- Canada

- /

- Energy Services

- /

- TSX:ESI

Does Ensign Energy Services (TSE:ESI) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Ensign Energy Services (TSE:ESI), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Ensign Energy Services

How Fast Is Ensign Energy Services Growing Its Earnings Per Share?

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. Which is why EPS growth is looked upon so favourably. It is awe-striking that Ensign Energy Services' EPS went from CA$0.046 to CA$0.22 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Ensign Energy Services shareholders is that EBIT margins have grown from 4.6% to 10% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

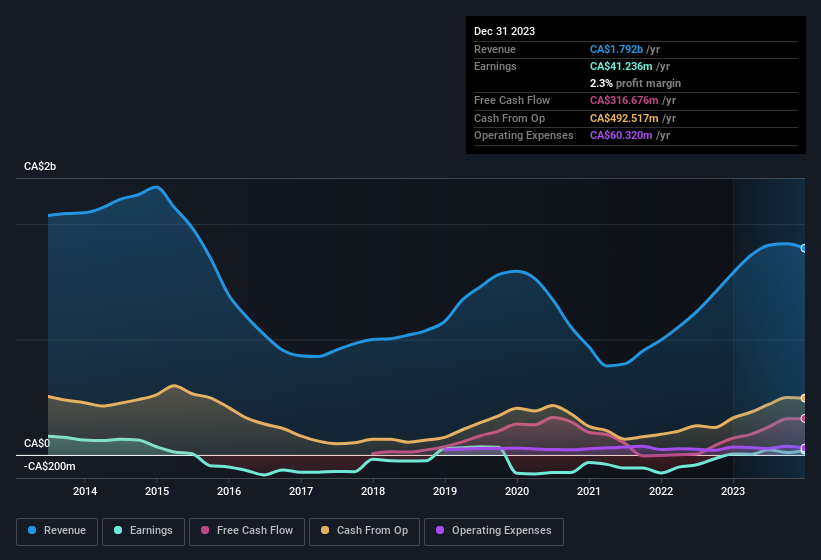

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Ensign Energy Services?

Are Ensign Energy Services Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Ensign Energy Services shareholders can gain quiet confidence from the fact that insiders shelled out CA$809k to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. It is also worth noting that it was President Robert Geddes who made the biggest single purchase, worth CA$747k, paying CA$2.99 per share.

The good news, alongside the insider buying, for Ensign Energy Services bulls is that insiders (collectively) have a meaningful investment in the stock. Holding CA$123m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. That holding amounts to 27% of the stock on issue, thus making insiders influential owners of the business and aligned with the interests of shareholders.

Is Ensign Energy Services Worth Keeping An Eye On?

Ensign Energy Services' earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Ensign Energy Services deserves timely attention. You should always think about risks though. Case in point, we've spotted 1 warning sign for Ensign Energy Services you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Ensign Energy Services isn't the only one. You can see a a curated list of Canadian companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Ensign Energy Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ESI

Ensign Energy Services

Provides oilfield services to the oil and natural gas industries in Canada, the United States, and internationally.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives