Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, ARC Resources Ltd. (TSE:ARX) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for ARC Resources

What Is ARC Resources's Debt?

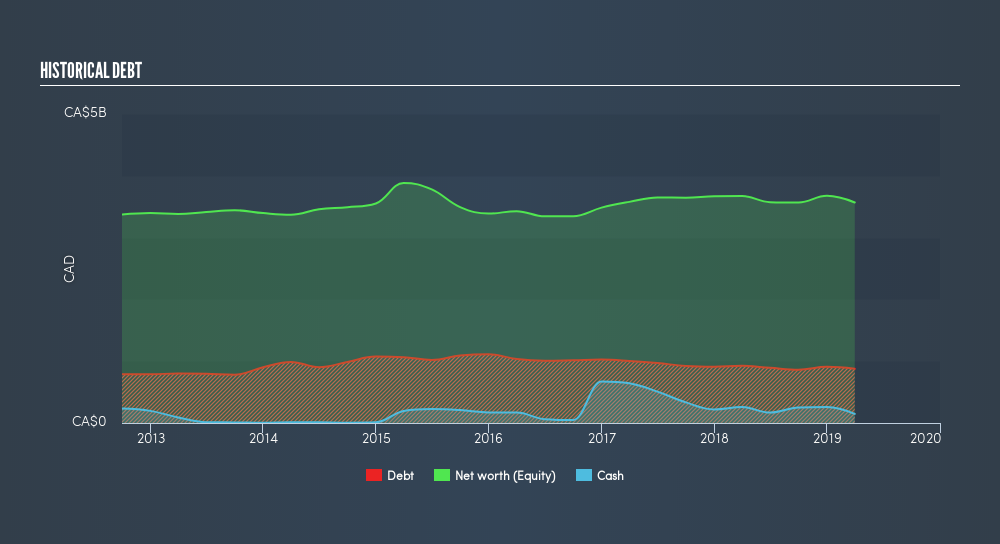

As you can see below, ARC Resources had CA$877.6m of debt at March 2019, down from CA$925.0m a year prior. However, because it has a cash reserve of CA$147.9m, its net debt is less, at about CA$729.7m.

How Strong Is ARC Resources's Balance Sheet?

We can see from the most recent balance sheet that ARC Resources had liabilities of CA$295.2m falling due within a year, and liabilities of CA$2.09b due beyond that. On the other hand, it had cash of CA$147.9m and CA$132.0m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$2.10b.

This is a mountain of leverage relative to its market capitalization of CA$2.27b. So should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. Because it carries more debt than cash, we think it's worth watching ARC Resources's balance sheet over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Looking at its net debt to EBITDA of 0.98 and interest cover of 5.97 times, it seems to us that ARC Resources is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Importantly, ARC Resources's EBIT fell a jaw-dropping 43% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if ARC Resources can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, ARC Resources saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, ARC Resources's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its net debt to EBITDA is a good sign, and makes us more optimistic. We're quite clear that we consider ARC Resources to be really rather risky, as a result of its debt. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on the balance sheet . Given the risks around ARC Resources's use of debt, the sensible thing to do is to check if insiders have been unloading the stock.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:ARX

ARC Resources

Engages in the acquiring and developing crude oil, natural gas, condensate, and natural gas liquids in Canada.

Very undervalued with proven track record.

Market Insights

Community Narratives