- Canada

- /

- Oil and Gas

- /

- TSX:ENB

Enbridge (TSX:ENB) Valuation in Focus as Leadership Shifts and U.S. Strategy Gain Traction

Reviewed by Kshitija Bhandaru

Enbridge (TSX:ENB) is making headlines with leadership changes set for early 2026, as new executives step into key roles. At the same time, the company is recalibrating its investment strategy in response to ongoing Canadian regulatory hurdles.

See our latest analysis for Enbridge.

Enbridge’s recent leadership announcements and its sharper focus on U.S. investments have put the company in the spotlight just as investor interest heats up. While recent news has underscored Enbridge’s adaptability, the share price has seen only modest movement. However, the one-year total shareholder return, including dividends, remains positive and reflects the steady income focus investors expect from established infrastructure plays. Momentum isn’t runaway, but with these strategic pivots, the company’s long-term outlook is still very much in play.

If you’re weighing your next move, now’s the perfect time to broaden your scope and discover fast growing stocks with high insider ownership

With shares trading close to analyst targets and a track record of steady returns, are investors overlooking a value opportunity here, or is the market already factoring in everything Enbridge’s evolving strategy has to offer?

Most Popular Narrative: Fairly Valued

Compared to Enbridge’s previous close of CA$69.88, the narrative consensus fair value is only slightly higher. This suggests the market and analysts are nearly in sync on what the business is worth at this stage. This slim gap highlights a tension between the share price and the assumptions behind the most widely tracked outlook.

The strategic build-out responding to surging electricity and data center needs, including utility-scale renewables, gas transmission expansions, and power generation projects, underpins multi-year earnings and cash flow growth as power demand accelerates through the decade.

Curious what underpins this lockstep fair value? The analysts are betting on a wave of new projects to turbocharge Enbridge's cash flows and future margins. But what assumptions about future profits and sector momentum do these forecasts really rely on? Only by peeling back the layers will you discover the forecasted leaps in earnings and the level of optimism baked into that consensus price target.

Result: Fair Value of $68.40 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory hurdles and evolving decarbonization policies could challenge Enbridge's growth prospects and cast doubt on those optimistic analyst forecasts.

Find out about the key risks to this Enbridge narrative.

Another Perspective: Discounted Cash Flow Signals Untapped Value

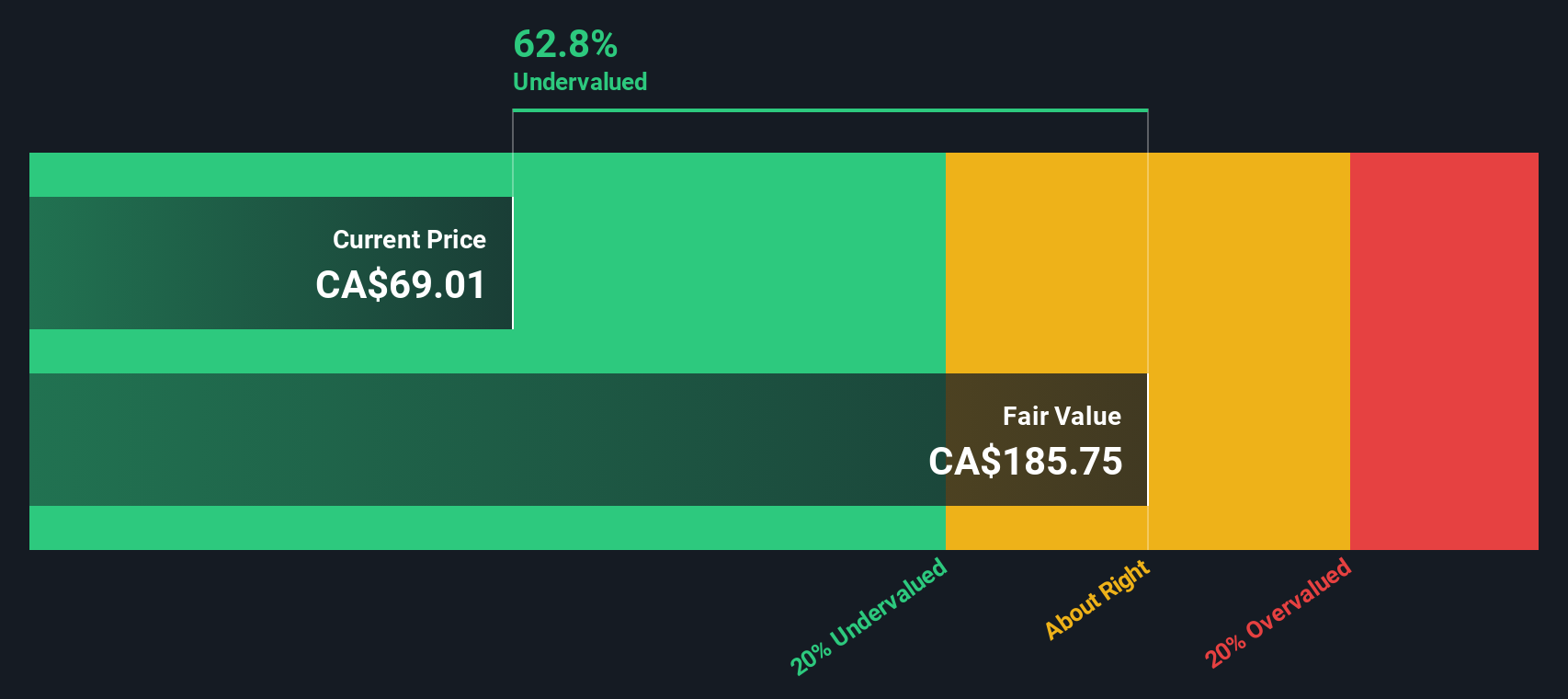

Looking from another angle, the SWS DCF model suggests Enbridge’s shares are trading well below fair value, by nearly 63%. This model incorporates projected cash flows and discounts them at today’s rates. Could the market be underestimating future earnings power, or are risks still understated?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Enbridge for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Enbridge Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own story from the data in just a few minutes, so why not Do it your way

A great starting point for your Enbridge research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by. Set yourself up to catch the next big winner by using powerful screeners tailored for savvy investors:

- Jumpstart your portfolio’s income potential by reviewing these 19 dividend stocks with yields > 3% with impressive yields above 3%.

- Uncover tomorrow’s tech giants before the crowd by analyzing these 24 AI penny stocks driving innovation in artificial intelligence.

- Strengthen your strategy with ultra-affordable picks by investigating these 896 undervalued stocks based on cash flows filtered for standout cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enbridge might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ENB

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives