- Canada

- /

- Energy Services

- /

- TSX:FLNT

ClearStream Energy Services Inc.'s (TSE:CSM) CEO Compensation Is Looking A Bit Stretched At The Moment

Under the guidance of CEO Yves Paletta, ClearStream Energy Services Inc. (TSE:CSM) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 18 June 2021. However, some shareholders will still be cautious of paying the CEO excessively.

View our latest analysis for ClearStream Energy Services

How Does Total Compensation For Yves Paletta Compare With Other Companies In The Industry?

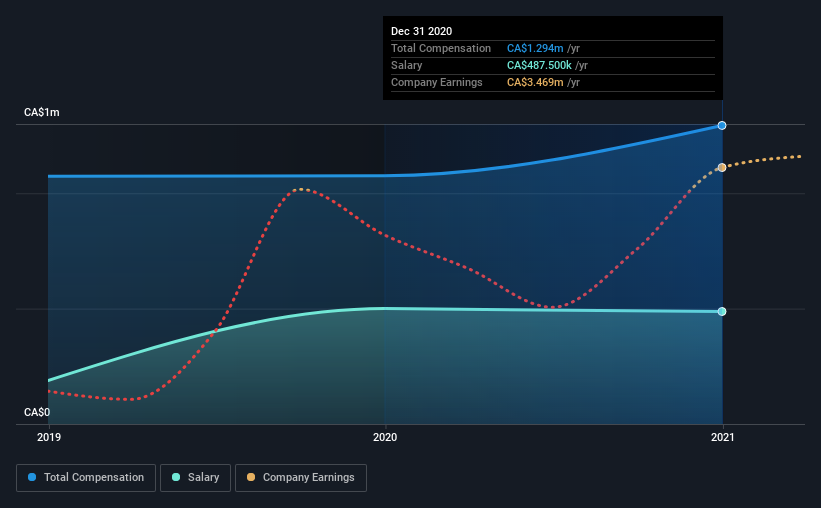

According to our data, ClearStream Energy Services Inc. has a market capitalization of CA$9.3m, and paid its CEO total annual compensation worth CA$1.3m over the year to December 2020. We note that's an increase of 20% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CA$488k.

In comparison with other companies in the industry with market capitalizations under CA$242m, the reported median total CEO compensation was CA$610k. Hence, we can conclude that Yves Paletta is remunerated higher than the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$488k | CA$500k | 38% |

| Other | CA$806k | CA$576k | 62% |

| Total Compensation | CA$1.3m | CA$1.1m | 100% |

Talking in terms of the industry, salary represented approximately 36% of total compensation out of all the companies we analyzed, while other remuneration made up 64% of the pie. Although there is a difference in how total compensation is set, ClearStream Energy Services more or less reflects the market in terms of setting the salary. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at ClearStream Energy Services Inc.'s Growth Numbers

ClearStream Energy Services Inc.'s earnings per share (EPS) grew 76% per year over the last three years. In the last year, its revenue is down 31%.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has ClearStream Energy Services Inc. Been A Good Investment?

ClearStream Energy Services Inc. has served shareholders reasonably well, with a total return of 13% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 5 warning signs (and 2 which are potentially serious) in ClearStream Energy Services we think you should know about.

Important note: ClearStream Energy Services is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:FLNT

Flint

Provides upstream, midstream, and downstream production services in Canada and the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success