Energy Services' P/S sits in line with the majority of other companies given the industry is set for a decline. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

What We Can Learn From Ensign Energy Services' P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Ensign Energy Services' analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't resulting in the company trading at a higher P/S, as per our expectations. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. It appears some are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Ensign Energy Services that you should be aware of.

If you're unsure about the strength of Ensign Energy Services' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Ensign Energy Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ESI

Ensign Energy Services

Provides oilfield services to the oil and natural gas industries in Canada, the United States, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives