Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Canadian Natural Resources Limited (TSE:CNQ) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Canadian Natural Resources

What Is Canadian Natural Resources's Debt?

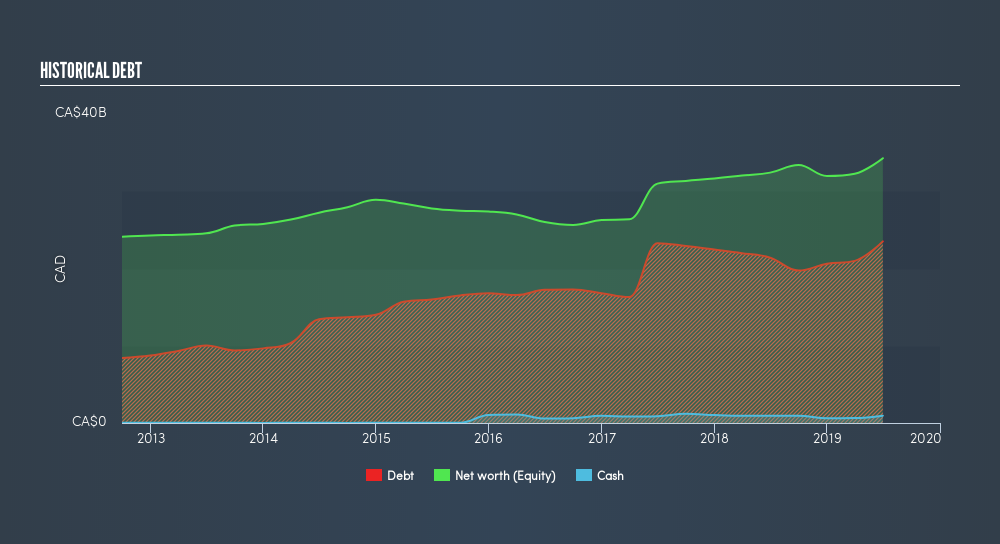

As you can see below, at the end of June 2019, Canadian Natural Resources had CA$23.5b of debt, up from CA$21.4b a year ago. Click the image for more detail. On the flip side, it has CA$945.0m in cash leading to net debt of about CA$22.6b.

A Look At Canadian Natural Resources's Liabilities

The latest balance sheet data shows that Canadian Natural Resources had liabilities of CA$7.90b due within a year, and liabilities of CA$36.8b falling due after that. Offsetting these obligations, it had cash of CA$945.0m as well as receivables valued at CA$2.12b due within 12 months. So its liabilities total CA$41.6b more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's huge CA$38.2b market capitalization, you might well be inclined to review the balance sheet, just like one might study a new partner's social media. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Canadian Natural Resources's net debt is sitting at a very reasonable 2.3 times its EBITDA, while its EBIT covered its interest expense just 6.3 times last year. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. If Canadian Natural Resources can keep growing EBIT at last year's rate of 11% over the last year, then it will find its debt load easier to manage. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Canadian Natural Resources's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Canadian Natural Resources actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

On our analysis Canadian Natural Resources's conversion of EBIT to free cash flow should signal that it won't have too much trouble with its debt. However, our other observations weren't so heartening. To be specific, it seems about as good at staying on top of its total liabilities as wet socks are at keeping your feet warm. When we consider all the factors mentioned above, we do feel a bit cautious about Canadian Natural Resources's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. We'd be motivated to research the stock further if we found out that Canadian Natural Resources insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:CNQ

Canadian Natural Resources

Engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) in Western Canada, the United Kingdom sector of the North Sea, and Offshore Africa.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives