- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

How Investors Are Reacting To Canadian Natural Resources (TSX:CNQ) Emphasizing Dividend Growth and Stability

Reviewed by Sasha Jovanovic

- In recent days, Canadian Natural Resources has highlighted its status as a top dividend-growth stock on the TSX, emphasizing consistent cash flow, robust shareholder returns through dividends and buybacks, and a focus on low operating costs and long-life oil sands assets.

- An interesting takeaway is that the company’s continued investments in debt reduction and emissions-reduction technology have further strengthened its appeal as a stable source of long-term income for investors, particularly when compared with its peers.

- We’ll explore how Canadian Natural’s track record of strong cash generation and capital discipline shapes its investment narrative going forward.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Canadian Natural Resources Investment Narrative Recap

To be a shareholder in Canadian Natural Resources, you need to believe in the long-term value of large-scale oil sands assets, the company's cost discipline, and its commitment to reliable cash flow and income. The recent emphasis on dividend growth and capital returns does not materially change the most important near-term catalyst, which remains the consistent generation of free cash flow, nor does it remove the primary risk of heightened environmental and regulatory pressures.

Canadian Natural's latest quarterly dividend declaration and robust share buyback activity, both announced on November 6, are particularly relevant. They reinforce a focus on capital returns at a time when production growth and efficiency gains are already supporting stability, key factors for the near-term outlook.

But in contrast, investors should also keep in mind the real potential for rising environmental regulation and its impact on future returns...

Read the full narrative on Canadian Natural Resources (it's free!)

Canadian Natural Resources' outlook anticipates CA$36.7 billion in revenue and CA$8.1 billion in earnings by 2028. This reflects a 1.2% annual revenue decline and a CA$0.2 billion decrease in earnings from the current CA$8.3 billion.

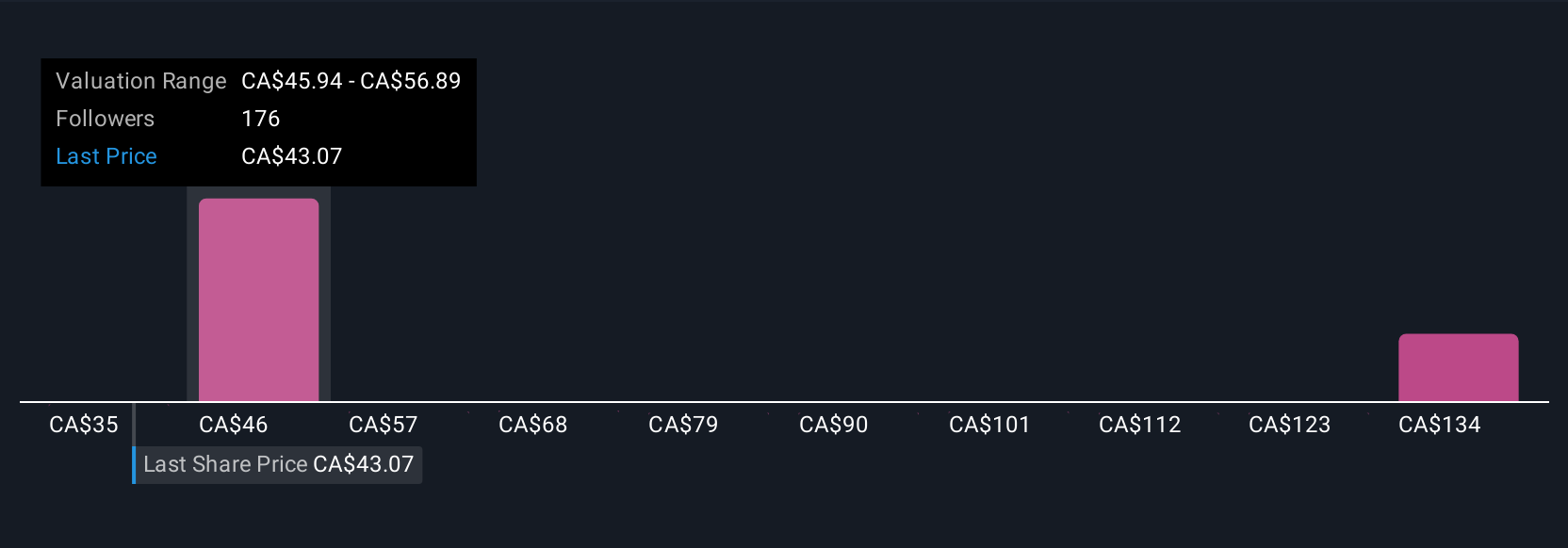

Uncover how Canadian Natural Resources' forecasts yield a CA$52.95 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have posted 26 fair value estimates for Canadian Natural Resources, ranging widely from CA$33.39 to over CA$157.66 per share. While many see attractive value below current levels, ongoing regulatory risk remains a common concern shaping future returns; make sure to review multiple viewpoints for a fuller picture.

Explore 26 other fair value estimates on Canadian Natural Resources - why the stock might be worth over 3x more than the current price!

Build Your Own Canadian Natural Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Natural Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Canadian Natural Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Natural Resources' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNQ

Canadian Natural Resources

Engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) in Western Canada, the United Kingdom sector of the North Sea, and Offshore Africa.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026