The Canadian market has shown resilience, with the TSX rising over 2% recently, even as global markets grapple with tariff uncertainties and economic pressures. In this context, penny stocks—often seen as a niche investment area—continue to offer intriguing opportunities for growth in smaller or newer companies. By focusing on those with strong financial health and potential for stability, investors can uncover valuable prospects within this segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.58 | CA$60.69M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.54 | CA$66.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.585 | CA$419.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.20 | CA$690.42M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.70 | CA$275.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$181.71M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.55 | CA$512.47M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.71 | CA$69.84M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.51 | CA$13.75M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.15 | CA$43.93M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 926 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

ACT Energy Technologies (TSX:ACX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ACT Energy Technologies Ltd. offers directional drilling services to oil and natural gas companies in Canada and the United States, with a market cap of CA$164.90 million.

Operations: The company generates CA$571.79 million in revenue from its directional drilling services.

Market Cap: CA$164.9M

ACT Energy Technologies has shown robust financial performance, with annual revenues of CA$571.79 million and a significant net income increase to CA$57.91 million from the previous year. The company maintains a high return on equity at 24% and strong interest coverage, indicating effective debt management. Recent executive changes include the appointment of Robert Skilnick as CFO, bringing extensive industry experience to the role. Despite earnings growth outpacing industry averages, upcoming forecasts suggest a slight decline in earnings over the next three years. Additionally, ACT's share buyback program reflects confidence in its valuation strategy.

- Take a closer look at ACT Energy Technologies' potential here in our financial health report.

- Assess ACT Energy Technologies' future earnings estimates with our detailed growth reports.

Dundee (TSX:DC.A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dundee Corporation is a publicly owned investment manager with a market cap of CA$200.30 million.

Operations: The company's revenue is derived from Mining Services, which generated CA$2.06 million, and Mining Investments, contributing CA$0.72 million.

Market Cap: CA$200.3M

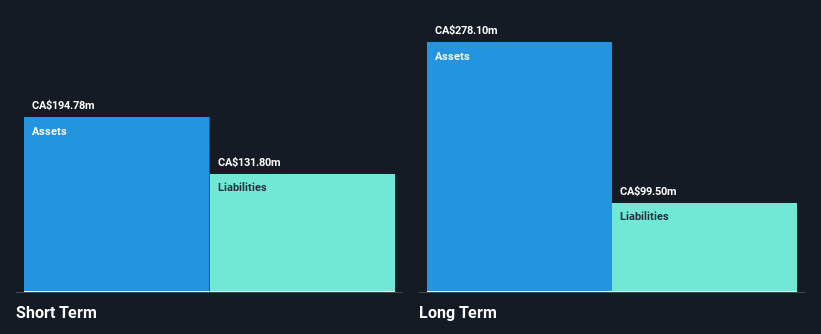

Dundee Corporation has transitioned to profitability, reporting a net income of CA$59.11 million for the year ending December 31, 2024, compared to a net loss the previous year. Despite limited revenue of CA$4.63 million from its mining services and investments, Dundee's financial health is bolstered by cash reserves exceeding debt levels and short-term assets covering liabilities comfortably. The company's Price-to-Earnings ratio stands at 3.5x, below the Canadian market average, suggesting potential undervaluation. With an experienced board and management team in place, Dundee's strategic positioning may appeal to investors seeking value opportunities within penny stocks.

- Click here to discover the nuances of Dundee with our detailed analytical financial health report.

- Examine Dundee's past performance report to understand how it has performed in prior years.

Neptune Digital Assets (TSXV:NDA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Neptune Digital Assets Corp. builds, owns, and operates infrastructure supporting the digital currency ecosystem in Canada with a market cap of CA$166.49 million.

Operations: The company generates revenue from its data processing segment, amounting to CA$2.19 million.

Market Cap: CA$166.49M

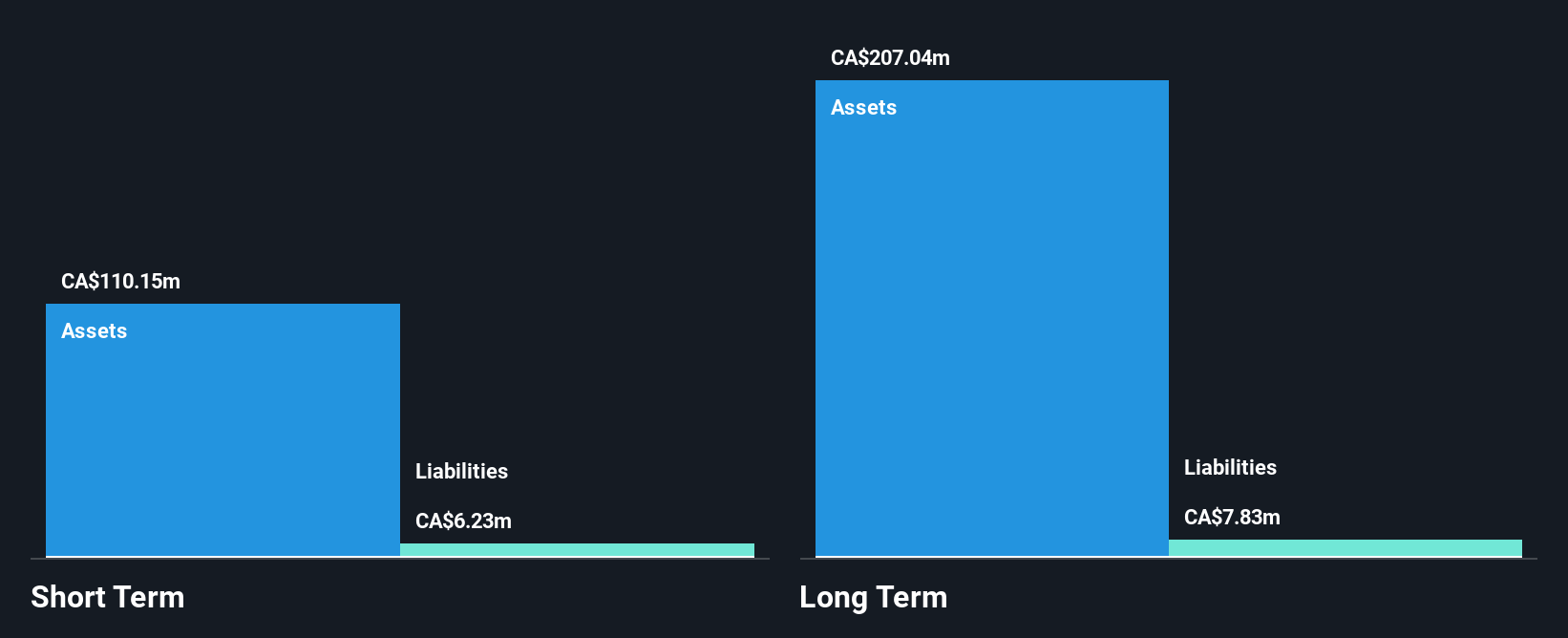

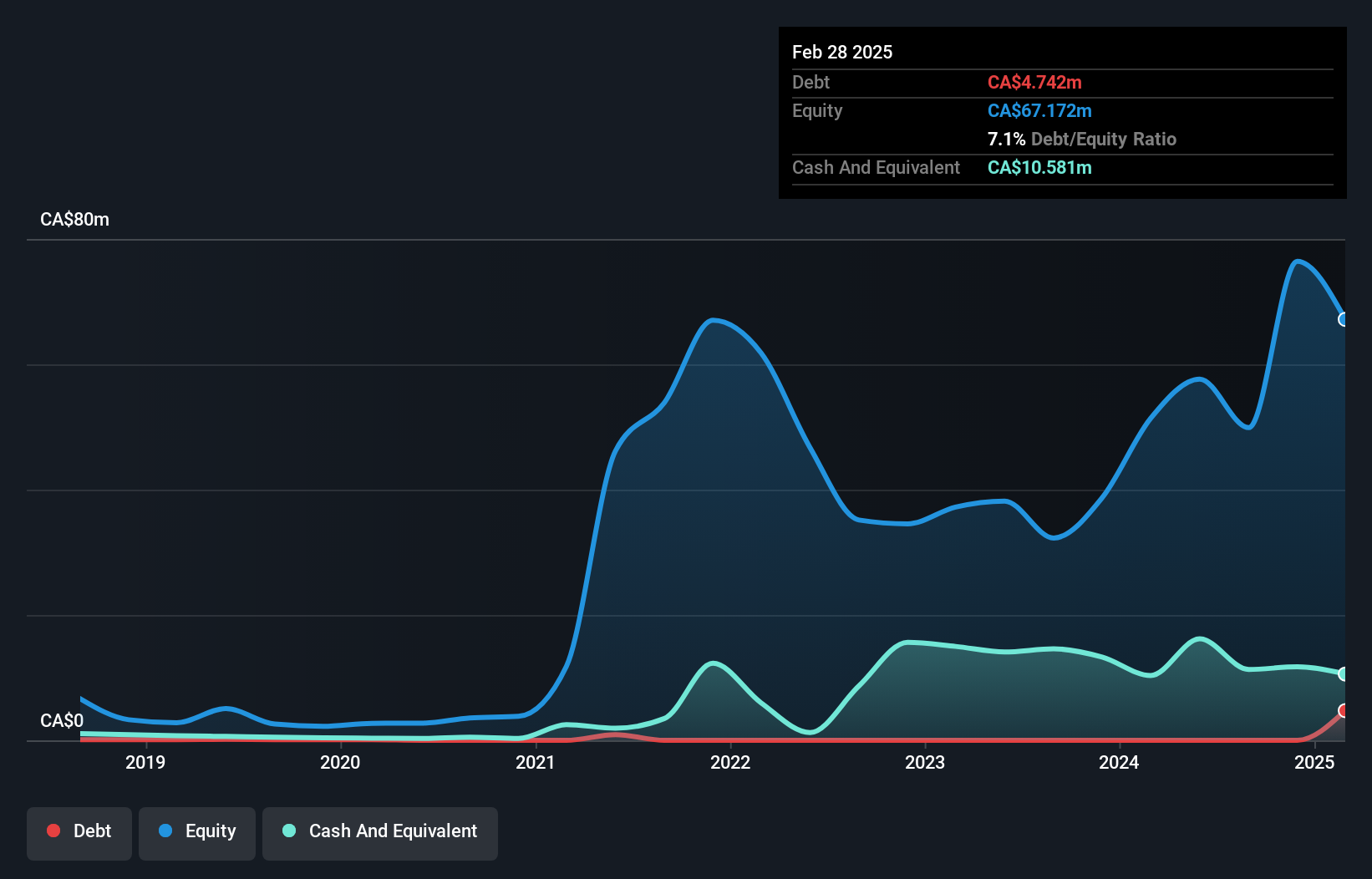

Neptune Digital Assets Corp. has recently become profitable, reporting a net income of CA$4.69 million for the first quarter ending November 30, 2024, despite limited revenue of CA$0.45 million from its data processing operations. The company benefits from being debt-free and having short-term assets significantly exceeding liabilities, with no long-term liabilities on record. Neptune's share price has been highly volatile over the past three months, which is common in penny stocks. The recent appointment of Tara Amiri as an independent director brings additional expertise in corporate finance and mergers to the board amidst ongoing strategic developments such as increased borrowing capacity with Sygnum Bank.

- Unlock comprehensive insights into our analysis of Neptune Digital Assets stock in this financial health report.

- Learn about Neptune Digital Assets' future growth trajectory here.

Turning Ideas Into Actions

- Unlock our comprehensive list of 926 TSX Penny Stocks by clicking here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neptune Digital Assets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NDA

Neptune Digital Assets

Neptune Digital Assets Corp. builds, owns, and operates infrastructure supporting the digital currency ecosystem in Canada.

Slight with mediocre balance sheet.

Market Insights

Community Narratives