- Canada

- /

- Oil and Gas

- /

- TSX:BIR

3 Undiscovered Canadian Gems with Promising Potential

Reviewed by Simply Wall St

The Canadian market has shown resilience, with the TSX climbing over 2% recently, even as global markets grapple with tariff uncertainties and mixed economic signals. In this environment, identifying stocks that can navigate these challenges while offering growth potential is crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 4.89% | 13.46% | 20.23% | ★★★★★★ |

| Pinetree Capital | 0.24% | 59.68% | 61.83% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Genesis Land Development | 46.48% | 30.46% | 55.37% | ★★★★★☆ |

| Itafos | 28.17% | 11.62% | 53.49% | ★★★★★☆ |

| Mako Mining | 8.59% | 38.81% | 59.80% | ★★★★★☆ |

| Corby Spirit and Wine | 59.18% | 8.79% | -5.67% | ★★★★☆☆ |

| Pizza Pizza Royalty | 15.76% | 4.94% | 5.38% | ★★★★☆☆ |

| Senvest Capital | 81.59% | -11.73% | -12.63% | ★★★★☆☆ |

| Dundee | 3.91% | -36.42% | 49.66% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Aris Mining (TSX:ARIS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aris Mining Corporation is involved in the acquisition, exploration, development, and operation of gold properties across Canada, Colombia, and Guyana with a market capitalization of approximately CA$1.29 billion.

Operations: Aris Mining generates revenue primarily from its Marmato Project and Segovia Operations, with the latter contributing significantly more at $455.08 million compared to $55.53 million from Marmato.

Aris Mining's recent performance showcases its potential as a noteworthy player in the Canadian mining sector. With earnings growth of 115% over the past year, it has outpaced the broader Metals and Mining industry, which saw a 33.7% increase. This impressive growth is supported by high-quality earnings and a satisfactory net debt to equity ratio of 24%. Despite shareholder dilution in the past year, Aris trades at 95% below its estimated fair value, presenting an intriguing valuation opportunity. The company reported sales of US$510 million for 2024, with net income doubling to US$24 million compared to the previous year.

Birchcliff Energy (TSX:BIR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Birchcliff Energy Ltd. is an intermediate oil and natural gas company focused on the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada with a market cap of approximately CA$1.63 billion.

Operations: The primary revenue stream for Birchcliff Energy comes from its oil and gas exploration and production segment, generating CA$601.44 million. The company's market capitalization stands at approximately CA$1.63 billion.

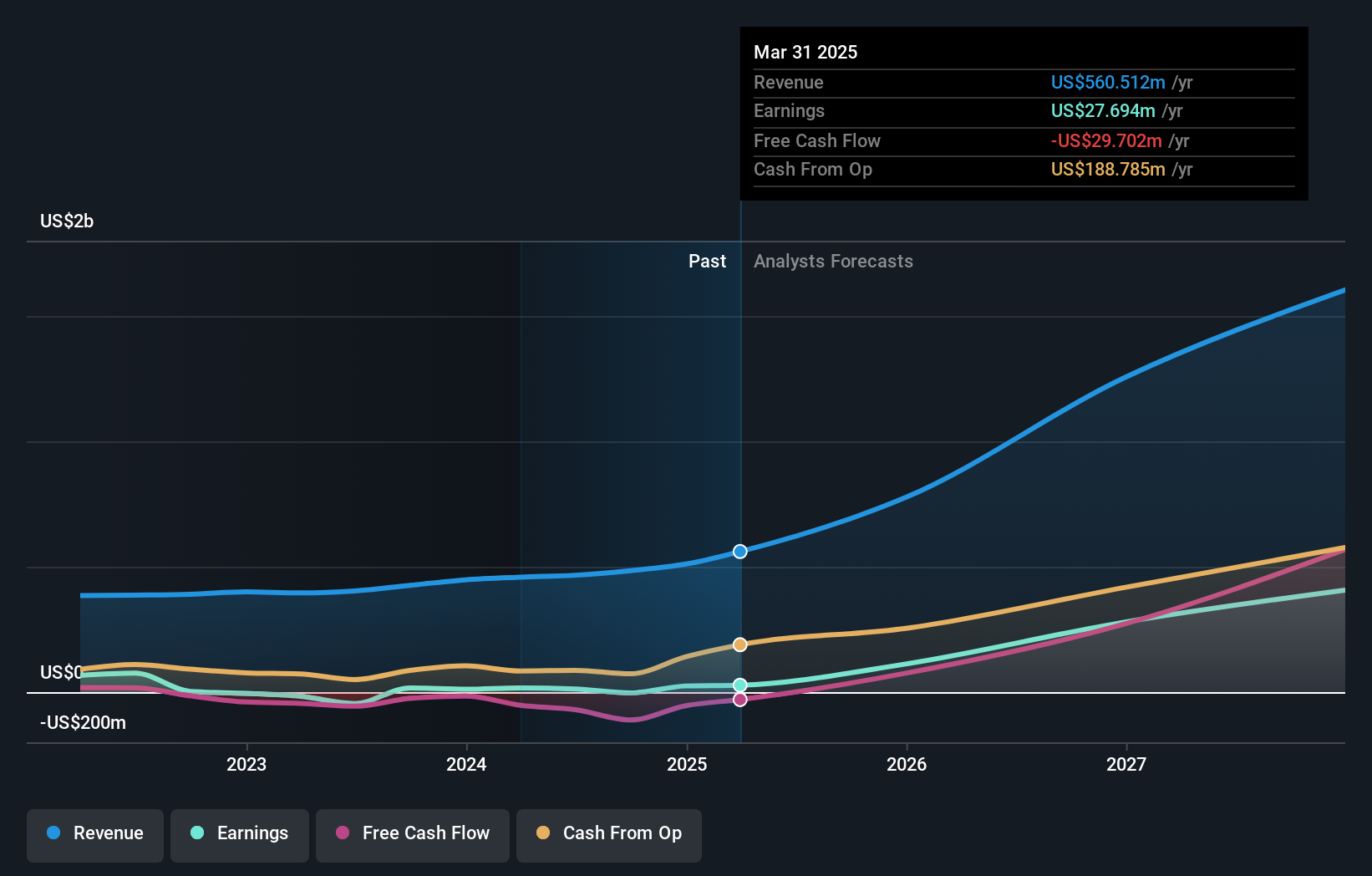

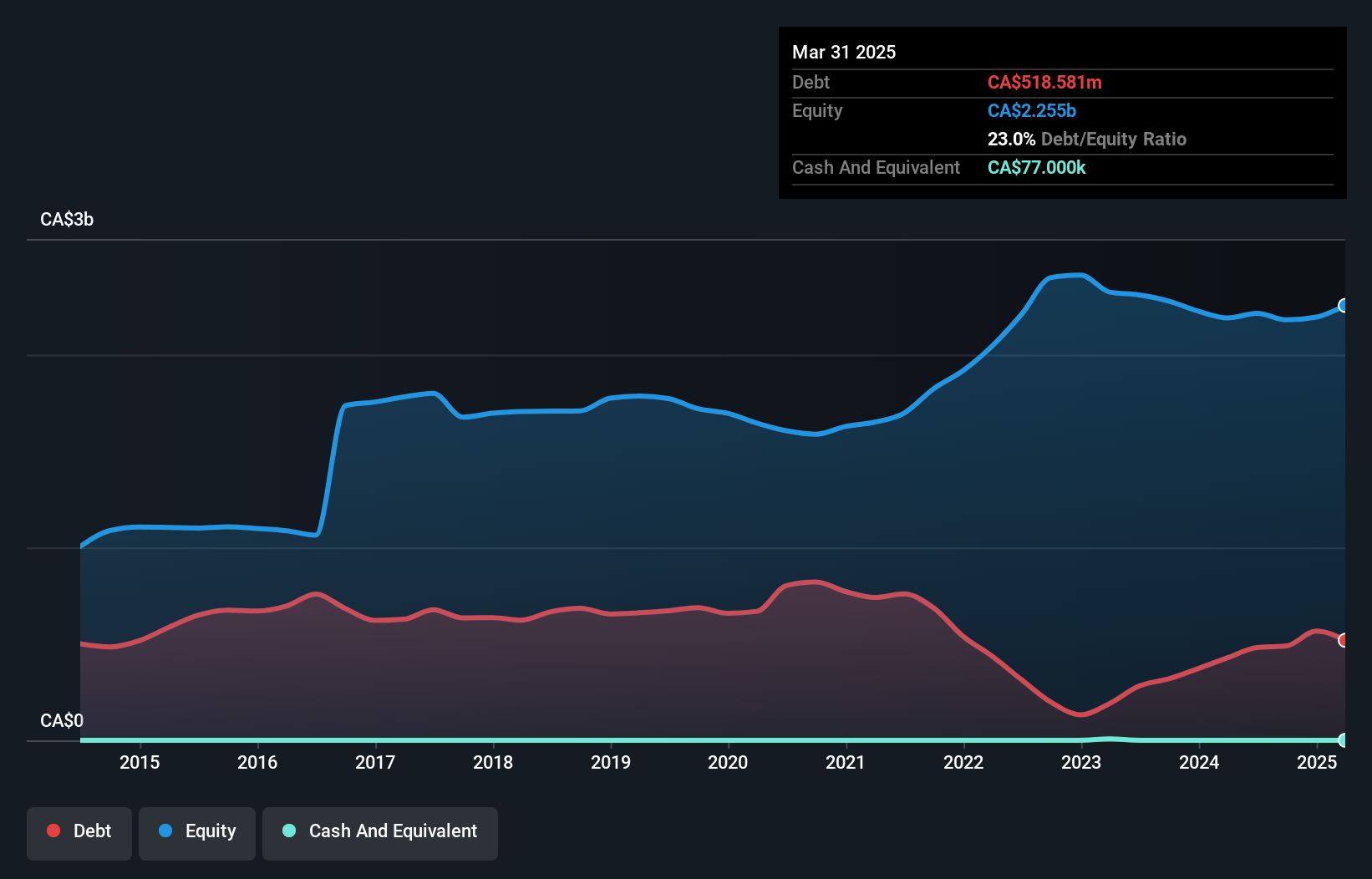

Birchcliff Energy, a smaller player in Canada's energy sector, reported impressive earnings growth of 473.6% over the past year, far surpassing the industry average of -23.7%. With revenue reaching CAD 709.38 million and net income climbing to CAD 56.1 million from CAD 9.78 million previously, the company shows robust financial health despite its challenges with interest coverage at just 2.8 times EBIT. The net debt to equity ratio stands at a satisfactory 25.8%, reflecting prudent financial management over five years as it dropped from 38.9%. While free cash flow remains negative, Birchcliff's high-quality earnings and reduced debt position suggest resilience in navigating market conditions.

- Get an in-depth perspective on Birchcliff Energy's performance by reading our health report here.

Assess Birchcliff Energy's past performance with our detailed historical performance reports.

Senvest Capital (TSX:SEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Senvest Capital Inc. is a privately owned hedge fund sponsor with a market capitalization of CA$779.69 million.

Operations: Senvest Capital generates revenue primarily through the management of its own investments and those of the funds, amounting to CA$969.27 million.

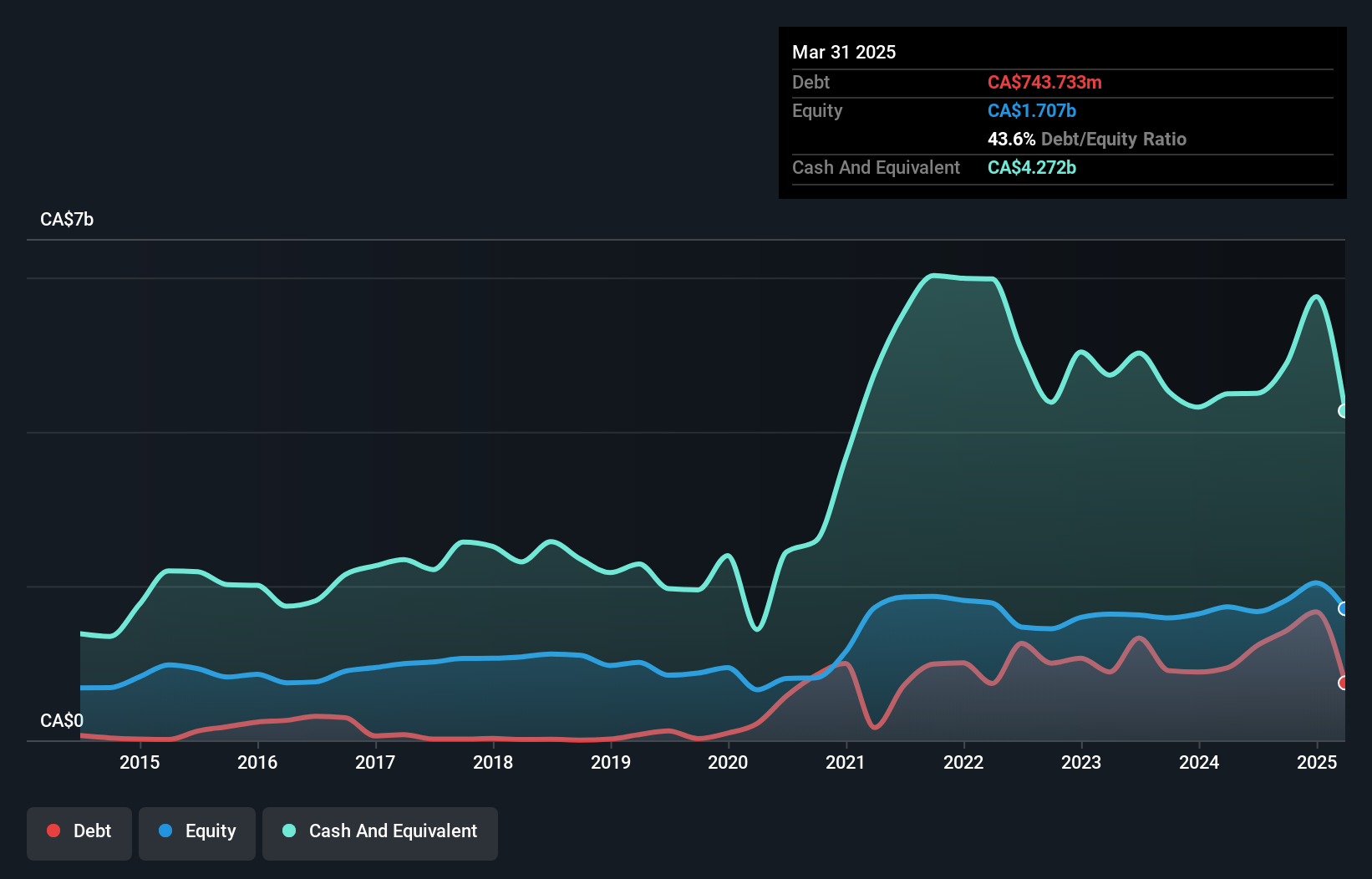

Senvest Capital, a nimble player in the Canadian market, showcases an impressive 208.8% earnings growth over the past year, outpacing the industry average of 25%. Its price-to-earnings ratio stands at a mere 3x compared to the broader Canadian market's 14.6x, hinting at potential undervaluation. Despite its high-quality earnings and profitability alleviating cash runway concerns, its debt-to-equity ratio has surged from 9.9% to 81.6% over five years. However, with interest payments well-covered by EBIT (8.9x), Senvest remains financially sound amidst illiquid shares and substantial revenue growth from CAD 432 million to CAD 964 million last year.

Summing It All Up

- Dive into all 37 of the TSX Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Birchcliff Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BIR

Birchcliff Energy

An intermediate oil and natural gas company, engages in the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives