- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

Can Canadian Natural Resources' (TSX:CNQ) Strong Cash Generation Outlast Volatile Shifts in the Energy Sector?

Reviewed by Sasha Jovanovic

- In recent news, Canadian Natural Resources was highlighted for its resilient operations, robust shareholder distributions, and fundamentally strong position amid ongoing energy sector volatility.

- An interesting insight is the company's ability to offset technology-driven market disruption with its stable, non-discretionary energy demand and diversified, long-life oil sands assets.

- We'll examine how Canadian Natural Resources' reputation for reliable cash generation and disciplined financial management shapes its investment narrative going forward.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Canadian Natural Resources Investment Narrative Recap

To be a shareholder in Canadian Natural Resources, you need to believe in ongoing strong structural demand for oil and gas, the value of diversified, long-life oil sands assets, and the company’s ability to generate high free cash flow even as the energy sector evolves. The recent spotlight on Canadian Natural’s resilience and shareholder distributions underscores its robust position; however, it does not materially change the biggest short-term catalyst, which remains the completion and operational impact of new acquisitions. The most significant risk remains persistent regulatory and environmental pressures, which could alter long-term earnings power and necessitate higher spending.

Among recent developments, Canadian Natural’s completion of its multi-billion dollar buyback program and another dividend increase stand out. These actions highlight management’s ongoing commitment to returning capital to shareholders, reinforcing the company’s narrative of capital discipline as acquisition synergies and cost efficiencies continue to play out. Both shareholder returns and new asset integration remain closely watched as short-term catalysts.

By contrast, investors should not overlook the risk of tighter emissions regulations or rising compliance costs, especially if...

Read the full narrative on Canadian Natural Resources (it's free!)

Canadian Natural Resources' narrative projects CA$36.7 billion revenue and CA$8.1 billion earnings by 2028. This requires a 1.2% annual revenue decline and a CA$0.2 billion decrease in earnings from the current CA$8.3 billion.

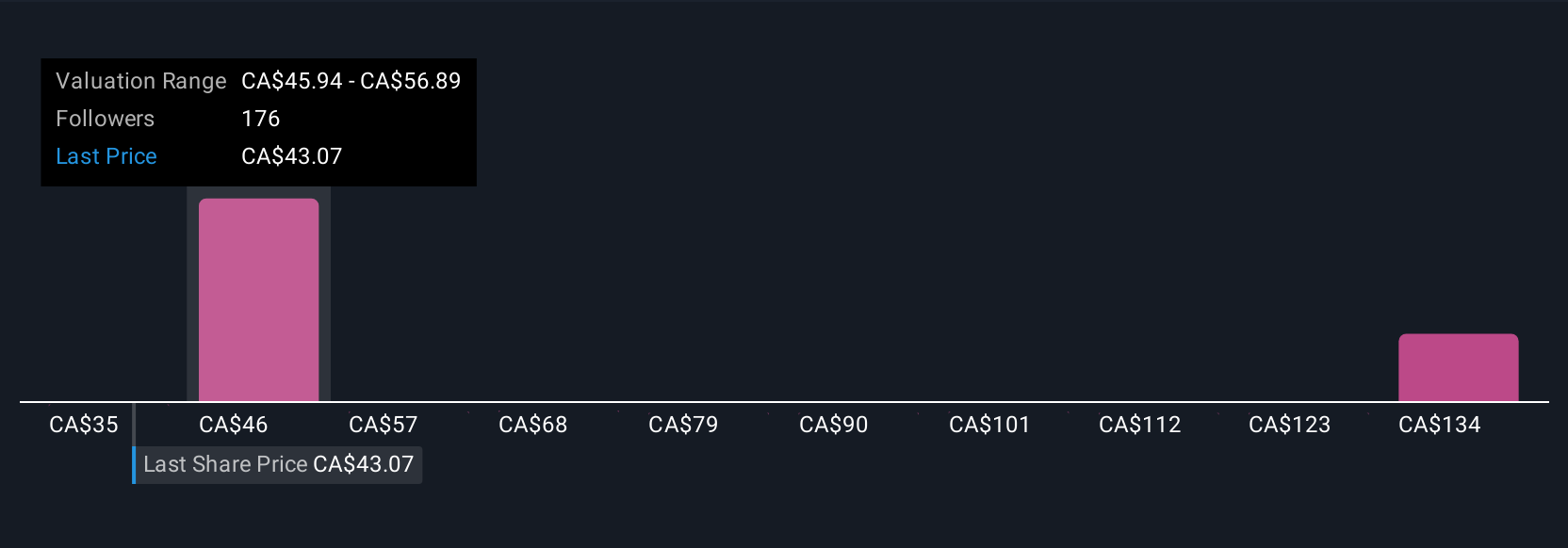

Uncover how Canadian Natural Resources' forecasts yield a CA$52.68 fair value, a 17% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s 26 fair value estimates for Canadian Natural Resources range widely from CA$33.68 to CA$151.45 per share. While viewpoints differ, the recurring concern about rising regulatory costs and environmental requirements could ultimately have a broad impact on investor expectations and company performance.

Explore 26 other fair value estimates on Canadian Natural Resources - why the stock might be worth 25% less than the current price!

Build Your Own Canadian Natural Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Natural Resources research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Canadian Natural Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Natural Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNQ

Canadian Natural Resources

Engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) in Western Canada, the United Kingdom sector of the North Sea, and Offshore Africa.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives