- Canada

- /

- Oil and Gas

- /

- TSX:ENB

Enbridge (TSX:ENB) Eyes Strategic M&A and Renewable Investments Amid Market Expansion

Reviewed by Simply Wall St

Enbridge (TSX:ENB) is currently navigating a period marked by both significant opportunities and pressing challenges. Recent developments include high financing costs and regulatory risks, balanced against strategic growth in renewable energy projects and utility integration. In the discussion that follows, we will explore Enbridge's core strengths, critical weaknesses, potential growth strategies, and key risks to provide a comprehensive overview of the company's current business situation.

Click to explore a detailed breakdown of our findings on Enbridge.

Strengths: Core Advantages Driving Sustained Success For Enbridge

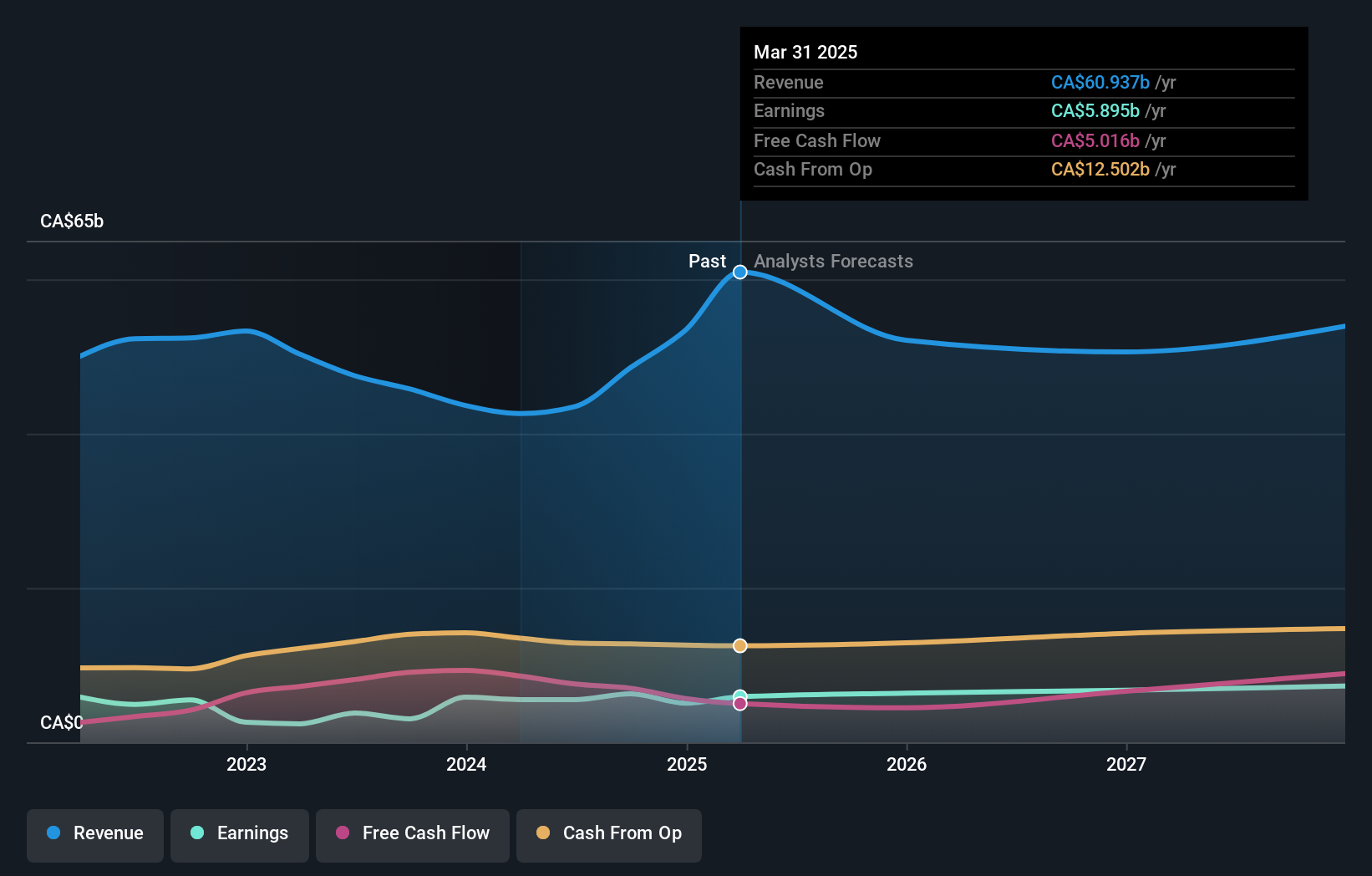

Enbridge's financial health is underscored by its robust balance sheet, with debt to EBITDA well within the targeted range at 4.7x, providing financial flexibility for capital allocation priorities. Operational excellence is evident, with high utilization across its franchises and record volumes achieved on the Mainline and at the Ingleside export facility. The company's strategic growth in its customer base, particularly in Ontario, where residential and industrial growth is expected, further strengthens its market position. Enbridge's proven track record of effective M&A execution highlights its strong relationships with stakeholders, as noted by CEO Greg Ebel in the latest earnings call. Despite being considered expensive based on its Price-To-Earnings Ratio (21.7x) compared to the Canadian Oil and Gas industry average (11.4x) and the peer average (21.1x), Enbridge is trading below the estimated fair value of CA$64.64, indicating potential undervaluation.

Weaknesses: Critical Issues Affecting Enbridge's Performance and Areas For Growth

Enbridge faces significant financial challenges, particularly with high financing costs on floating rate debt and new issuances, impacting per share metrics as highlighted by CFO Patrick Murray. The company's earnings growth forecast of 11.2% per year is slower than the Canadian market average of 15.1% per year. Additionally, Enbridge's revenue growth forecast of 0.6% per year is considerably slower than the Canadian market's 6.9% per year. The high payout ratio of 137.4% suggests that dividend payments are not well covered by earnings, raising concerns about sustainability. Furthermore, the management team is relatively inexperienced, with an average tenure of 1.4 years, which may impact strategic execution and long-term planning.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Enbridge has several strategic opportunities to enhance its market position. The integration of newly acquired utilities into gas distribution and storage presents significant growth potential, as emphasized by EVP Michele Harradence. The company is also investing in renewable energy projects, such as the 130-megawatt Orange Grove solar project in Texas, backed by a long-term PPA with AT&T. Growing demand for natural gas and renewable power, coupled with the interconnectivity of these energy sources, presents further expansion opportunities. Additionally, the burgeoning data center market in Utah, with projected population growth of 5% annually through 2028, offers a lucrative avenue for Enbridge to explore.

Threats: Key Risks and Challenges That Could Impact Enbridge's Success

Regulatory risks pose a significant threat to Enbridge, with potential moratoriums and regulatory changes impacting operations, as noted by EVP Cynthia Hansen. Market competition, particularly from smaller and older terminals, could erode Enbridge's market share, as highlighted by EVP Colin Gruending. Economic factors, such as the impact of wildfires, present additional challenges, with CEO Greg Ebel emphasizing the company's commitment to supporting partners and communities during these times. Furthermore, the company's interest payments are not well covered by earnings, raising concerns about financial stability. The dilution of shareholders, with total shares outstanding growing by 2.4% in the past year, also poses a risk to investor confidence.

Conclusion

Enbridge's strong balance sheet and operational excellence position it well for future growth, particularly with its strategic expansion in Ontario and successful M&A activities. However, the company faces challenges such as high financing costs and a high payout ratio, which could impact its financial stability and dividend sustainability. Enbridge's investments in renewable energy and potential growth in the data center market offer promising opportunities, yet regulatory risks and market competition remain significant threats. Although Enbridge's Price-To-Earnings Ratio of 21.7x is higher than the Canadian Oil and Gas industry average of 11.4x and the peer average of 21.1x, its current trading price below the estimated fair value of CA$64.64 suggests there may be room for price appreciation, contingent on effective management of its financial and operational challenges.

Next Steps

- Is Enbridge part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

Valuation is complex, but we're here to simplify it.

Discover if Enbridge might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:ENB

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives