- Canada

- /

- Oil and Gas

- /

- TSX:BIR

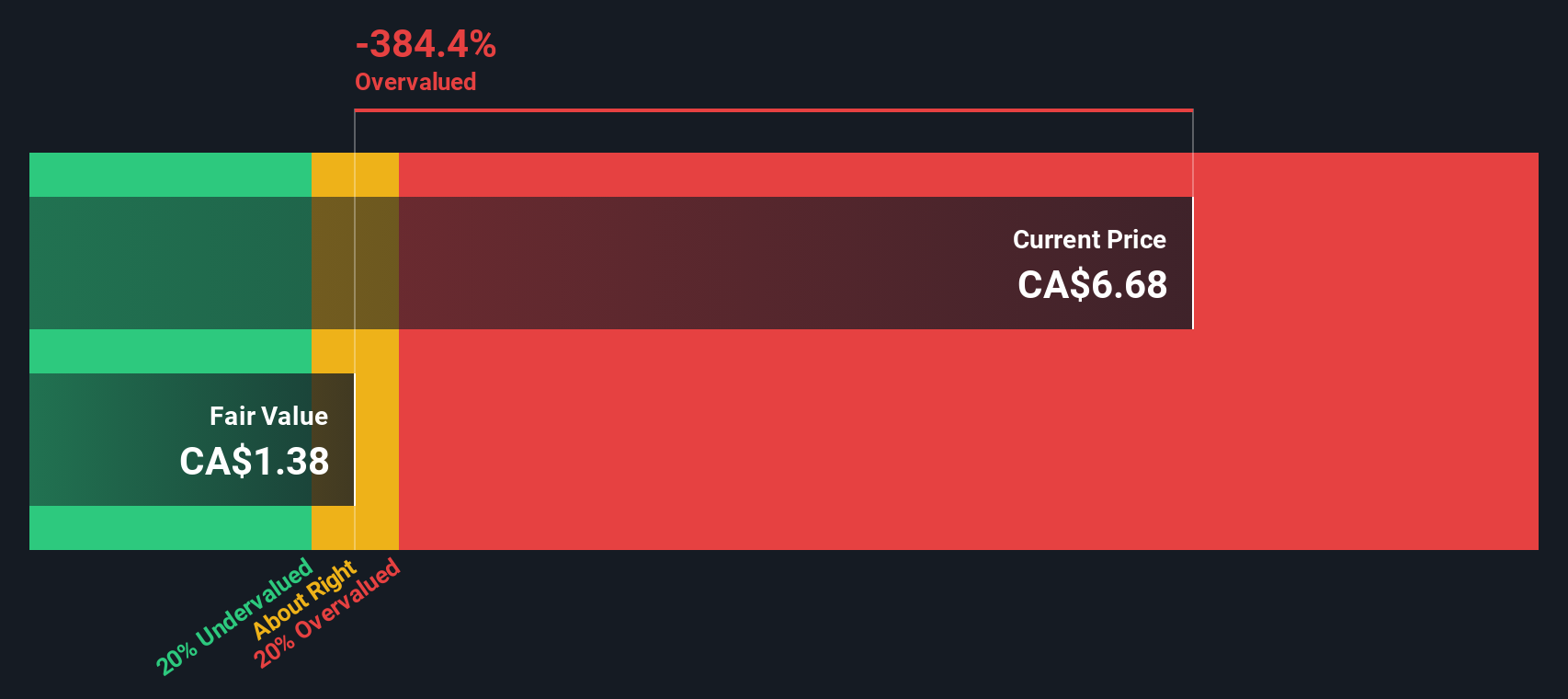

Birchcliff Energy (TSX:BIR): Assessing Valuation Following Upgraded 2025 Production Guidance and Strong Q4 Performance

Reviewed by Simply Wall St

See our latest analysis for Birchcliff Energy.

Against a backdrop of rising production guidance and a fresh dividend affirmation, Birchcliff Energy’s 1-month share price return of 18.17% stands out as momentum has accelerated sharply, bringing its year-to-date gain to 26.09%. Long-term investors have enjoyed a 45.8% total shareholder return over the past year, while five-year total returns remain impressive at over 340%. This underscores the company’s ability to bounce back after a tough three-year stretch.

If Birchcliff’s ongoing turnaround and momentum have you watching for more opportunities, this could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with shares rallying and the latest upgrades already in the spotlight, the question remains: does Birchcliff’s recent momentum mean the stock is still undervalued, or has the market already priced in its anticipated growth?

Price-to-Earnings of 26.1: Is it justified?

Birchcliff Energy currently trades at a price-to-earnings (P/E) ratio of 26.1, notably above its industry average. With a last close price of CA$6.96, this higher multiple suggests that the market is paying a premium for Birchcliff’s recent turnaround and strong operational performance.

The price-to-earnings ratio captures how much investors are willing to pay today for a dollar of earnings. A higher P/E often indicates expectations of stronger future profit growth or sustained market momentum. For energy companies, P/E should be considered alongside earnings volatility and industry cycles.

At 26.1 times earnings, Birchcliff is valued significantly higher than the Canadian Oil and Gas sector average of 14.7. This implies that investors have factored in a robust recovery and positive near-term growth, possibly influenced by the company’s sharp earnings rebound after recent challenges. Compared to the peer average of 22.3, the premium remains clear, reflecting either growing confidence or a higher perceived risk profile within the peer set.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 26.1 (OVERVALUED)

However, slower revenue growth or unexpected shifts in industry cycles could quickly shift market sentiment and challenge Birchcliff’s current premium valuation.

Find out about the key risks to this Birchcliff Energy narrative.

Another View: What Does Our DCF Say?

There is another way to look at Birchcliff’s valuation. According to our DCF model, the shares are trading roughly 22.8% below their estimated fair value. In simple terms, this suggests there could be more upside from here and challenges the premium signaled by its high price-to-earnings multiple. Could this gap present a real opportunity, or is there something the market sees that the model can't capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Birchcliff Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Birchcliff Energy Narrative

If you want to dig deeper or take a different perspective, it’s easy to explore Birchcliff’s numbers firsthand. You can shape your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Birchcliff Energy.

Looking for More Smart Investment Ideas?

Opportunities in fast-moving markets rarely wait around. The right screen can pinpoint proven performers, undervalued gems, or tomorrow’s tech innovators. This gives you a real edge over the crowd.

- Uncover high-yielding potential by targeting market leaders with these 16 dividend stocks with yields > 3%, designed to deliver consistent returns above 3%.

- Tap into trailblazers transforming healthcare by checking out these 32 healthcare AI stocks for powerful new entrants in diagnostics, automation, and medical technologies.

- Capitalize on future financial trends when you start with these 82 cryptocurrency and blockchain stocks to track innovators building tomorrow’s blockchain and cryptocurrency markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Birchcliff Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BIR

Birchcliff Energy

An intermediate oil and natural gas company, engages in the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives