- Canada

- /

- Energy Services

- /

- TSX:CEU

New Debt Issuance Might Change the Case for Investing in CES Energy Solutions (TSX:CEU)

Reviewed by Sasha Jovanovic

- On October 23, 2025, CES Energy Solutions Corp. announced the successful closing of an additional US$75 million private placement of 6.875% senior unsecured notes due May 2029, raising the total outstanding amount of these notes to US$275 million.

- This debt issuance, priced at a premium and with proceeds allocated to repaying existing credit facility borrowings and general corporate purposes, highlights solid debt market demand and improved financial flexibility for CES Energy Solutions.

- Now, we’ll assess how CES Energy Solutions’ strengthened balance sheet from this financing could influence its longer-term investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CES Energy Solutions Investment Narrative Recap

For CES Energy Solutions shareholders, the underlying investment case centers on belief in the long-term need for specialized drilling fluids and production chemicals, particularly as oilfield operators focus on recovery optimization. The recent US$75 million private placement, which strengthens CES’s balance sheet, provides improved financial flexibility but does not fundamentally shift the short-term catalyst of contract wins for large production chemical tenders. It also does not materially reduce the main risk of competitive pricing and margin pressures as sector commoditization persists.

Among recent announcements, the April 28, 2025 credit facility amendment, which increased its available credit to approximately CA$550 million, directly relates to CES’s efforts to refinance and manage debt. This financial management supports ongoing bids for new contracts, which remain key to near-term growth, but does not alter exposure to sector pricing pressures.

In contrast, investors should be mindful of how increased competition and customer procurement strategies may still weigh on CES’s future margins if…

Read the full narrative on CES Energy Solutions (it's free!)

CES Energy Solutions' narrative projects CA$2.7 billion revenue and CA$221.4 million earnings by 2028. This requires 3.1% yearly revenue growth and a CA$37 million earnings increase from CA$184.4 million today.

Uncover how CES Energy Solutions' forecasts yield a CA$11.16 fair value, a 16% upside to its current price.

Exploring Other Perspectives

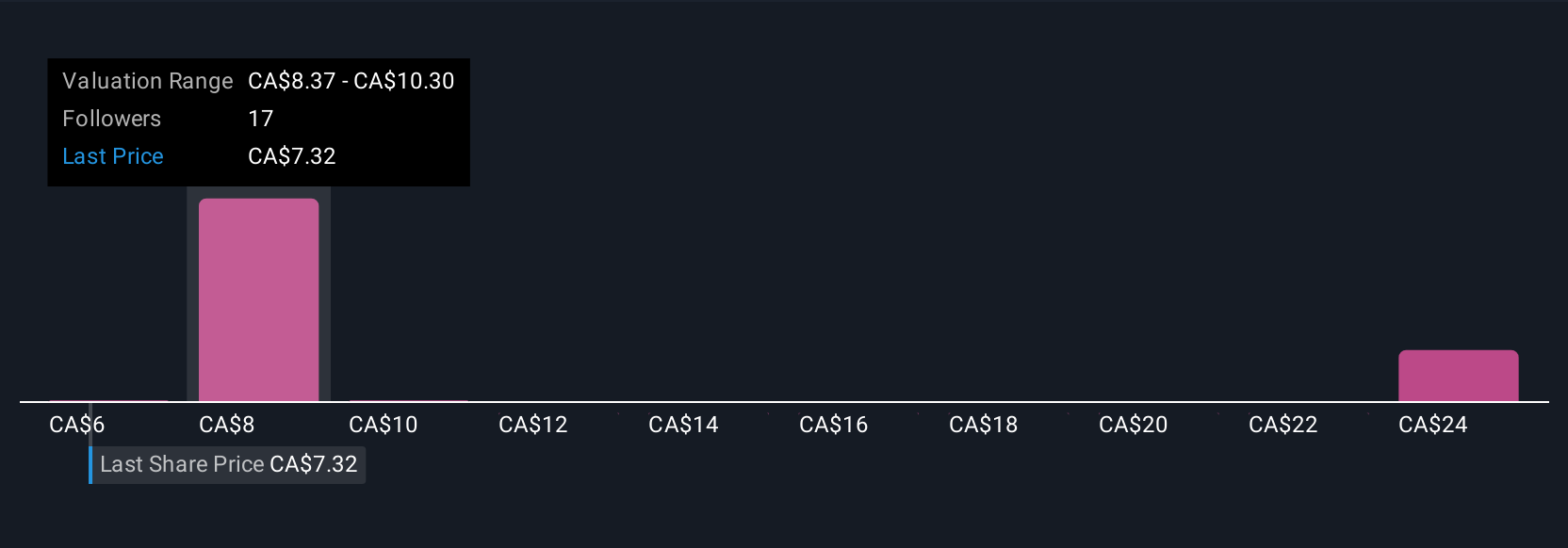

Four unique fair value estimates from the Simply Wall St Community span CA$6.43 to CA$25.35 per share. While some see significant upside, competition and pressure on industry pricing continue to shape CES’s outlook and may limit earnings growth, so you can compare each perspective with these realities.

Explore 4 other fair value estimates on CES Energy Solutions - why the stock might be worth over 2x more than the current price!

Build Your Own CES Energy Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CES Energy Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CES Energy Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CES Energy Solutions' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CEU

CES Energy Solutions

Engages in the design, implementation, and manufacture of advanced consumable fluids and specialty chemicals in the United States and Canada.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives