For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Cardinal Energy (TSE:CJ). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Cardinal Energy

Cardinal Energy's Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that Cardinal Energy grew its EPS from CA$0.79 to CA$2.92, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Cardinal Energy shareholders is that EBIT margins have grown from 49% to 82% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

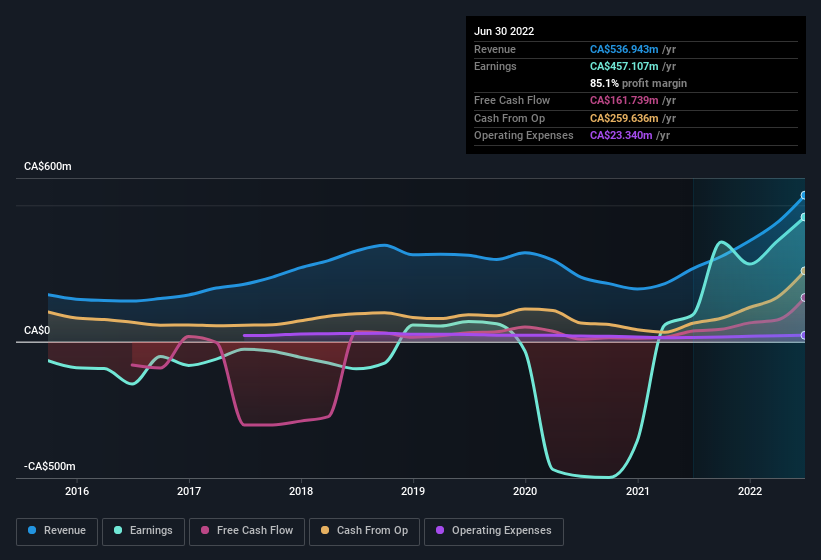

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Cardinal Energy Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Despite some Cardinal Energy insiders disposing of some shares, we note that there was CA$68k more in buying interest among those who know the company best Although some people may hesitate due to the share sales, the fact that insiders bought more than they sold, is a positive thing to note. It is also worth noting that it was Independent Director John Brussa who made the biggest single purchase, worth CA$339k, paying CA$8.99 per share.

The good news, alongside the insider buying, for Cardinal Energy bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth CA$320m. This totals to 24% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Very encouraging.

Is Cardinal Energy Worth Keeping An Eye On?

Cardinal Energy's earnings per share have been soaring, with growth rates sky high. What's more, insiders own a significant stake in the company and have been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Cardinal Energy belongs near the top of your watchlist. We don't want to rain on the parade too much, but we did also find 3 warning signs for Cardinal Energy (1 shouldn't be ignored!) that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Cardinal Energy, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CJ

Cardinal Energy

Engages in the acquisition, exploration, development, optimization, and production of petroleum and natural gas in the provinces of Alberta, British Columbia, and Saskatchewan in Canada.

Adequate balance sheet and fair value.

Market Insights

Community Narratives