- Canada

- /

- Oil and Gas

- /

- TSX:CVE

Is There Value in Cenovus After Five Years of 308% Price Growth?

Reviewed by Bailey Pemberton

- Ever wondered if Cenovus Energy could be a hidden gem or if the market has already caught on? You're not alone. Many investors are curious about whether the current price offers real value.

- The stock has climbed 16.1% over the past year and is up an impressive 308.5% in the last five years, though it's seen a slight dip of 3.9% in the last week.

- Significant moves in Cenovus shares have come alongside surging oil prices and industry headlines discussing the company's expanded upstream operations and strategic acquisitions. Many are watching how Cenovus is positioning itself amid shifting market sentiment and evolving energy policy.

- On our valuation checks, Cenovus scores 4 out of 6, suggesting it is undervalued in several key areas. However, there is more to the story than just the numbers. Next, we will break down the major valuation approaches and reveal a more insightful way to understand what the market might be missing by the end of this article.

Approach 1: Cenovus Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its future cash flows and discounting them back to present day using a risk-adjusted rate. This method allows investors to look beyond current profits and focus on long-term cash generation potential.

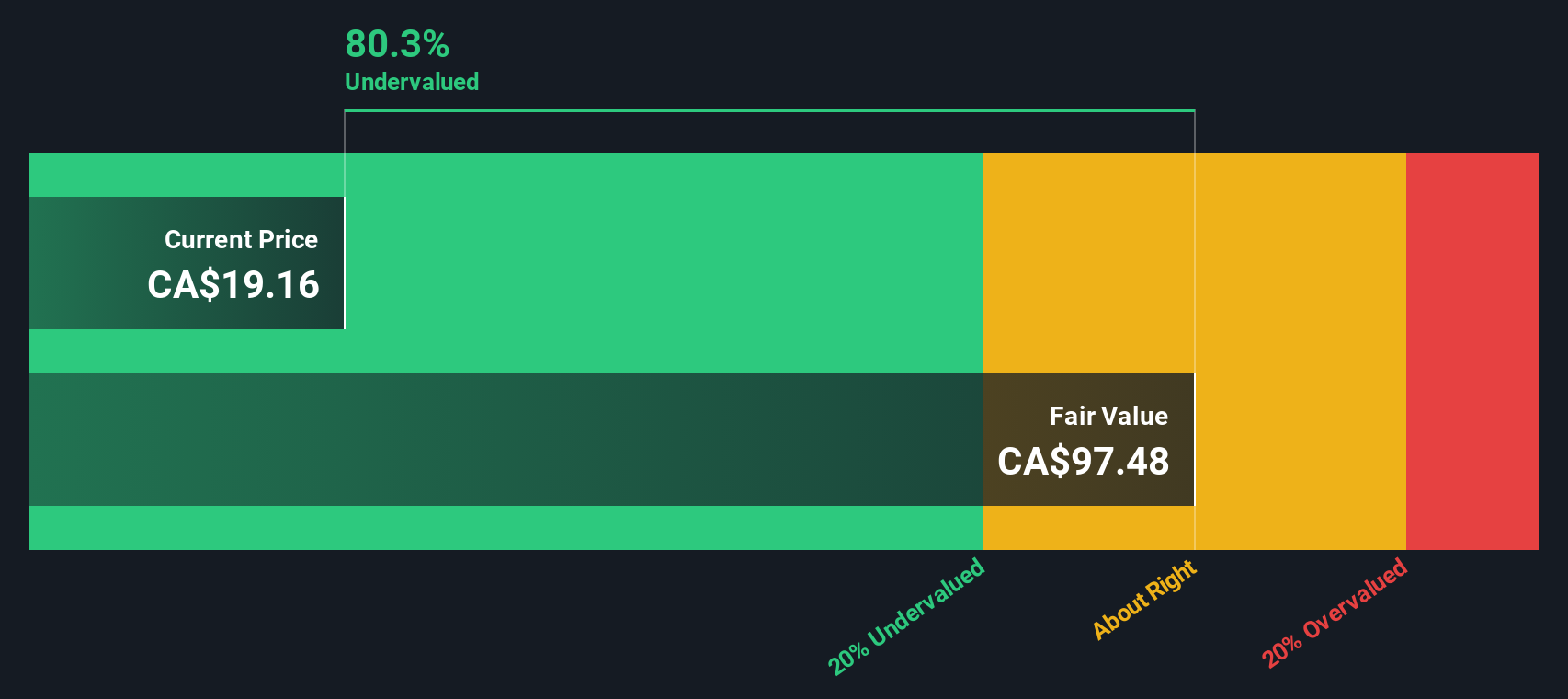

Cenovus Energy’s most recent free cash flow stands at CA$3.27 billion. Analyst forecasts extend five years out, projecting solid growth in free cash flow. For example, it is estimated to reach CA$5.06 billion by 2028. For years beyond the analyst horizon, Simply Wall St extends these projections further and arrives at estimates of up to CA$6.84 billion by 2035. All cash flow figures are shown in Canadian dollars.

