- Canada

- /

- Metals and Mining

- /

- TSXV:SCZ

Discovering Canada's Undiscovered Gems In July 2025

Reviewed by Simply Wall St

In the first half of 2025, Canadian stocks have shown resilience amidst global economic shifts, with the market navigating new tariffs and changes in fiscal policies. As investors seek opportunities within this dynamic landscape, identifying undiscovered gems requires a keen eye for companies that can capitalize on regulatory changes and demonstrate robust growth potential despite external pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 11.60% | 32.30% | ★★★★★★ |

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Zoomd Technologies | 8.92% | 10.04% | 44.63% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Cardinal Energy (TSX:CJ)

Simply Wall St Value Rating: ★★★★☆☆

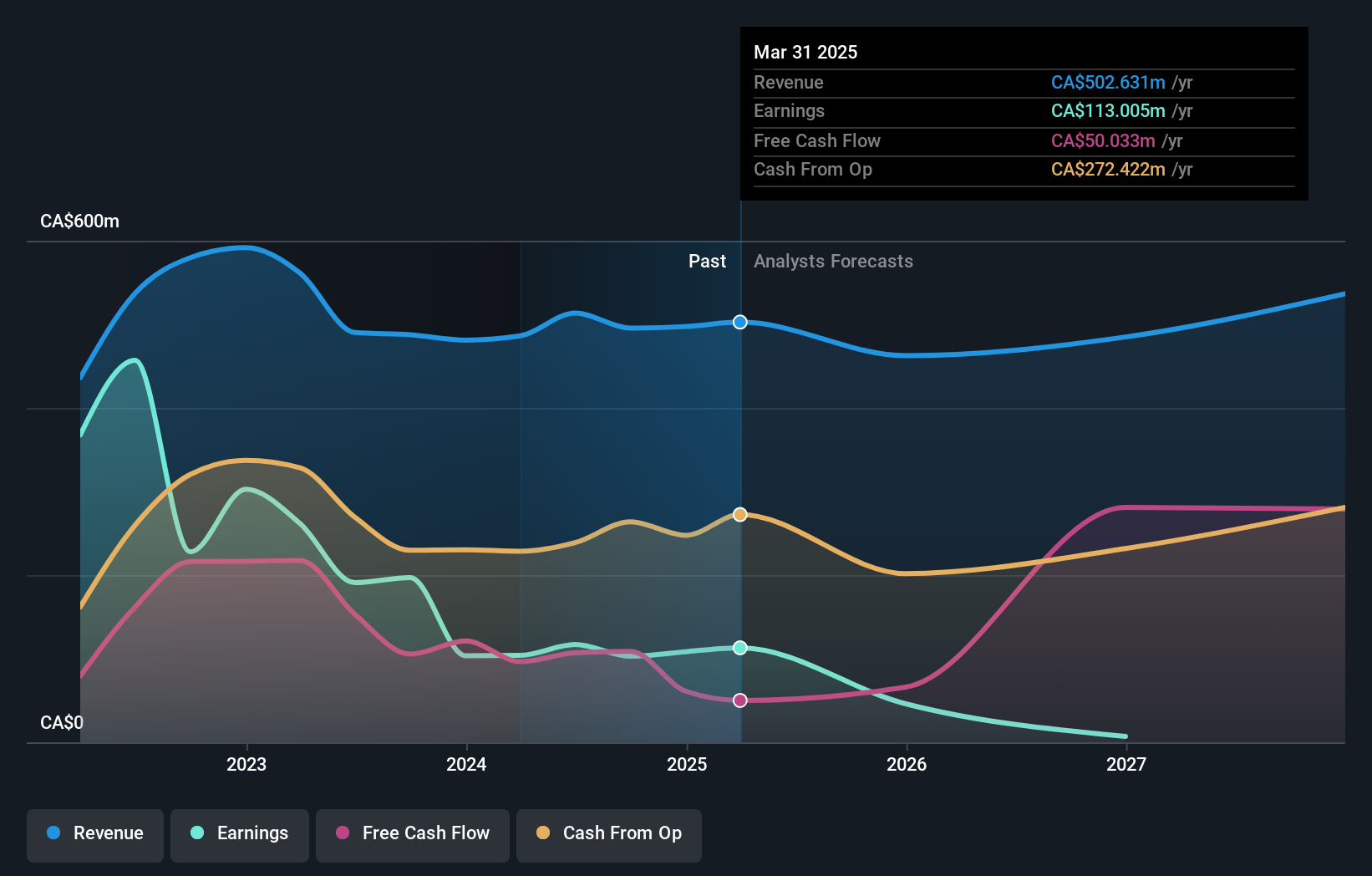

Overview: Cardinal Energy Ltd. is involved in the acquisition, exploration, development, optimization, and production of petroleum and natural gas across Alberta, British Columbia, and Saskatchewan in Canada with a market cap of CA$1.11 billion.

Operations: Cardinal Energy generates revenue primarily from its oil and gas exploration and production segment, amounting to CA$502.63 million. The company has a market cap of CA$1.11 billion.

Cardinal Energy, a small Canadian energy player, is trading at 76.1% below its estimated fair value. Over the past year, it has outpaced the industry with an 8.6% earnings growth compared to the sector's 3.9%. The company's net debt to equity ratio stands at a satisfactory 11.3%, and interest payments are well covered by EBIT at a robust 31.3 times coverage. Recent financials show promising results with Q1 revenue of C$118 million and net income rising to C$21 million from last year's C$17 million, while dividends remain steady at C$0.06 per share monthly through July.

- Navigate through the intricacies of Cardinal Energy with our comprehensive health report here.

Evaluate Cardinal Energy's historical performance by accessing our past performance report.

BMTC Group (TSX:GBT)

Simply Wall St Value Rating: ★★★★★☆

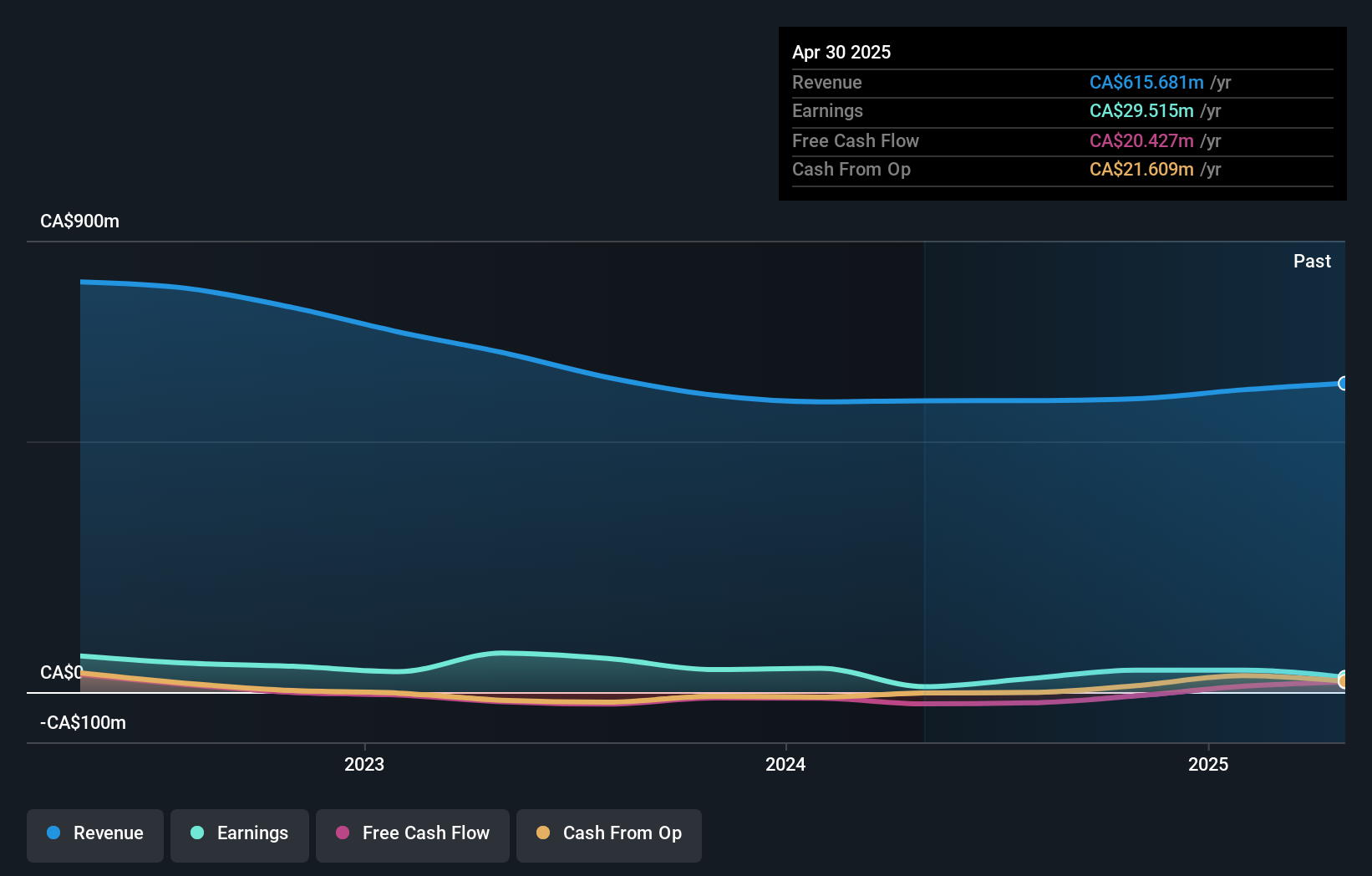

Overview: BMTC Group Inc., with a market cap of CA$445.80 million, manages and operates a retail network specializing in furniture, household appliances, and electronic products across Canada.

Operations: BMTC Group generates revenue primarily through its retail operations in furniture, household appliances, and electronic products. The real estate segment contributes CA$3.25 million to the overall revenue.

BMTC Group, a nimble player in Canada's retail scene, has seen its earnings grow by an impressive 171.5% over the past year, outpacing the specialty retail industry's 6.7%. Despite a net loss of C$12.93 million in Q1 2025 compared to a profit last year, sales climbed to C$150.12 million from C$137.14 million. The company trades at about 78% below its estimated fair value and remains debt-free, highlighting its potential as an undervalued asset with strong growth prospects despite recent challenges. Over the past year, BMTC repurchased shares worth C$4.72 million under its buyback program.

- Take a closer look at BMTC Group's potential here in our health report.

Review our historical performance report to gain insights into BMTC Group's's past performance.

Santacruz Silver Mining (TSXV:SCZ)

Simply Wall St Value Rating: ★★★★★★

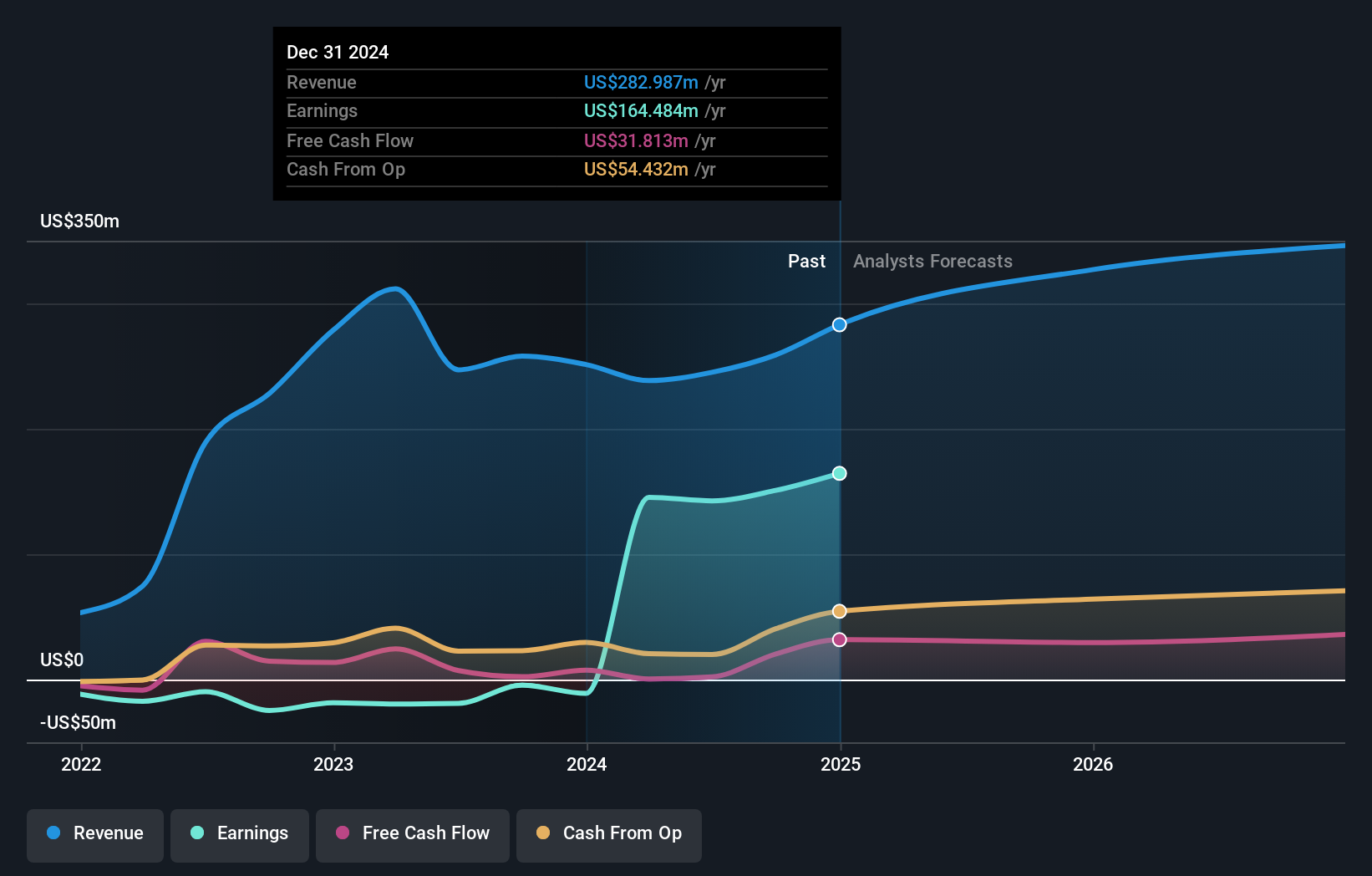

Overview: Santacruz Silver Mining Ltd. is a company focused on the acquisition, exploration, development, production, and operation of mineral properties in Latin America with a market capitalization of approximately CA$501.76 million.

Operations: Santacruz Silver Mining generates revenue primarily from its mineral properties, with significant contributions from Zimapan ($90.38 million), Bolivar ($85.81 million), and SAN Lucas ($83.22 million). The company faces cost implications due to inter-company eliminations and joint operation eliminations totaling -$74.27 million.

Santacruz Silver Mining, a smaller player in the metals and mining sector, is making strides despite recent challenges. The company recently reported a net income of US$9.45 million for Q1 2025, down from US$132.66 million the previous year, with sales rising to US$70.31 million from US$52.59 million in the same period last year. The firm’s debt situation looks favorable as it holds more cash than total debt and covers interest payments 42 times over with EBIT. While insider selling was significant recently, Santacruz continues its structured payment plan for Bolivian assets acquisition, aiming for long-term value creation through financial discipline.

- Click here to discover the nuances of Santacruz Silver Mining with our detailed analytical health report.

Assess Santacruz Silver Mining's past performance with our detailed historical performance reports.

Make It Happen

- Get an in-depth perspective on all 45 TSX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SCZ

Santacruz Silver Mining

Engages in the acquisition, exploration, development, production, and operation of mineral properties in Latin America.

Flawless balance sheet and good value.

Market Insights

Community Narratives