- Canada

- /

- Oil and Gas

- /

- TSX:CCO

Cameco (TSX:CCO) Q2 Earnings Surge: Strategic Alliances and Long-Term Contracts Drive Growth

Reviewed by Simply Wall St

Unlock comprehensive insights into our analysis of Cameco stock here.

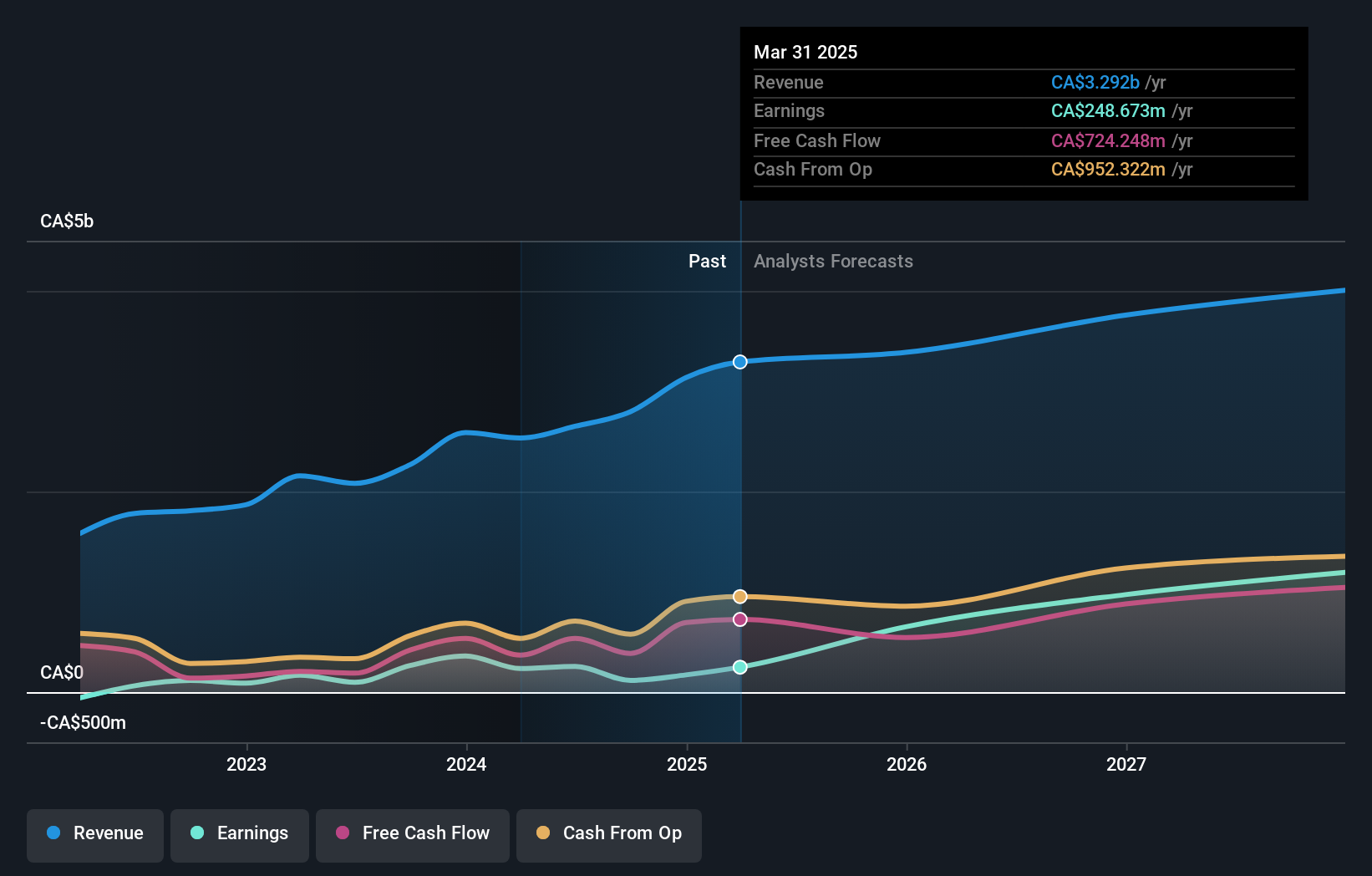

Strengths: Core Advantages Driving Sustained Success For Cameco

Cameco has demonstrated strong financial health, with a robust balance sheet and a strategic focus on long-term contracts. As noted by CEO Timothy Gitzel, the company has successfully increased its annual commitments to an average of about 28 million pounds per year from 2024 through 2028. This stability is further supported by their operational efficiency, with production rates and costs in the uranium segment reflecting a transition back to a Tier 1 cost structure. Moreover, the company is trading at 8.9% below its fair value estimate of CA$66.13, indicating potential for upward movement. The management team's experience, with an average tenure of 8.8 years, contributes significantly to achieving these strategic goals.

Weaknesses: Critical Issues Affecting Cameco's Performance and Areas For Growth

Despite its strengths, Cameco faces several challenges. The company is considered expensive based on its Price-To-Earnings Ratio (101.9x) compared to the peer average (24.2x) and the Canadian Oil and Gas industry average (11.7x). Additionally, geopolitical risks, as highlighted by Timothy Gitzel, amplify global supply chain and transportation risks. The company's Return on Equity is forecast to be low at 14.2% in three years, which is below industry benchmarks. Furthermore, sulfuric acid supply issues present a significant challenge, impacting production efficiency.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Cameco has substantial opportunities for growth, particularly in the expansion of nuclear power. Timothy Gitzel emphasized the essential role of nuclear energy in the clean energy transition, supported by governments and power suppliers. Investments in new technologies and potential for new builds present additional avenues for growth. The company's earnings are expected to grow significantly at 28.5% per year, outpacing the Canadian market's forecast of 14.9%. These strategic moves could enhance Cameco's market position and capitalize on emerging opportunities in the nuclear energy sector.

Threats: Key Risks and Challenges That Could Impact Cameco's Success

Cameco faces several external threats that could impact its long-term success. Competitive pressures and market dynamics, as mentioned by Timothy Gitzel, indicate that the company is still in the early stages of its strategic initiatives. Regulatory challenges, particularly those related to the long-term storage of nuclear fuel, pose significant risks. Economic factors also present elevated risks, requiring focused management attention. Additionally, the company's revenue growth is forecast to be slower than the Canadian market, at 5.6% per year compared to 6.9%, which could affect its competitive edge.

Conclusion

Cameco's strong financial health, supported by a strategic focus on long-term contracts and operational efficiency, positions the company well for sustained success. However, its high Price-To-Earnings Ratio compared to peers and industry averages suggests that investors are paying a premium for its growth prospects, despite the stock trading below its fair value estimate based on discounted cash flow analysis. The company's significant opportunities in the nuclear energy sector, driven by the global shift towards clean energy, are tempered by geopolitical risks, regulatory challenges, and supply chain issues. While Cameco's earnings growth is projected to outpace the Canadian market, its relatively lower revenue growth forecast and competitive pressures necessitate careful management to maintain its market position and capitalize on emerging opportunities.

Where To Now?

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:CCO

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives