- Canada

- /

- Energy Services

- /

- TSX:EFX

Investors Still Aren't Entirely Convinced By Enerflex Ltd.'s (TSE:EFX) Revenues Despite 26% Price Jump

Enerflex Ltd. (TSE:EFX) shares have continued their recent momentum with a 26% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 4.1% isn't as impressive.

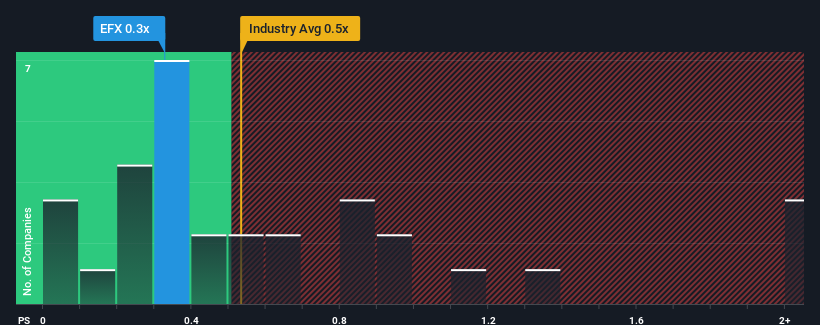

Although its price has surged higher, there still wouldn't be many who think Enerflex's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Canada's Energy Services industry is similar at about 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Enerflex

What Does Enerflex's P/S Mean For Shareholders?

Recent times have been advantageous for Enerflex as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Enerflex will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Enerflex?

The only time you'd be comfortable seeing a P/S like Enerflex's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 78%. Pleasingly, revenue has also lifted 160% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 2.1% each year during the coming three years according to the ten analysts following the company. This is still shaping up to be materially better than the broader industry which is also set to decline 6.5% per year.

With this information, it's perhaps curious but not a major surprise that Enerflex is trading at a fairly similar P/S in comparison. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares.

The Final Word

Its shares have lifted substantially and now Enerflex's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It looks to us like Enerflex currently trades on a lower than expected P/S since its revenue forecast is not as bad as the struggling industry. There's a chance that the market isn't looking too favourably on the potential risks which are preventing the P/S ratio from matching the more attractive outlook compared to its peers. Perhaps there is some hesitation about the company's ability to keep resisting the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you settle on your opinion, we've discovered 1 warning sign for Enerflex that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Enerflex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:EFX

Enerflex

Offers energy infrastructure and energy transition solutions in North America, Latin America, and the Eastern Hemisphere.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)