When these future cash flows are discounted back to today, the resulting intrinsic value for Cenovus Energy shares comes out to CA$82.16. This value implies the stock is trading at a 70.0% discount to its estimated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cenovus Energy is undervalued by 70.0%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: Cenovus Energy Price vs Earnings

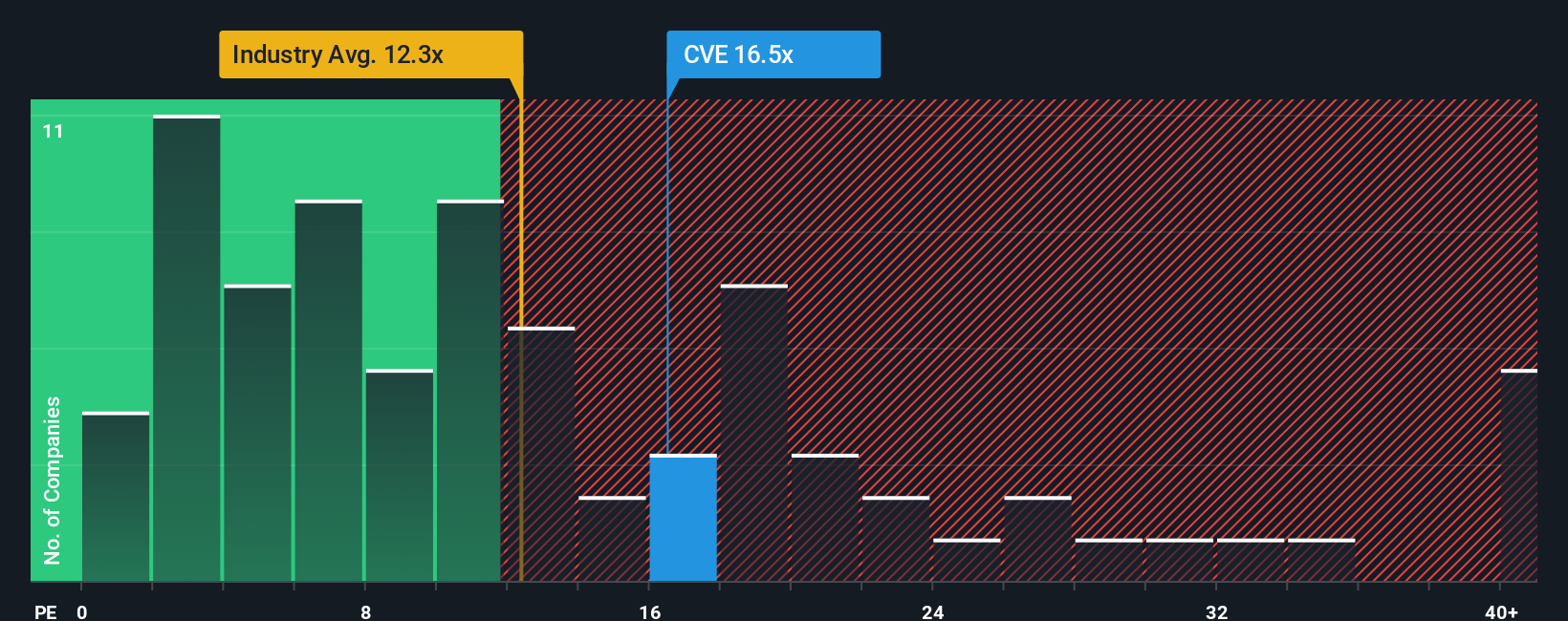

The price-to-earnings (PE) ratio is a widely used valuation tool for profitable companies because it compares a company's current share price against its earnings, giving investors a sense of how much they are paying for each dollar of profit. For companies in steady profit mode like Cenovus Energy, the PE ratio is an especially practical benchmark to gauge whether shares offer value or are trading at a premium.

However, what qualifies as a "fair" PE ratio depends on several factors, including growth expectations, profitability, risk profile, and market conditions. Fast-growing companies or those with strong margins often justify higher PE ratios, while riskier or slower-growing firms tend to trade at lower multiples.

Cenovus Energy currently trades at a PE ratio of 15.0x. This is slightly above the oil and gas industry average of 14.6x, but below the peer group average of 17.9x. Simply Wall St’s Fair Ratio is an advanced metric factoring in company-specific growth prospects, profit margins, industry characteristics, market capitalization, and risk, and comes in at 15.8x for Cenovus. Unlike straightforward peer or industry comparisons, the Fair Ratio is tailored to Cenovus’s fundamentals and outlook, giving a more accurate assessment of what represents “fair value” for its shares.

With Cenovus’s actual PE ratio just below its Fair Ratio, the stock appears to be fairly valued on earnings and in line with where it should be given its growth profile and risk-reward balance.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cenovus Energy Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your unique investment story for a company, blending your assumptions about its future revenues, earnings, and profit margins with your outlook on industry trends and company strategy to create a personalized estimate of fair value.

Narratives go a step beyond the raw numbers, linking Cenovus Energy’s fundamental strengths and risks directly to your own forecast. This helps you see the company’s potential through the lens of your analysis instead of just market consensus. On the Simply Wall St Community page, you can effortlessly create or browse Narratives, making the approach accessible to everyone regardless of investing experience.

With Narratives, millions of investors decide when to buy or sell by continuously comparing their fair value to Cenovus Energy’s current share price. Every Narrative automatically updates as the latest news or earnings emerge. For example, one investor’s Narrative might see Cenovus integrating the MEG deal flawlessly, driving strong margin and earnings growth for a fair value of CA$32. Another, more cautious Narrative may factor in execution and regulatory risks, seeing fair value closer to CA$21. Both viewpoints reflect how Narratives empower you to chart your own path, anchored on transparent financial logic and timely information.

Do you think there's more to the story for Cenovus Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CVE

Cenovus Energy

Develops, produces, refines, transports, and markets crude oil, natural gas, and refined petroleum products in Canada, the United States, and China.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success