- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

Is Now the Right Moment for Canadian Natural Resources After Project Expansion News?

Reviewed by Bailey Pemberton

- Wondering if Canadian Natural Resources is trading at a bargain or if the ship has sailed? You are not alone, as many investors are eyeing its value potential right now.

- The stock posted a 6.1% rise over the past month, though it has lost 2.1% in the past week. This suggests quick shifts in sentiment and raises fresh questions about risk and upside.

- Canadian Natural Resources recently made headlines with new project announcements and strategic capacity expansions. These actions signal the company's ongoing efforts to adapt and grow in a fast-changing energy market, giving investors fresh reasons to revisit the company’s long-term story.

- Our valuation checks give Canadian Natural Resources a score of 3 out of 6 for being undervalued. How those numbers are derived, and whether there is an even smarter way to spot value, is what we will unpack next.

Approach 1: Canadian Natural Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of Canadian Natural Resources by projecting its future cash flows and discounting them back to today's value using a reasonable rate. This helps investors understand what the company is worth based on its ability to generate cash in the years ahead, not just current profits.

Currently, Canadian Natural Resources generates Free Cash Flow (FCF) of approximately CA$8.9 Billion. Analysts forecast FCF to grow steadily, reaching a projected CA$11.5 Billion by the end of 2029. While only around five years of direct analyst estimates are available, future numbers from 2030 onwards are extrapolated based on recent growth trends and industry assumptions to provide a complete ten-year picture.

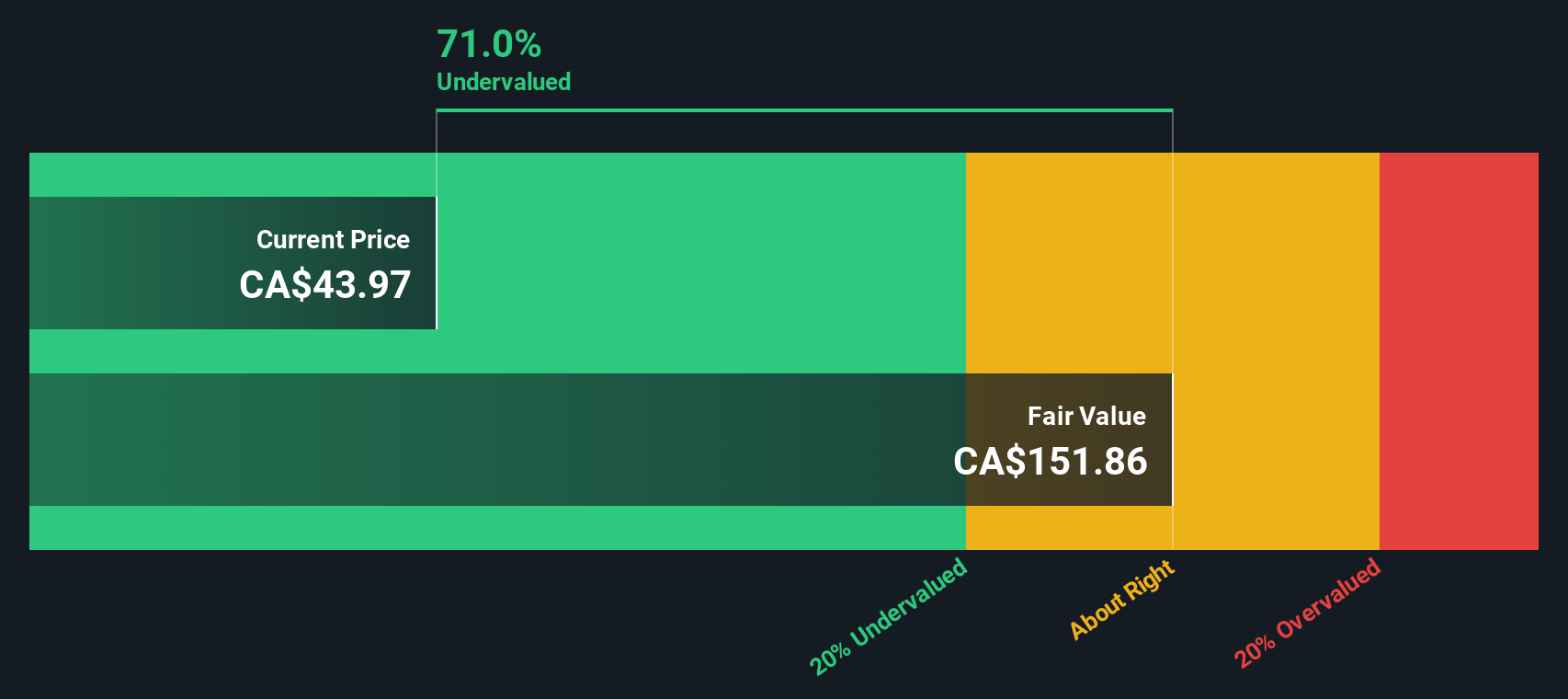

Applying the DCF approach, the resulting estimated intrinsic value per share is CA$157.66. With the current share price trading at a meaningful discount of about 70.3% below this estimate, the model strongly suggests the stock is significantly undervalued today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Canadian Natural Resources is undervalued by 70.3%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

Approach 2: Canadian Natural Resources Price vs Earnings

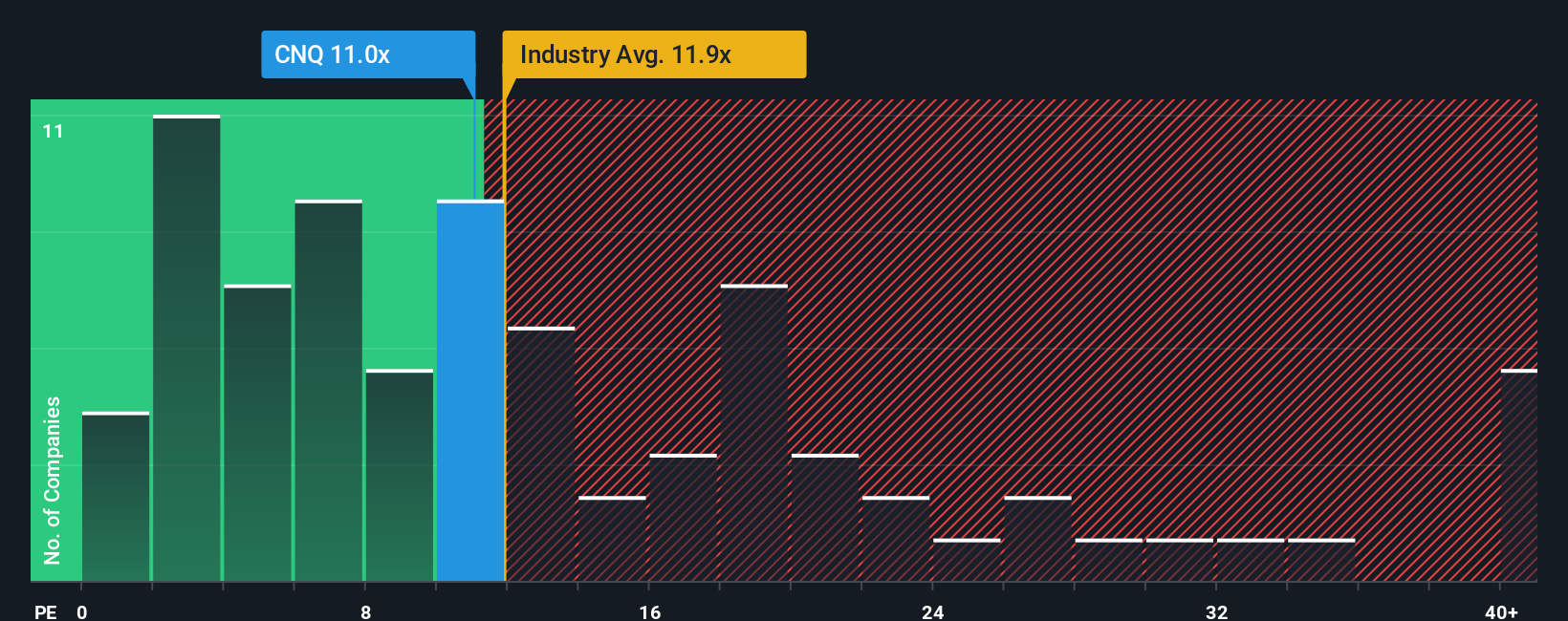

For profitable companies like Canadian Natural Resources, the Price-to-Earnings (PE) ratio is a widely used and effective valuation measure. The PE ratio tells investors how much they are paying for each dollar of the company's earnings, making it especially useful for established, consistently profitable businesses.

A company’s "normal" or "fair" PE ratio is shaped by expectations for future earnings growth and the level of risk involved. Generally, companies with higher growth prospects or lower risk levels command higher PE ratios, while those facing more challenges or uncertain outlooks tend to see lower multiples.

Currently, Canadian Natural Resources trades at a PE ratio of 14.6x. This is almost identical to both its industry average PE of 14.6x and the peer average of 14.6x, suggesting that investors are valuing the company in line with its closest competitors.

A more nuanced view comes from Simply Wall St's proprietary "Fair Ratio," which calculates a tailored PE multiple of 16.7x for Canadian Natural Resources. This Fair Ratio blends many relevant factors, such as projected earnings growth, business risks, profit margins, market size, and sector performance. Unlike a simple industry or peer average, it offers a more complete, company-specific benchmark for today's market conditions.

Since the Fair Ratio of 16.7x is just a bit above the current PE of 14.6x and the difference is not dramatic, the stock appears to be valued about right using this approach.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1432 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Canadian Natural Resources Narrative

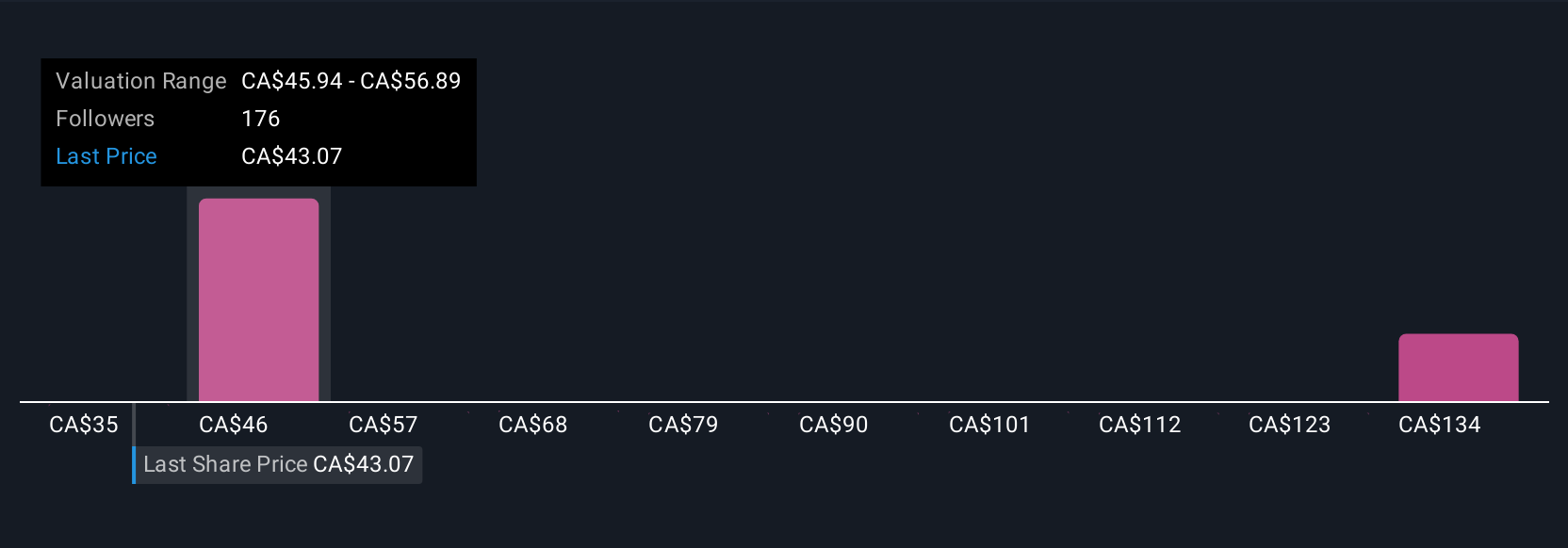

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a story-driven approach to investing; it is an easy way for you to combine your personal perspective on a company with the underlying numbers by outlining your assumptions around future revenue, earnings, and profit margins, and then linking those to an estimated fair value.

Rather than focusing solely on multiples or analyst targets, Narratives empower you to provide context and rationale behind those numbers, making your forecasted fair value transparent and unique to your outlook. Available on Simply Wall St’s Community page, this tool is used by millions of investors as a dynamic, accessible way to articulate their view and see how it compares to others.

Narratives also update dynamically with new company announcements, news, or earnings. This ensures that your underlying story and estimate remain current. By comparing your own Fair Value to the prevailing share price, Narratives help you answer critical questions like whether it is time to buy more, hold tight, or take profits.

For example, with Canadian Natural Resources, some investors expect dividend growth and capital return leadership will support outperformance and have set fair values as high as CA$62.00, while others, concerned about sector headwinds and long-term risks, have set targets as low as CA$45.00.

Do you think there's more to the story for Canadian Natural Resources? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNQ

Canadian Natural Resources

Engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) in Western Canada, the United Kingdom sector of the North Sea, and Offshore Africa.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success