- Canada

- /

- Oil and Gas

- /

- TSX:CCO

Cameco (TSX:CCO): Revisiting Valuation After a 65% Year-to-Date Surge in Uranium-Fueled Optimism

Reviewed by Simply Wall St

Cameco (TSX:CCO) has quietly extended its strong run, with shares up about 65% this year as uranium demand expectations shift. That move has investors revisiting how much future growth is already priced in.

See our latest analysis for Cameco.

At around CA$124 per share, Cameco’s year-to-date share price return of roughly 65 percent, backed by a powerful five-year total shareholder return above 600 percent, suggests momentum is still firmly on the front foot as uranium appetite and sentiment improve.

If Cameco’s surge has you rethinking your energy exposure, it might be worth exploring aerospace and defense stocks as another way to tap into long-duration demand tied to global security and infrastructure spending.

Yet with earnings rising, a solid value score, and analyst targets still pointing higher, investors face a crucial question: is Cameco still underappreciated, or is the market already baking in years of uranium growth?

Most Popular Narrative: 17.6% Undervalued

With Cameco last closing at around CA$124 versus a narrative fair value near CA$151, the story leans toward upside, hinging on long term nuclear build out.

Westinghouse (Cameco's 49% share) is poised for significant upside as dozens of planned gigawatt scale reactors in the US, Europe, and Asia reach final investment decision (FID). These builds are not yet in current business guidance, suggesting meaningful forward earnings and EBITDA improvement as project approvals materialize.

Curious how steady but unspectacular revenue growth, surging margins, and a bold future earnings multiple can still argue for upside at today’s price? Read on.

Result: Fair Value of $150.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent project delays and operational hiccups at key mines could constrain volumes and margins. This may challenge today’s upbeat assumptions about Cameco’s upside.

Find out about the key risks to this Cameco narrative.

Another Way to Look at Value

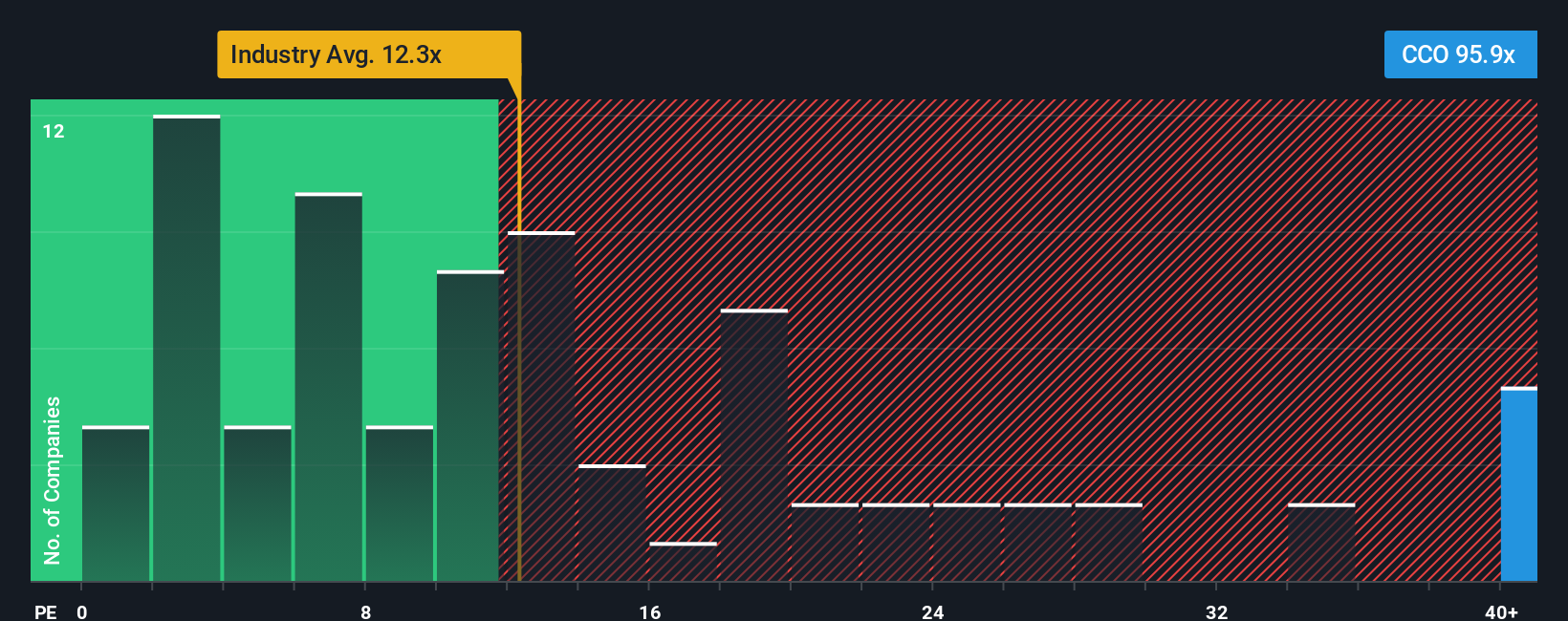

On simple earnings metrics, Cameco looks far richer than the upbeat narrative implies. The stock trades at about 102.8 times earnings versus roughly 14.3 times for the Canadian Oil and Gas industry and about 15.5 times for peers, while our fair ratio sits closer to 20.6 times. That gap suggests expectations are stretched, leaving little room for earnings disappointment. Is the market paying too far in advance for future uranium upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cameco Narrative

If you see the story differently or simply prefer to dig into the numbers yourself, you can build a personalized narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Cameco.

Looking for more investment ideas?

Do not stop with a single stock when you can quickly line up your next moves using targeted screeners that spotlight high conviction opportunities across the market.

- Capture asymmetric upside by scanning these 3623 penny stocks with strong financials that already show solid financial foundations instead of blind speculation.

- Position your portfolio for the next technology wave by targeting these 25 AI penny stocks that bring artificial intelligence into real world revenue today.

- Lock in quality at a discount by focusing on these 914 undervalued stocks based on cash flows where cash flow strength is not yet fully reflected in the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCO

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion