- Canada

- /

- Oil and Gas

- /

- TSX:VRN

Easy Come, Easy Go: How Crescent Point Energy (TSE:CPG) Shareholders Got Unlucky And Saw 90% Of Their Cash Evaporate

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. Anyone who held Crescent Point Energy Corp. (TSE:CPG) for five years would be nursing their metaphorical wounds since the share price dropped 90% in that time. And it's not just long term holders hurting, because the stock is down 55% in the last year. There was little comfort for shareholders in the last week as the price declined a further 4.2%.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Crescent Point Energy

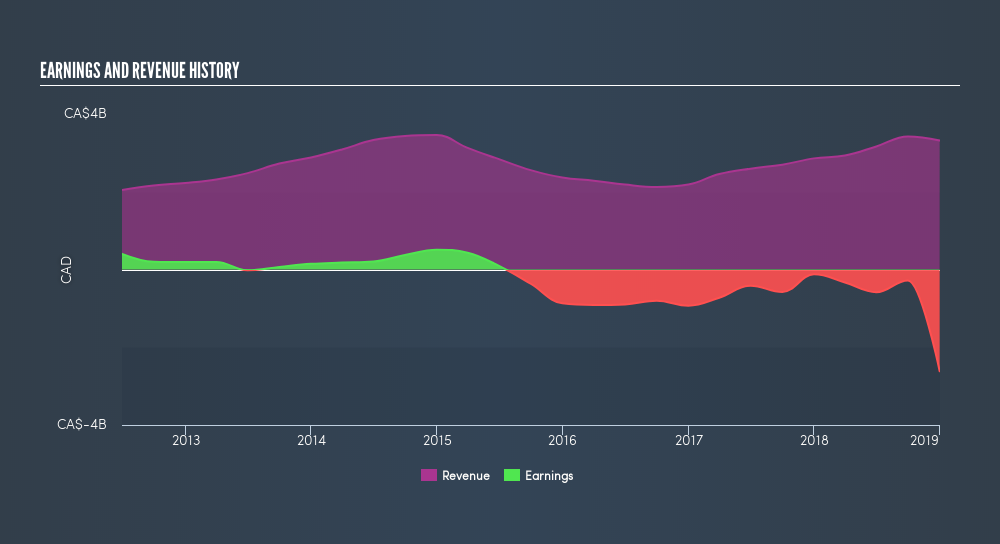

Crescent Point Energy isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Crescent Point Energy reduced its trailing twelve month revenue by 0.9% for each year. That's not what investors generally want to see. The share price fall of 37% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. Fear of becoming a 'bagholder' may be keeping people away from this stock.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This freereport showing analyst forecasts should help you form a view on Crescent Point Energy

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Crescent Point Energy the TSR over the last 5 years was -87%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Crescent Point Energy shareholders are down 53% for the year (even including dividends), but the market itself is up 7.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 34% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:VRN

Veren

Engages in acquiring, developing, and holding interests in petroleum assets operations across western Canada.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives