- Canada

- /

- Oil and Gas

- /

- TSX:CCO

How to Weigh Cameco’s Soaring 61.5% Gain Amid Nuclear Energy Optimism in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with Cameco stock lately? You are not alone. After a wild run over the last few years, Cameco continues to catch the attention of investors, both seasoned uranium bulls and newcomers drawn in by growing nuclear energy optimism. From the outside, those soaring numbers are hard to ignore: up 61.5% year-to-date and almost nine times higher than five years ago. In short, Cameco has delivered eye-popping long-term returns, and the pace hardly looks like it is slowing down.

But why the surge now? Much of the stock’s momentum is tied to shifting attitudes around nuclear power, with governments revisiting energy mixes to favor cleaner alternatives. Recent headlines about new nuclear plant approvals and supply chain concerns have only fueled the narrative that uranium demand and prices could remain higher for longer. For Cameco, as one of the world's largest uranium producers, that spells impressive revenue prospects and the renewed attention we are seeing on the stock.

Given all the excitement, though, some investors are wondering if Cameco is still undervalued or if the growth is already priced in. Recently, on key valuation measures, Cameco actually scored a 0 out of 6 for being undervalued, suggesting that, by the numbers, the stock might not be the steal it once was.

Of course, headline valuation checks can only tell us so much. Let’s dig deeper into the different ways analysts try to put a price tag on Cameco, and later, I will share a smarter way to get a clearer picture of the company’s real worth.

Cameco scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Cameco Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular valuation approach that estimates what a company is worth today by projecting its future free cash flows and then discounting those amounts back to the present. Essentially, it tells us what Cameco’s future stream of cash is worth right now, in today's CA$.

Cameco’s most recent twelve months of Free Cash Flow totaled CA$910.6 million. Over the next several years, analysts forecast that Cameco’s cash flow will keep rising, with projections for 2029 expected to reach CA$1.60 billion. Since analyst estimates are only available for up to five years, later projections are extrapolated based on current trends and estimates by financial platforms such as Simply Wall St.

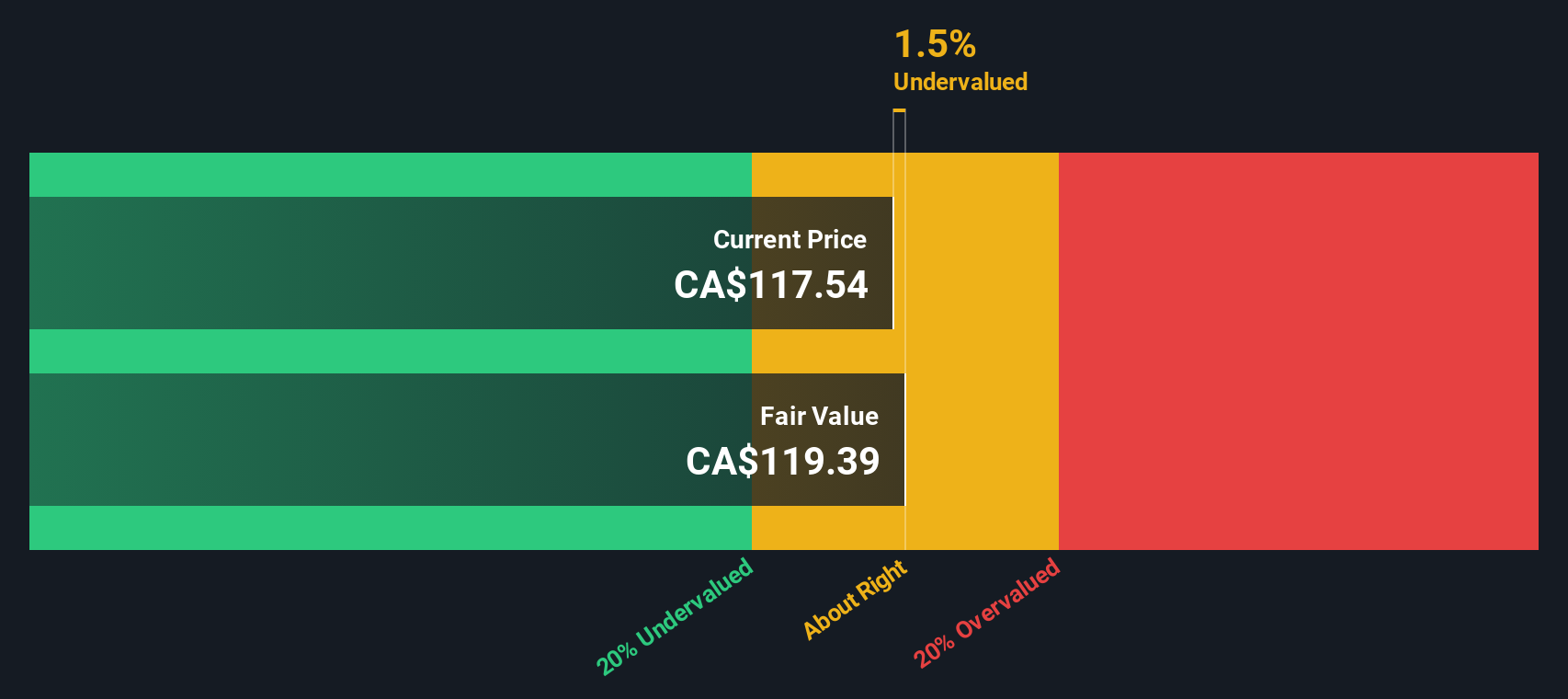

Pulling these numbers into the DCF model, Cameco’s estimated intrinsic value lands at CA$119.26 per share. Compared to the current share price, the implied discount is approximately -1.7%. This means Cameco is trading just above its modeled worth, which suggests the shares are neither a bargain nor highly inflated at these levels.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Cameco's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Cameco Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Cameco because it reflects how much investors are willing to pay for each dollar of current earnings. Given Cameco’s established profitability, the PE ratio offers a familiar checkpoint for comparing value across similar companies and industries.

A company’s "normal" or "fair" PE ratio is shaped by several factors. Fast-growing firms or those with lower risks tend to command higher multiples, while more volatile or slow-growing businesses usually see lower ones. These expectations help investors understand whether they are paying a premium for growth potential or accepting more risk for lower returns.

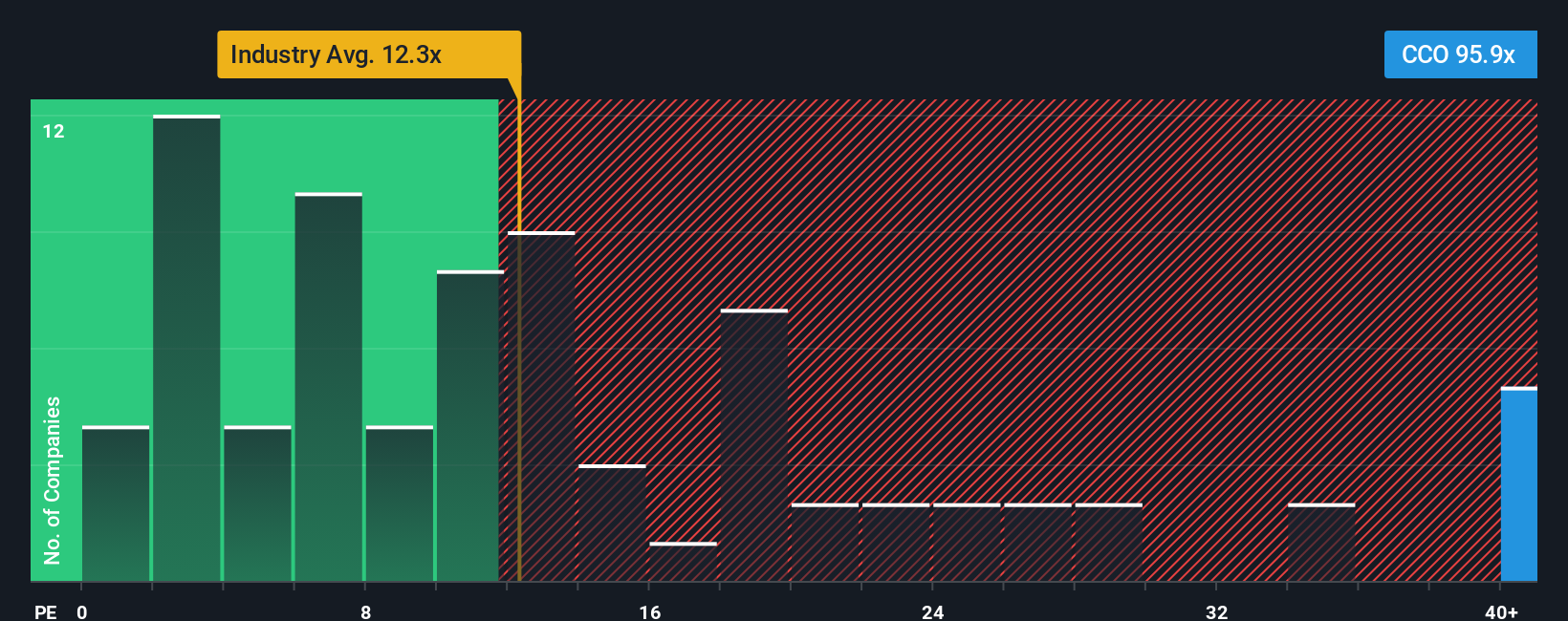

Cameco currently trades at a PE ratio of 99x. This is dramatically above the Oil and Gas industry average of 12.5x and the average of its immediate peers at 14.8x. At a glance, this might suggest Cameco is significantly overvalued relative to the broader sector and similar companies. However, Simply Wall St’s proprietary “Fair Ratio,” which accounts for Cameco’s specific growth prospects, profitability, industry positioning, and size, sets a tailored benchmark at 19.6x. Unlike simple peer or industry comparisons, the Fair Ratio provides a more meaningful evaluation because it factors in the unique combination of Cameco’s risk profile and opportunity ahead.

Given that Cameco’s actual PE of 99x is far higher than its Fair Ratio of 19.6x, the shares appear considerably overvalued by this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cameco Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story for a company; it is how you connect the business’s big-picture themes to a specific financial forecast and, ultimately, a fair value estimate based on your own assumptions for future revenue, earnings, and margins.

On Simply Wall St’s Community page, used by millions of investors, Narratives make it easy and transparent to express your outlook. You pick the drivers that matter most, outline your expectations, and the platform automatically ties those scenarios to a live financial model, linking your story directly to a dynamic fair value. This hands-on method lets you decide when to buy or sell, simply by comparing a Narrative’s fair value with the current price.

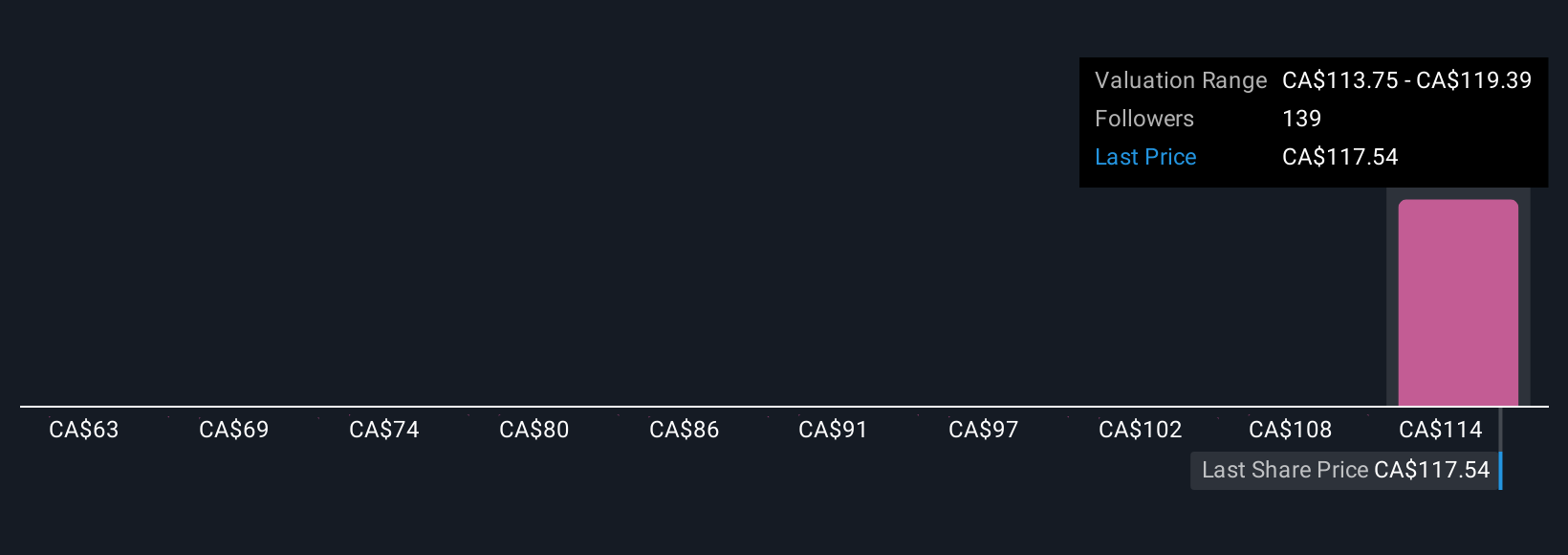

Narratives also update automatically as new data or news comes in, keeping your thesis current and actionable. For example, with Cameco’s stock, one Narrative might assume surging global nuclear demand, higher profit margins, and price targets above CA$130, while a more cautious Narrative could expect muted revenue growth and margins, pegging fair value close to CA$100. This shows how different perspectives confidently shape your investment decisions.

Do you think there's more to the story for Cameco? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCO

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives