- Canada

- /

- Oil and Gas

- /

- TSX:EFR

Energy Fuels (TSX:EFR) Valuation in Focus After Rare Earth Supply Chain Partnership With Vulcan Elements

Reviewed by Simply Wall St

If you have been watching Energy Fuels (TSX:EFR) lately, you probably noticed the headlines about their new partnership with Vulcan Elements. This collaboration aims to build a U.S.-based supply chain for rare earth magnets, materials that power everything from defense systems to electric vehicles. It is a big step for Energy Fuels, signaling a move beyond their core operations and into the critical materials space, which could have far-reaching implications for their growth story.

Markets seemed to pick up on the potential of this partnership, as the stock price has surged over the past year. Energy Fuels shares have more than doubled year-to-date and climbed nearly 183% over the last 12 months, with much of this momentum coming in the past three months. This growth comes on the back of other announcements too, such as the executive changes at their heavy mineral sands subsidiary and the commercial scaling of new rare earth oxide products.

But now that the stock is on a run, investors have to ask whether this partnership creates a genuine buying opportunity, or if all the promise is already reflected in the price.

Most Popular Narrative: 4% Undervalued

According to the most widely referenced narrative, Energy Fuels is currently trading at a roughly 4% discount to its fair value. This result suggests moderate upside potential if the company can meet analyst growth expectations.

Completion and commissioning of the White Mesa Mill rare earth separation Phase 2 expansion (potentially increasing monazite processing to 60,000 tonnes/year and enabling commercial-scale heavy rare earth production such as Dy/Tb) could establish Energy Fuels as a major western supplier, capturing price premiums driven by western supply chain security and increasing electrification demand. This could support long-term revenue and margin upside.

Want to know what ambitious profit margins and growth rates are fueling this valuation? Behind that moderate discount is a set of bold analyst assumptions, quantifying future expansion and market transformation. The narrative is built on high-impact projections and a breakaway profit outlook. Curious about the financial foundation driving this fair value?

Result: Fair Value of $17.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing dependence on uncertain rare earth feedstock and the large funding needs for key projects could quickly alter the bullish outlook for Energy Fuels.

Find out about the key risks to this Energy Fuels narrative.Another View: High Market Value Raises Questions

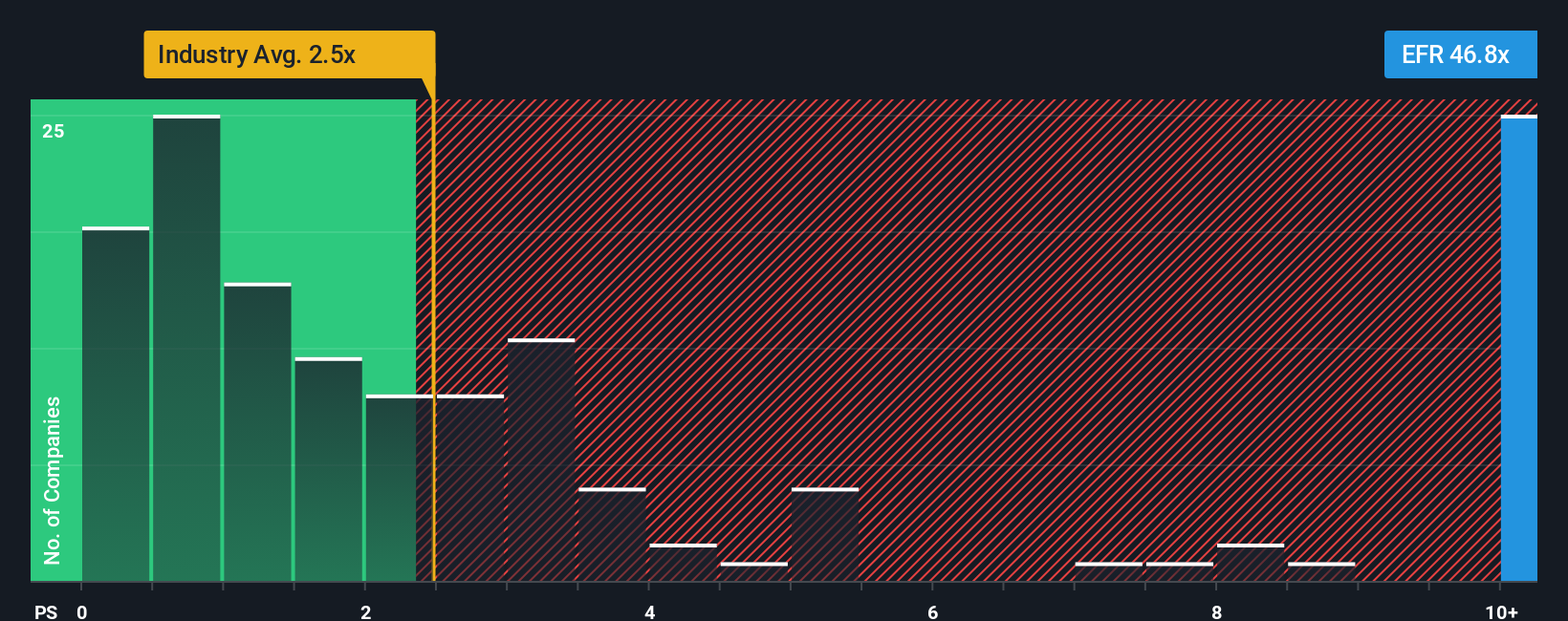

Looking from a different angle, the company appears expensive when you compare its market value to sales for the industry. This approach presents a more cautious picture than the fair value model. Could the growth story justify the premium investors are paying?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Energy Fuels to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Energy Fuels Narrative

If you want to challenge these perspectives or prefer to reach your own conclusions, you can craft a personalized narrative in just a few minutes using Do it your way.

A great starting point for your Energy Fuels research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Maximize your potential by targeting sectors making waves right now. Use these powerful tools to stay one step ahead and never miss the next standout opportunity:

- Tap into tomorrow’s tech by uncovering AI-powered companies making breakthroughs in automation and smart data with AI penny stocks.

- Secure reliable returns by pinpointing businesses offering attractive yields over 3 percent. Start your search with dividend stocks with yields > 3%.

- Catch value before the crowd by finding quality stocks priced below their cash flow potential using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Fuels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:EFR

Energy Fuels

Engages in the exploration, recovery, recycling, exploration, operation, development, permitting, evaluation, and sale of uranium mineral properties in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives